Planting Coins: the first report from our crypto portfolio

Management Summary The crypto investing series starts under adverse market conditions. Our investment strategy was able to compensate or dampen...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the fifth report since the initiation of our crypto portfolio, and the sixth part of our crypto investing series Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up for our newsletter to get the next reporting straight in your mailbox!

The portfolio was launched on November 2, 2022 at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data of this report is as per March 1, 2023 at 8am. CET.

.png?width=1280&height=720&name=Slide31%20(1).png)

Figure 1: Consolidation in Feburary.

Our portfolio value increased by another more than 20% at the beginning of the month before the various coins entered a consolidation and the portfolio ended the month with a positive performance of 4.8%. Looking at the staged investment process we used to invest in the falling market, we outperformed by 22.5% compared to a one-off investment at the beginning of November.

.png?width=1280&height=720&name=Slide32%20(1).png)

Figure 2: Mina Protocol is the new top performer

Mina Protocol made it to the top of the portfolio with a 60% contribution, ahead of Polygon Matic, Solana and Bitcoin. On the other hand, Cardano was the least successful cryptocurrency with a contribution of only 5%.

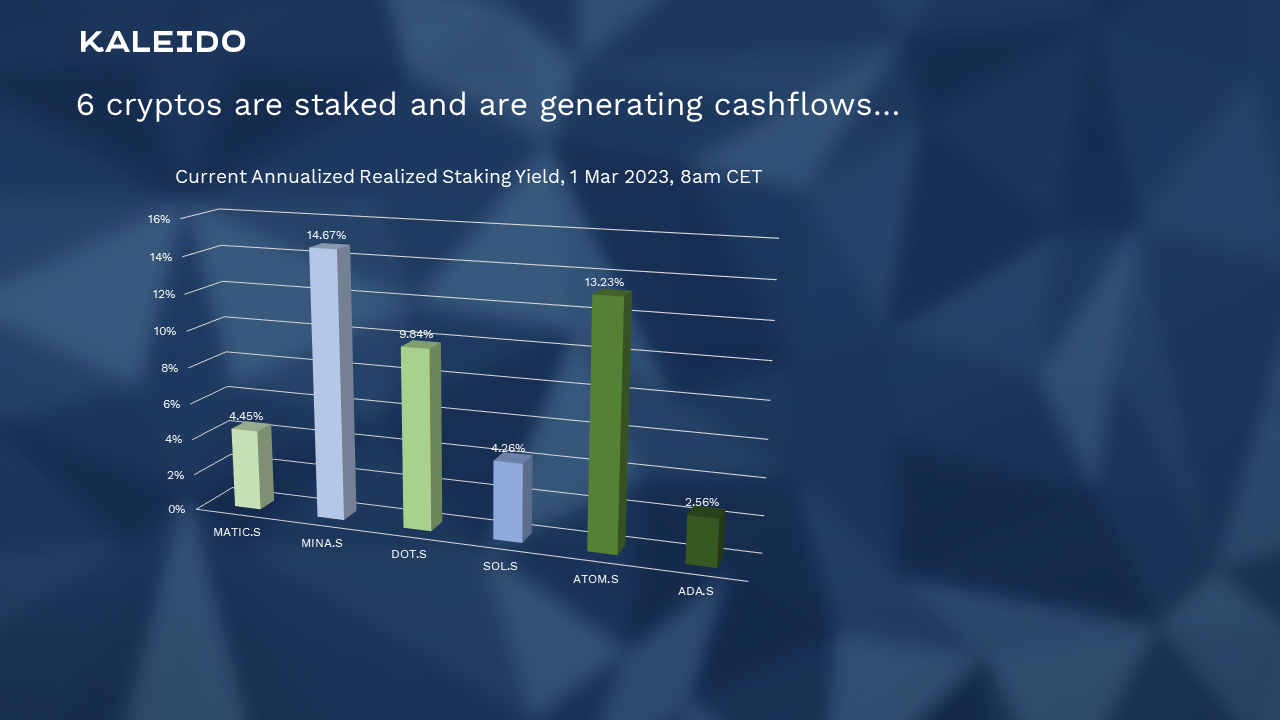

Figure 3: Six cryptos are staked generating cashflows…

The staking rewards of the six staked coins are also relatively constant and contribute a yearly gross return of between 2.56% and 14.67%. In this context, the returns on selected cryptocurrencies could be additionally increased, as Kraken has expanded its staking offering and, in addition to liquid staking, now also offers illiquid staking in compliance with the lock-in periods.

Staking rates are calculated on an annual basis based on the effectively realized staking rewards on a daily basis. Thus, they vary on a daily basis, but give an approximate indication of what to expect.

.png?width=1280&height=720&name=Slide34%20(1).png)

Figure 4: …contributing already 2.1% of performance to the portfolio

As figure 4 shows, the portfolio could already achieve 2.1% performance with the decision to stake the six currencies.

Disclaimer: The above information is advertising in accordance with Art. 8 para. 6 FinSA and is for information purposes only. We will provide you with further documentation free of charge at any time. The products, services and information offered may not be available to persons residing in certain countries. Please note the applicable sales restrictions for the corresponding products or services.

Management Summary The crypto investing series starts under adverse market conditions. Our investment strategy was able to compensate or dampen...

1 min read

Management Summary Today's focus is on the significant price recovery of cryptocurrencies in January and its impact on our crypto garden. In the...

We are in the midst of a crypto winter, and it is not the first since the launch of Bitcoin in 2008. Blockchain technology has been the talk of the...