Planting Coins: Fifth report

Management Summary Our crypto garden portfolio has now been invested for 120 days and has achieved a return of 26.7%. After the significant price...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the fifth report since the initiation of our crypto portfolio, and the sixth part of our crypto investing series Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up for our newsletter to get the next reporting straight in your mailbox!

Many investors who view crypto assets primarily as a long-term investment or even as a store of value can take advantage of a Lombard loan, for example, to cover ongoing everyday consumption costs without having to sell the crypto assets. Moreover, the Lombard loan liquidity can be used to either further diversify your crypto portfolio or to hedge your portfolio against price declines.

A Lombard loan is a secured loan that allows one to use their cryptocurrency portfolio as collateral to obtain a fiat currency loan. On the following lines, we will highlight the advantages, disadvantages, opportunities and risks of using a Lombard loan for your cryptocurrency portfolio.

Generic advantages

Specific advantages

In summary, a Lombard loan can be a useful financial tool for crypto investors who need quick access to cash while retaining ownership of their investment, or who wish to further diversify or hedge their crypto portfolio. However, it is important to carefully weigh the advantages, disadvantages, opportunities and risks before taking out a Lombard loan for your cryptocurrency portfolio. As with any financial decision, we at Kaleido are available to help you determine if a Lombard loan is right for you.

The portfolio was launched on November 2, 2022 at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data of this report is as per February 1, 2023 at 7am. CET.

Figure 1: A positive start into 2023.

After three months, the portfolio shows a positive performance of +21.9%, compared to -18.7% on 20 December 2022. This corresponds to an increase in value of over 40% in just under six weeks.

The developments can be attributed to a generally positive market sentiment in January, even though contagion risks still exist, particularly in the CeFi area around the Digital Currency Group DCG conglomerate.

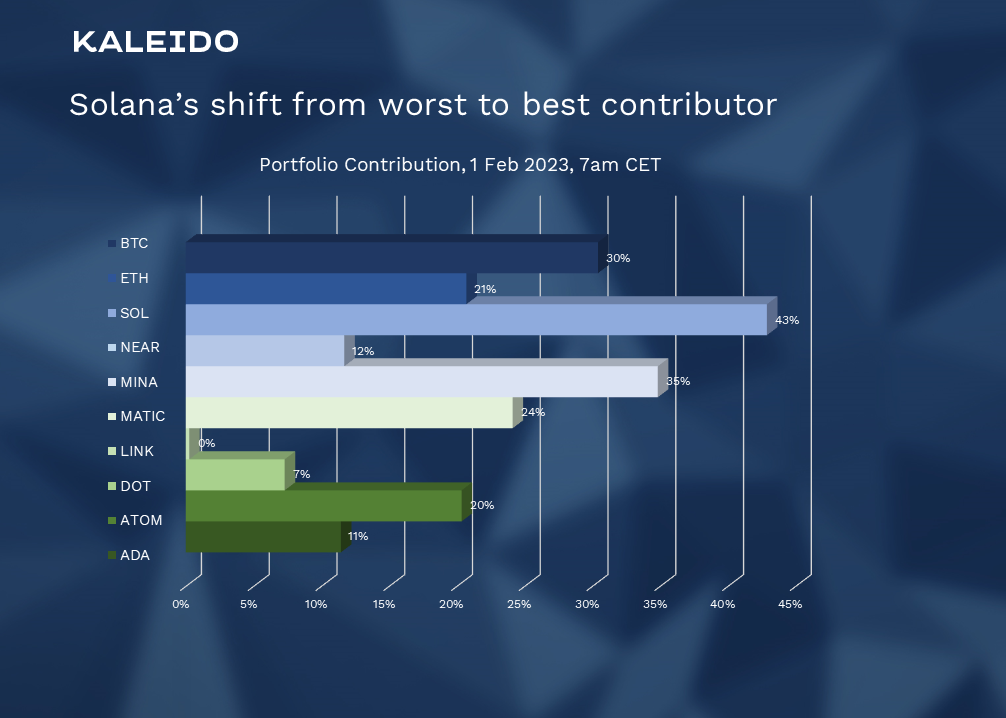

Figure 2: All coins contributing positively.

The main contributor in terms of performance was Solana, which also lost disproportionately in value in the wake of the FTX bankruptcy. Overall, all contributions are positive, even though we are practically back in field 1 with Chainlink.

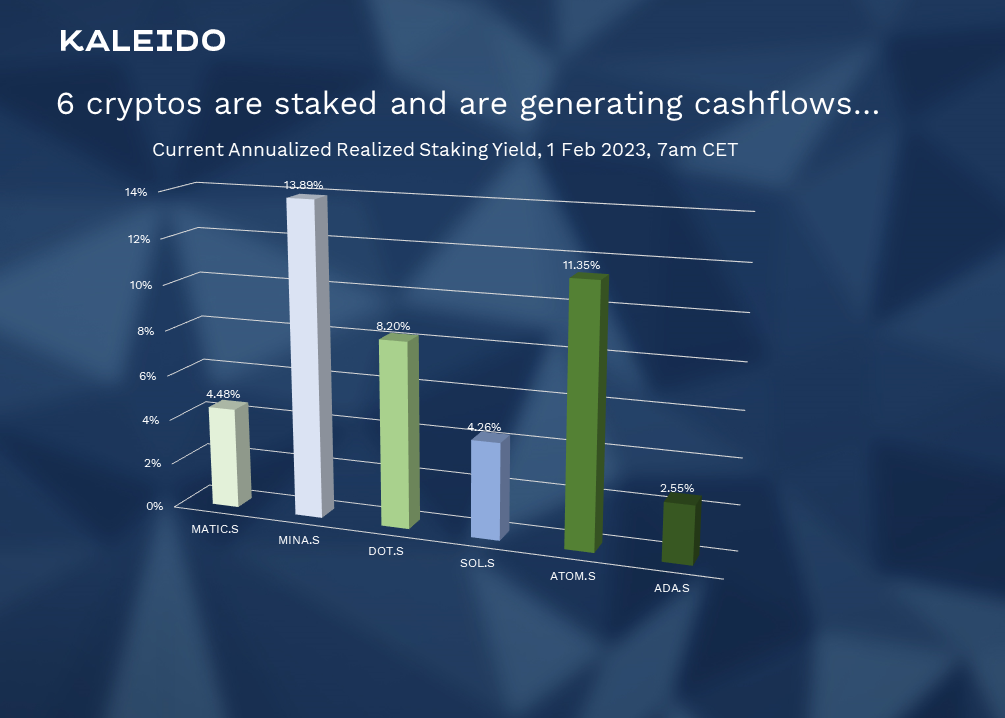

Figure 3: Six cryptos are staked generating cashflows…

The staking rewards of the 6 staked coins are also relatively constant and contribute a gross return of between 2.55% and 13.89%.

Staking rates are calculated on an annual basis based on the effectively realized staking rewards on a daily basis. Thus, they vary on a daily basis, but give an approximate indication of what to expect.

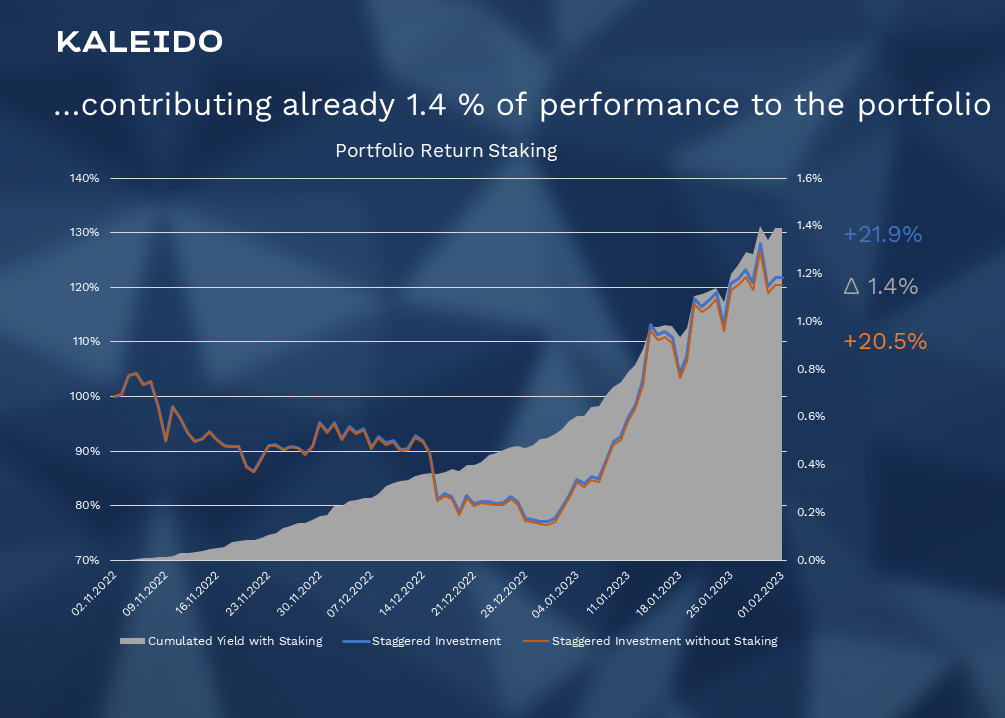

Figure 4: …contributing already 1.4% of performance to the portfolio

Of course, the staking rates have to be put into perspective with inflation, but in today's view it is first about how much the decision against staking would cost our portfolio. As figure 4 shows, we could already achieve 1.4% performance with the decision to stake the six currencies.

Disclaimer: The above information is advertising in accordance with Art. 8 para. 6 FinSA and is for information purposes only. We will provide you with further documentation free of charge at any time. The products, services and information offered may not be available to persons residing in certain countries. Please note the applicable sales restrictions for the corresponding products or services.

-1.png)

Management Summary Our crypto garden portfolio has now been invested for 120 days and has achieved a return of 26.7%. After the significant price...

Management Summary The crypto investing series starts under adverse market conditions. Our investment strategy was able to compensate or dampen...