2 min read

Planting Coins: Our crypto portfolio - second report (and strategies)

Management Summary Today's focus is on various portfolio construction strategies: lump-sum investment, market timing, staggered, or Dollar Cost...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the eighth crypto portfolio report since the initiation of our section Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up for our newsletter to get the following report straight into your mailbox!

At Kaleido Privatbank, we have been at the forefront of offering our clients access to crypto portfolio and Web3 investment opportunities for almost a year. From cryptocurrency trading and custody services to loans and specialized traditional collective investments, our clientele encompasses a diverse range of investors. In the following sections, we aim to categorize them into four distinct personas, shedding light on their reasoning and motivations.

This type of investor places unwavering faith in a specific cryptocurrency, such as Bitcoin. They view Bitcoin as a store of value, appreciating its decentralized nature as a distributed ledger. While they acknowledge the high volatility that currently limits its mainstream adoption as a currency, they still consider Bitcoin a worthwhile investment. As David Marcus from Paypal aptly puts it:

“I really like Bitcoin. I own Bitcoins. It’s a store of value, a distributed ledger. It’s also a good investment vehicle if you have an appetite for risk. But it won’t be a currency until volatility slows down.”

David Marcus, Paypal

Despite the inherent volatility, the Crypto Believer perceives Bitcoin as a valuable long-term investment, particularly for those comfortable with risk. They anticipate a future where Bitcoin could potentially become a widely accepted currency, provided the volatility diminishes over time. It's worth noting that being a Crypto Believer doesn't necessarily mean being a Bitcoin maximalist; some also advocate for a diversified portfolio.

Unlike the Crypto Believer, the Technology Believer recognizes the potential of blockchain technology beyond a specific cryptocurrency. They perceive blockchain as a transformative force with the ability to revolutionize various industries. For them, Bitcoin represents a groundbreaking application of this technology. As Marc Kenigsberg from Bitcoin Chaser states:

“Blockchain is the tech. Bitcoin is merely the first mainstream manifestation of its potential.”

Marc Kenigsberg, Bitcoin Chaser

These investors are enthusiastic about the underlying technology and believe that cryptocurrencies have the power to reshape the financial landscape. They see investing in cryptocurrencies as a means to participate in this technological revolution and explore its potential benefits. For technology advocates, cryptocurrencies are not only an asset class, but they also consider equity venture capital or market-neutral strategies, where returns are driven by technology risk rather than market risk.

The Diversified Investor understands the importance of maintaining a balanced investment portfolio, which includes a proportion of cryptocurrencies. They value the concept of diversification and perceive cryptocurrencies as one of many available investment options. Typically, they allocate a small percentage of their total assets to cryptocurrencies. As Mike Novogratz from Galaxy Digital Assets affirms:

“Ten percent of my net worth is in this space.”

Mike Novogratz, Galaxy Digital Assets

For the Diversified Investor, including cryptocurrencies in their portfolio, offers an opportunity to participate in the potential growth of digital assets while mitigating risk through diversification. Historical data reveals that even a low single-digit percentage exposure to the digital asset space has rewarded investors with significantly higher Sharpe Ratios.

The Traditionalist, as the name suggests, adopts a cautious approach and prefers to stick to more traditional investment options. They may harbor skepticism toward the hype surrounding cryptocurrencies and blockchain, choosing to keep their distance from this emerging market. As Jeffrey Gundlach from DoubleLine Capital humorously remarks:

“Maybe I’m just too old, but I’m going to let this mania go on without me.”

Jeffrey Gundlach, DoubleLine Capital

Guided by experience and a conservative mindset, the Traditionalist values stability and proven investment methods. They prioritize the preservation of wealth and opt for established avenues that align with their risk tolerance and principles.

At Kaleido, we believe that incorporating digital assets into a well-diversified crypto portfolio is exclusively a strategic move. Distributed ledger technology has already demonstrated concrete applications across various industries. Assuming the continued evolution from Web 1 and Web 2 to Web 3, with blockchain playing a prominent role, exposure to digital assets can be seen as an intriguing call option. By allocating a small percentage, for example, one or two percent of the portfolio, investors can still expect favorable risk-return potential in the coming years.

If you are interested in understanding Digital Assets and better opportunities, Do not hesitate to contact us.

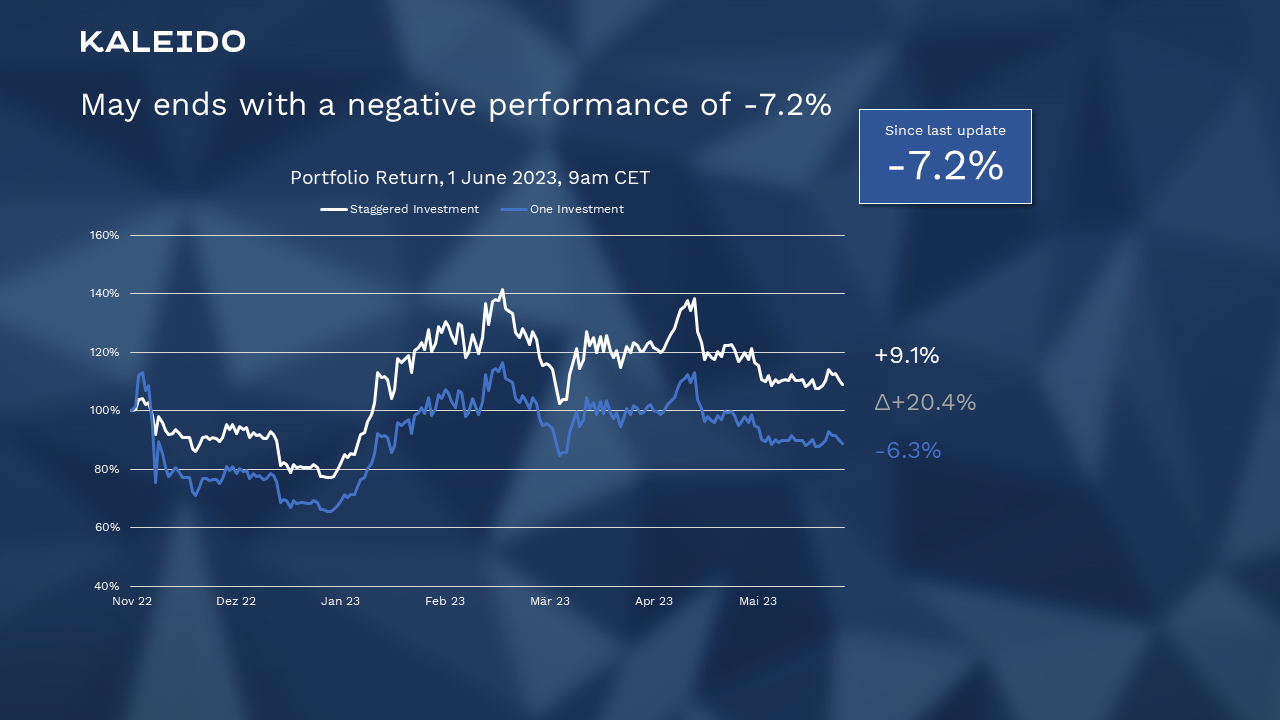

Our crypto portfolio was launched on November 2, 2022, at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data for this report is accurate as of June 1, 2023, at 9 a.m. CET.

May ends with a negative performance of -7.2%

The month of May was marked with a relatively high level of uncertainty in the markets. The dominant theme revolved around political discussions surrounding the increase in the US debt ceiling.

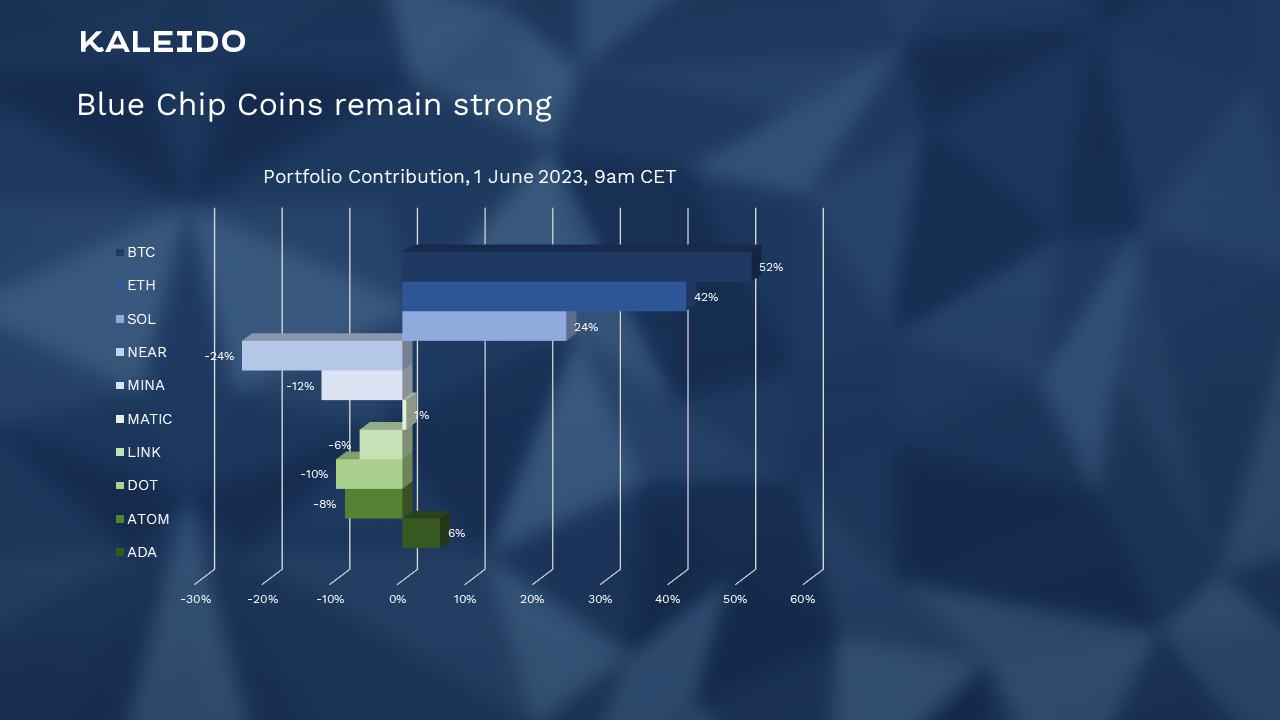

Blue Chip Coins remain strong

As we approach the end of the crypto winter, it is notable that highly capitalized coins, often referred to as Blue Chip Coins, exhibit relative strength. This trend is reflected in our portfolio, with BTC, ETH, SOL, and ADA contributing positively to its performance.

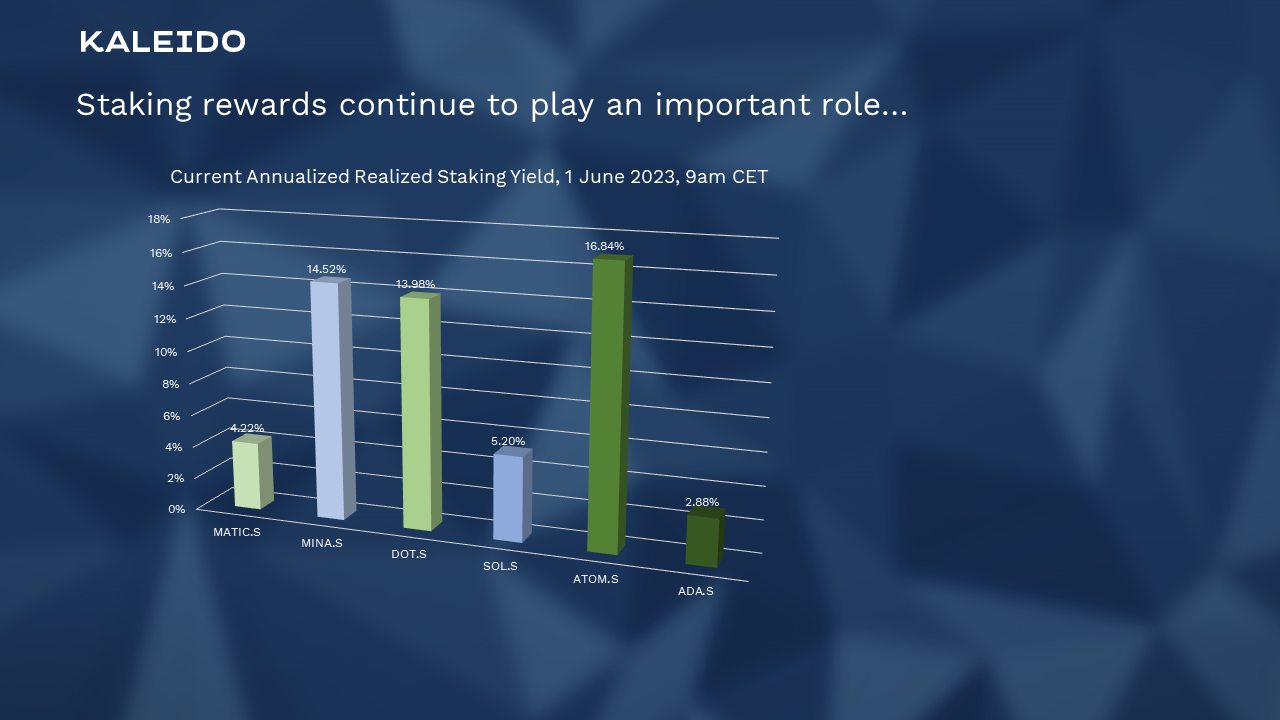

Staking rewards continue to play an important role…

We continue to benefit from bonded staking, which has allowed us to achieve staking rewards ranging from 3% to 17% annually. Additionally, after thorough analysis, we have positioned ourselves in the waiting line to participate in Ethereum Staking. Due to high market demand, the waiting period in the first half of May extended to nearly four weeks, making the first rewards expected in June.

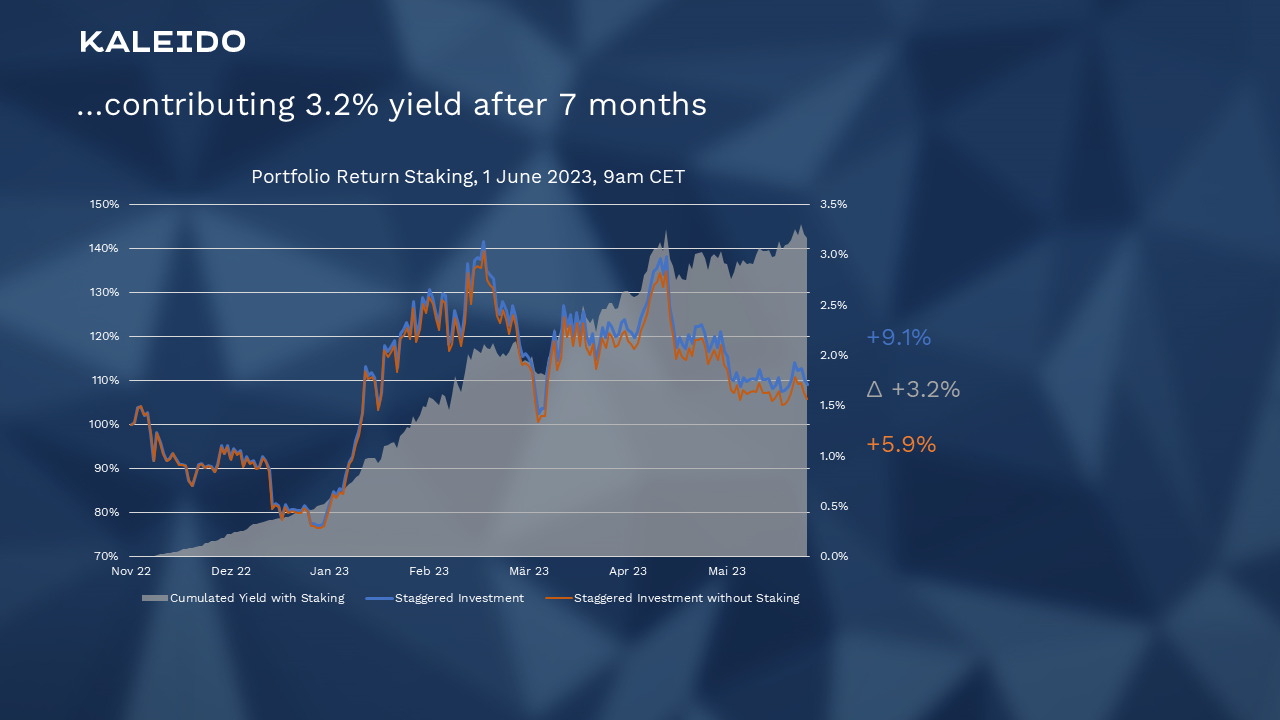

…contributing 3.2% yield after 7 months

Staking allowed us to achieve a 3.2% return, measured in USD, in the first 7 months of the Crypto Garden.

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation or financial advice. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

2 min read

Management Summary Today's focus is on various portfolio construction strategies: lump-sum investment, market timing, staggered, or Dollar Cost...

1 min read

Management Summary Kaleido Digital Asset Core Strategy started with a consolidation with a return of -11.3% in January Equal-weighted KDAC strategy...

Management Summary The crypto investing series starts under adverse market conditions. Our investment strategy was able to compensate or dampen...