Planting coins: Eleventh report

Management Summary

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

Management Summary

This blog post is the tenth report since the initiation of our crypto portfolio Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up for our newsletter to get the next reporting straight in your mailbox!

Why rebalancing matters?

A balanced investment portfolio can be an effective way to manage risk and maximize long-term returns. In the cryptocurrency space, where volatility and price fluctuations are commonplace, systematic rebalancing of the portfolio can be crucial. Such a rebalancing is also applied in our strategy as soon as the actual weights deviate more than five percentage points from the target weight.

Market weighting vs. equal weighting

Many strategies in the crypto space aim for a weighting by market capitalization. This means that the weighting of individual cryptocurrencies is proportional to their share of the overall market. However, this can lead to an overweighting of certain cryptocurrencies that are already very established on the one hand, but may also be overvalued on the other. In contrast, equal weighting aims to equally weight all cryptocurrencies in the portfolio, regardless of their market capitalization. This spreads the risk better and makes the portfolio less susceptible to extreme price fluctuations. Furthermore, there is the possibility to outperform the market in the longer term.

Rebalancing to reduce risk

A consistent rebalancing mechanism allows investors to manage and reduce the risk of their portfolio. By regularly reviewing the portfolio and rebalancing it when it reaches a certain deviation from the target weight. This allows investors to ensure that no single cryptocurrency dominates the portfolio over a longer time horizon, increasing the overall risk. Rebalancing puts the portfolio in a balanced position and effectively manages risk.

Avoiding transaction costs

When rebalancing, however, it is important to keep in mind that each transaction may involve costs. Therefore, it is advisable to consciously plan rebalancing measures to minimize transaction costs. One strategy is to let positions run for the time being that are above the target weight but have not yet reached a significant deviation. This makes it possible to let profits run and avoid transaction costs as long as the deviation is still within an acceptable range.

Letting profits run

The procedure just described underlines the importance of letting profits run instead of realizing them prematurely. If a cryptocurrency increases strongly and its share in the portfolio becomes larger than the target weight as a result, it may make sense not to reduce this position for the time being. As long as the deviation from the target weighting is not critical, investors can benefit from the fact that the price continues to rise and higher profits can be realized subsequently.

Waiting for the next leg up

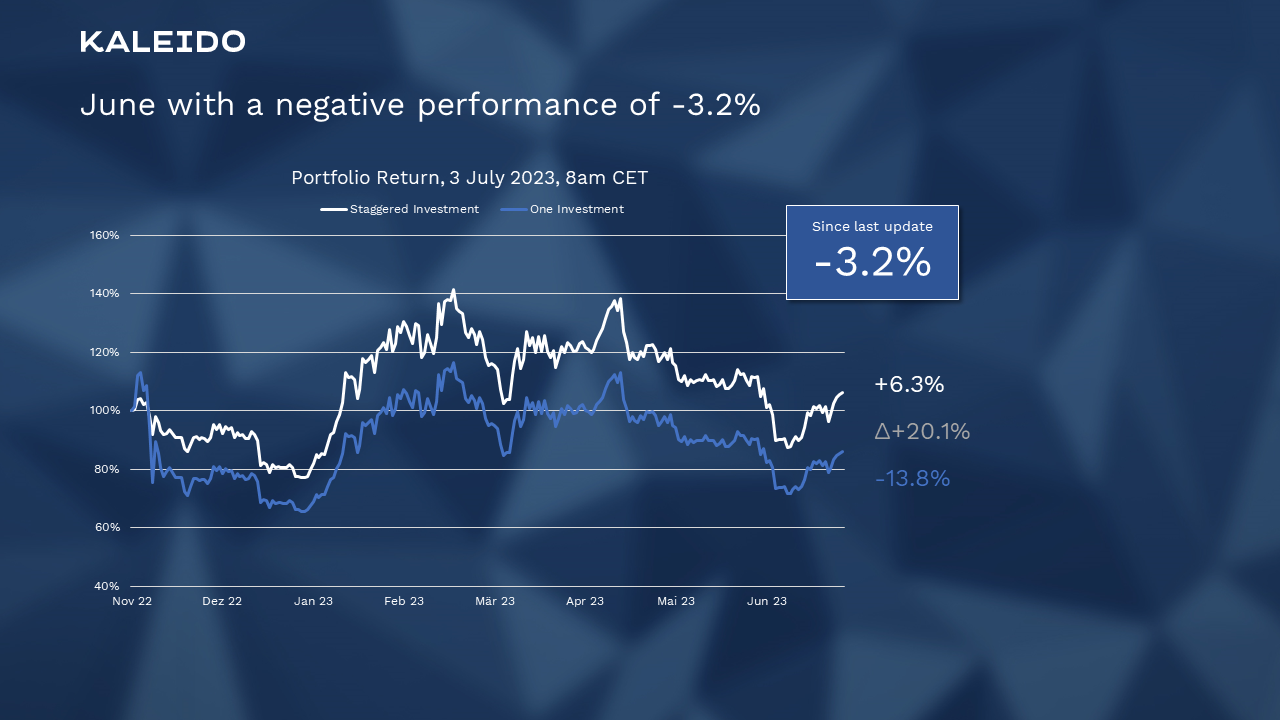

The portfolio was launched on November 2, 2022 at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data of this report is as per July 3, 2023 at 8am CET.

June with a negative performance of-3.2%

June was characterized by regulatory activities of the American SEC and the associated losses in various coins also in our portfolio. This led to a significant drawdown of around 24% in the first half of the month, which was almost recovered in the second half. This results in a June performance of -3.2% since the last report.

That a classification of Bitcoin as a security is very unlikely, could be observed in the weight of the coin in the portfolio at the end of the month, which amounted to more than 17% and thus triggered a rebalancing. The position of Bitcoin was accordingly reduced by about 40% to 10% portfolio weight as of June 26. In return, the positions in Cardano, Chainlink, Polygon Matic, Mina and Near were increased.

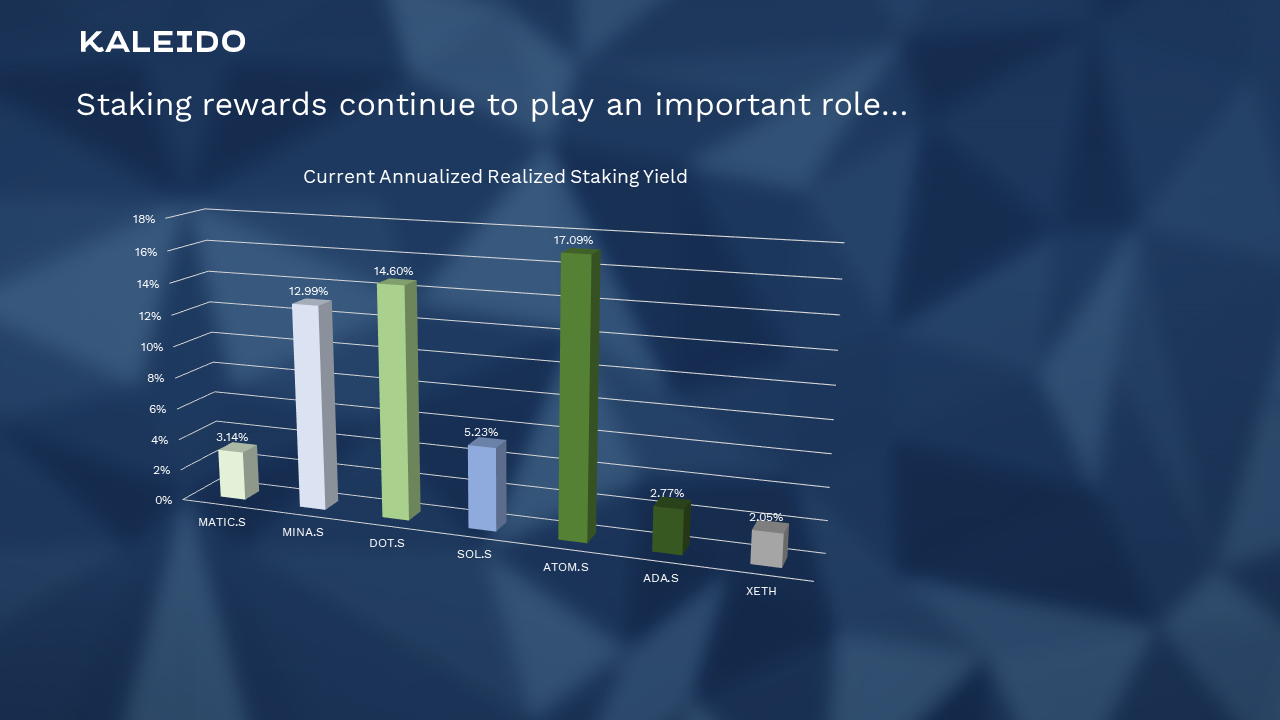

Staking rewards continue to play an important role…

As expected, the first ETH Staking Rewards were credited to the portfolio, resulting in a current annualized return of 2.05%. It should be noted that this expected return will still increase, as the waiting period until the first rewards will lose weight in relation to the return period.

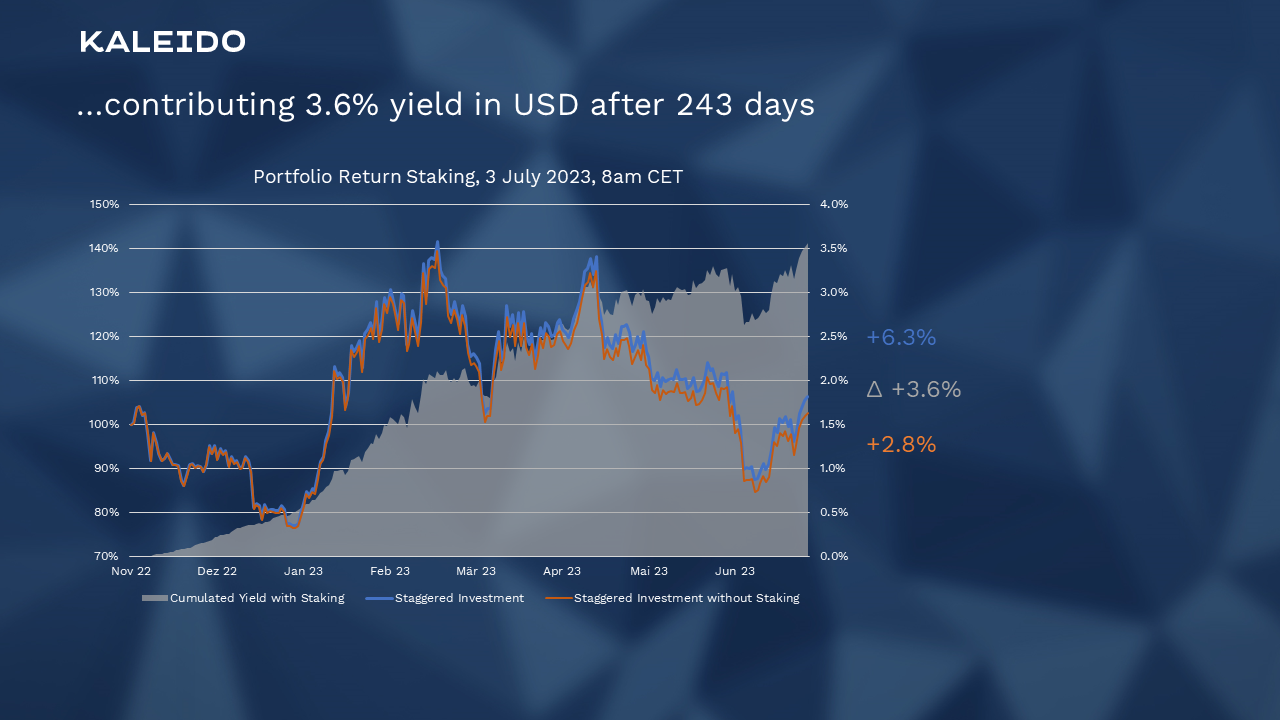

…contributing 3.6% yield after 243 days

The total Staking Rewards are still held in the respective coins, which brought a return of 3.6% in the first good 8 months.

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Management Summary October ended with a positive performance of +29.4% Altcoins benefit from initial redistribution of Bitcoin gains made In the...