Planting Coins: 02/25

Management Summary January was dominated by the launch of the Trump Coin. Bitcoin consolidates slightly above USD 100k, while altcoins performed...

Please click on the green "+" sign to open the full menu.

Get in touch with the most progressive private bank in Switzerland.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the second report in 2024 about the Kaleido Digital Asset Core Strategy. Read more about our crypto portfolio framework here. Don't forget to sign up to our newsletter to get the next reporting straight in your mailbox!

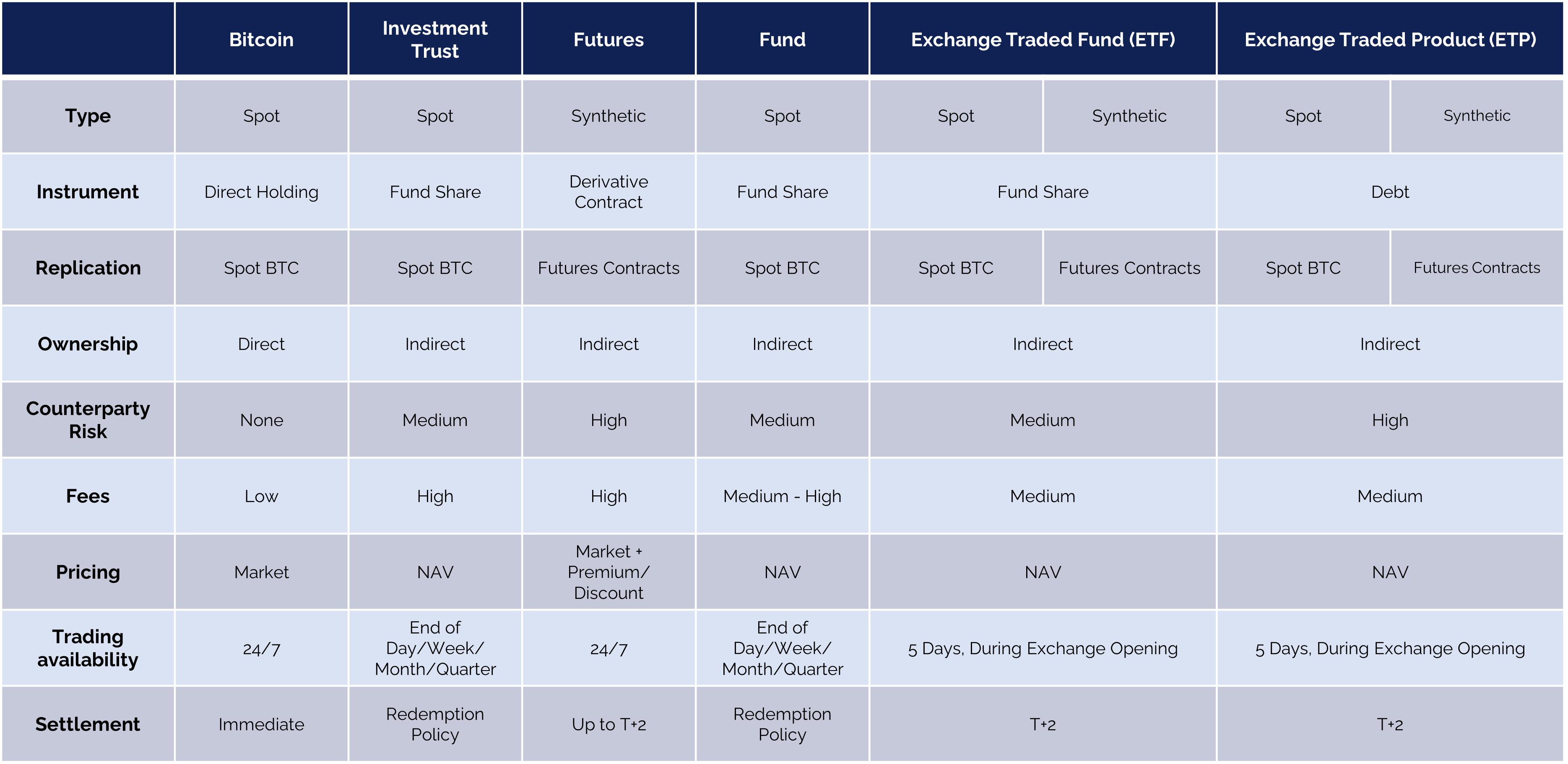

At least since the launch of Bitcoin ETFs, there is now another convenient way to add Bitcoin to a portfolio or speculate on its price performance. However, for newcomers to the digital currency space, understanding the different investment options can be overwhelming. Below, we'll outline six different methods of investing in Bitcoin and evaluate the pros and cons of each option, along with considerations for fees, tradability, counterparty risk and legal structure.

Overview of investment opportunities to create exposure to Bitcoin

Buying Bitcoin directly

What is it? The direct purchase of Bitcoin from a cryptocurrency exchange or peer-to-peer platform.

Advantages: Low fees, as transactions usually incur minimal costs. Full ownership and control of Bitcoin.

Disadvantages: Moderate tradability due to the need for a compatible exchange. Highest counterparty risk is associated with managing personal security measures.

Ownership: Ownership of the cryptocurrency itself.

Bitcoin Investment Trusts (BITs)

What is it? Investment vehicles holding Bitcoin on behalf of investors.

Pros: Low to medium fees, with management fees typically applied. Medium to high tradability depending on the exchange listing. Low counterparty risk, as trust entities manage the assets.

Cons: Medium to high counterparty risk, as investors rely on the trust's credibility. Regulatory constraints may affect availability.

Ownership: Ownership in a fund share.

Bitcoin Futures

What is it? Contracts allowing speculation on future Bitcoin prices.

Pros: Rather high fees in particular the funding rates, with trading fees comparable to traditional futures markets. High tradability on regulated exchanges. Low counterparty risk, as transactions are standardized and cleared by the exchange.

Cons: High risk due to leverage. Requires familiarity with futures trading.

Ownership: Derivative contract.

Bitcoin Funds

What is it? Mutual funds or hedge funds investing in Bitcoin and other cryptocurrencies.

Pros: Medium to high fees, with management fees typically applied. Medium to high tradability depending on fund structure. Low counterparty risk, as funds are managed by professionals.

Cons: Limited availability to accredited investors. Management fees may erode returns.

Ownership: Ownership in a fund share.

Bitcoin Exchange-Traded Funds (ETFs)

What is it? Publicly traded funds mirroring Bitcoin price movements.

Pros: Low to medium fees, with management fees similar to traditional ETFs. High tradability on stock exchanges. Low counterparty risk, as ETFs are regulated investment products.

Cons: Prices may deviate from Net Asset Value (NAV).

Ownership: Ownership in a fund share.

Bitcoin Exchange-Traded Products (ETPs)

What is it? Similar to ETFs, but may include a broader range of products such as ETNs which are notes representing a debt instrument of a special purpose vehicle.

Pros: Low to medium fees, comparable to ETFs. High tradability on regulated exchanges. Moderate counterparty risk, depending on the product structure.

Cons: Counterparty risk associated with ETNs and their legal entities, in particular also with regards to their jurisdiction. Prices may be influenced by market demand.

Ownership: Ownership in a debt instrument (e.g. ETN).

In summary, investing in Bitcoin offers a spectrum of opportunities, each with its own set of advantages and risks. Whether you opt for direct ownership, the convenience of traditional investment vehicles, or the flexibility of derivatives, understanding the associated fees, tradability, counterparty risk, and legal structure is crucial. Before diving into Bitcoin investments, conducting thorough research and seeking guidance from financial professionals can help you navigate this dynamic and evolving market landscape effectively. With careful consideration and informed decision-making, you can potentially capitalize on the potential benefits of including Bitcoin in your investment portfolio.

Consolidation ending with a performance of -11.3% in January

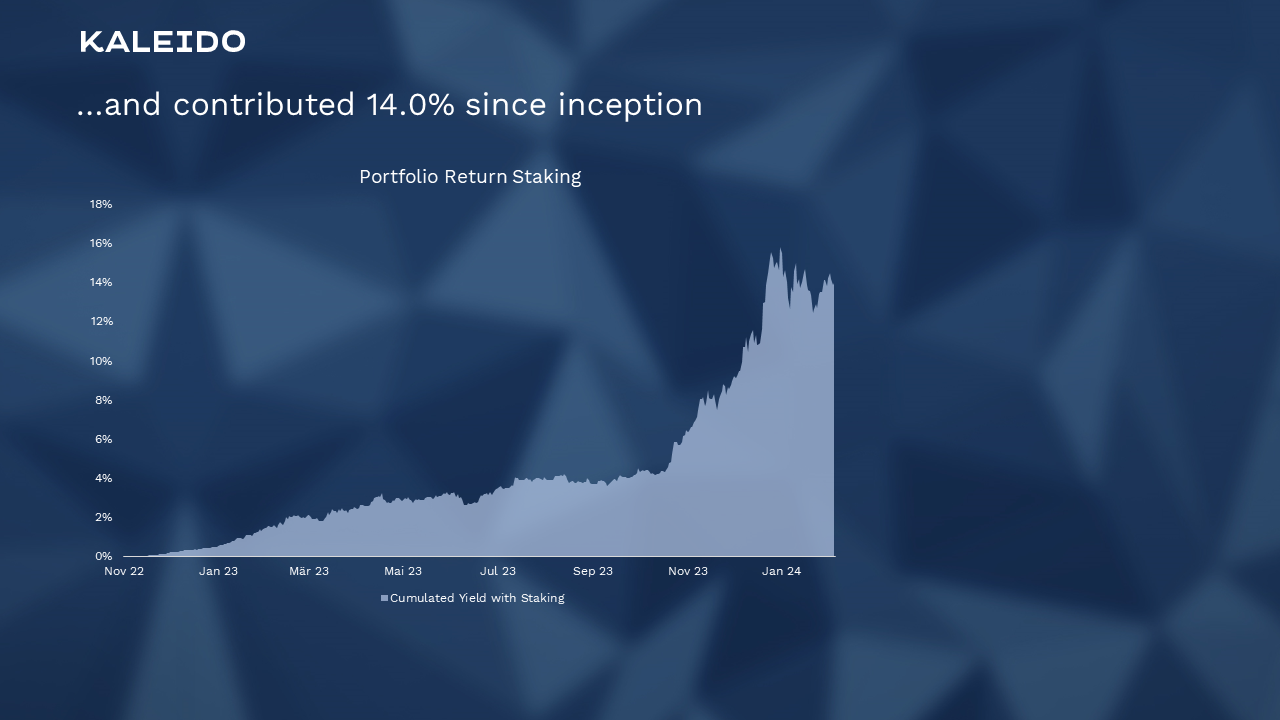

After the brilliant end-of-year rally, which also dominated the crypto markets, January began with a correction that coincided with the launch of Bitcoin ETFs. After a performance of almost 200% in 2023, of which staking contributed 14.1%, a breather is not surprising, but does not change the bullish sentiment with the emerging narrative of Bitcoin Halving and the first speculations regarding an Ether spot ETF launch in spring.

Resilient KDAC Strategy compared to market-weighted indices

Within the overall portfolio, we have also been able to observe an Altcoin rally in recent weeks, which is reflected on one hand in the coin allocation of the latter and on the other hand in an outperformance compared to Bitcoin-heavy investments, such as a Bitwise 10 Index.

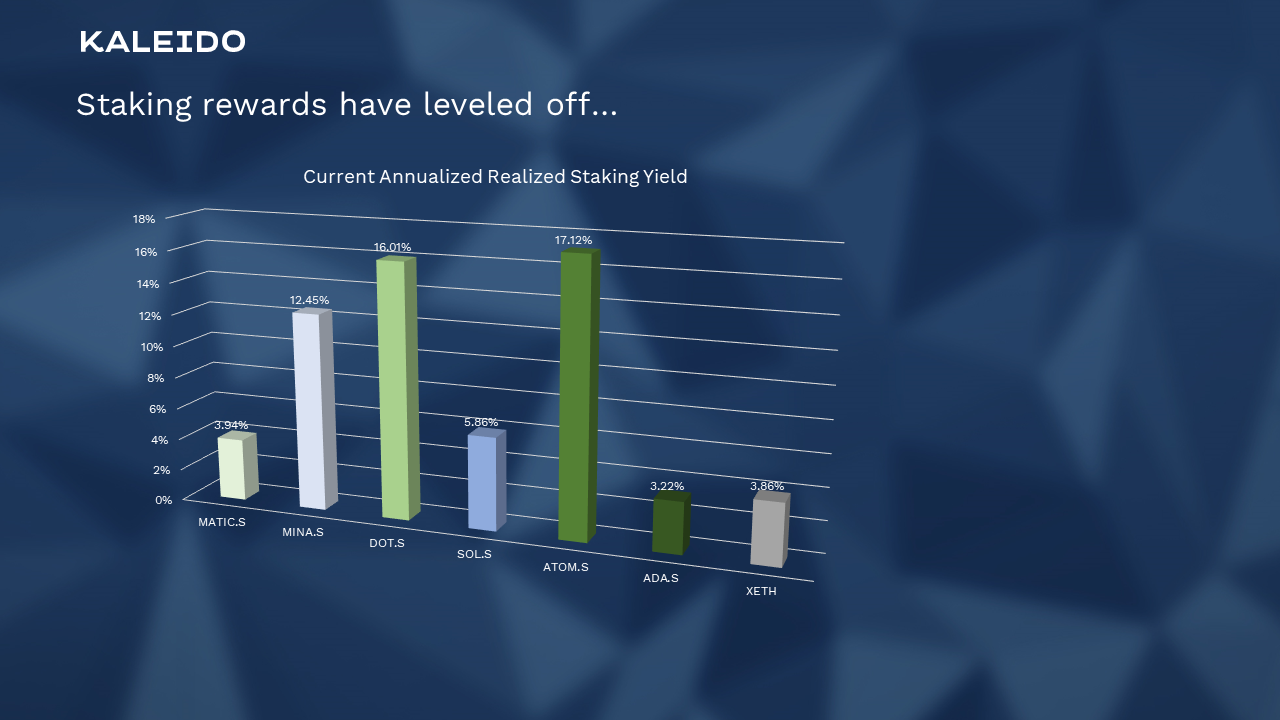

Staking rewards have leveled off…

The entire staking rewards are held in the respective coins, which generated a return of 14.0% in USD since inception.

…and contribute 14.0% to the portfolio performance since inception

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

.png)

Management Summary January was dominated by the launch of the Trump Coin. Bitcoin consolidates slightly above USD 100k, while altcoins performed...

.png)

Management Summary The altcoin rally was briefly interrupted by statements from the Fed in December. The Fear and Greed Index has eased...

.png)

Management Summary November marked the start of the Altcoin Rally with Bitcoin dominance dropping below 56%. The Fear and Greed Index reached...