Planting coins: Eleventh report

Management Summary

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

Management Summary

What is the crypto investing series?

This blog post is the seventh report since the initiation of our crypto portfolio Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up for our newsletter to get the next report straight in your mailbox!

To time or not to time

Since the crypto garden was set up last November, the question arose from time to time why the portfolio is constantly invested at 100%, and unlike other active strategies, no timing component was built in. Logically, the question always arises when investing: to time or not to time.

A basket as in our case with directional long exposure aims primarily to replicate the performance of the underlying index or asset by maintaining a constant long position in the market. This approach does not involve timing the market and is more focused on capturing the long-term upside potential of the asset.

A basket with a cash component, on the other hand, actively manages the allocation of assets in the portfolio by adjusting exposure to cash or other short-term, low-risk assets based on market conditions. This approach aims to reduce risk and maximize return by identifying the market in a timely manner and closing positions as needed.

Definitely, both approaches have their raison d'être, but the crypto garden raises the question of how to incorporate the portfolio in an overall portfolio context. The goal and intention of the crypto garden from the beginning were to build up the so-called core exposure within a core-satellite philosophy. For digital assets, our core strategy is about giving the investor a long-term oriented and diversified exposure to Distributed Ledger Technology (DLT) and managing this over time while adhering to certain rules and factors.

Such an approach comes with several benefits:

Of course, such a strategy also has disadvantages:

When working with professional investors in the context of managing an overall asset allocation, a 100% directional long investment further facilitates the portfolio manager's management of the cross-asset cash ratio, which is not distorted by instrument-level management.

Ultimately, deciding between a strategy with a cash component and one with only directional long exposure depends on investment objectives, risk tolerance, and market outlook. If you believe in the long-term growth potential of the cryptocurrency market and are comfortable with the inherent volatility, a solution with only directional long exposure may be a better choice. However, if you want to reduce downside risk and have the ability to actively manage portfolio allocation, a fund with a cash component may be better for you.

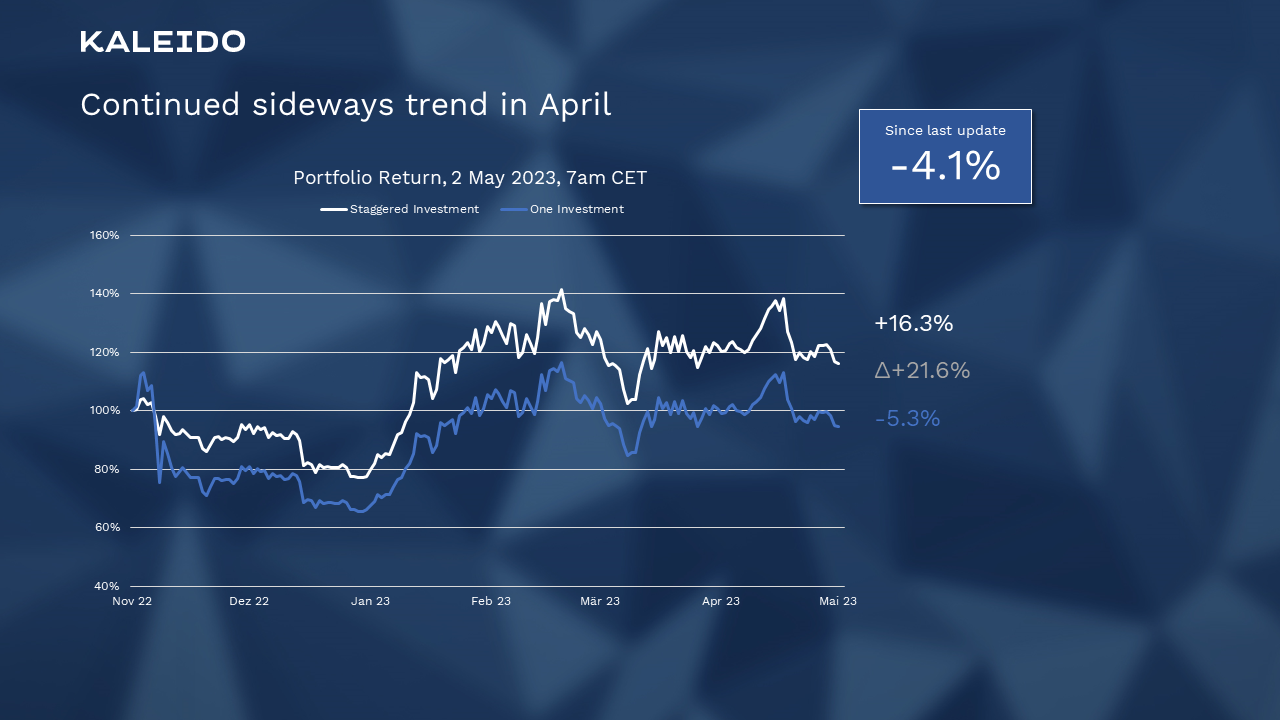

The continued sideways trend in April

The portfolio was launched on November 2, 2022, at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data of this report is as of May 2, 2023, at 7 am CET.

Figure 1: Continued sideways trend in April

After a short interim rise of the portfolio in mid-April to almost 140 points, the sideways phase continued, resulting in a negative monthly balance of -4.1%.

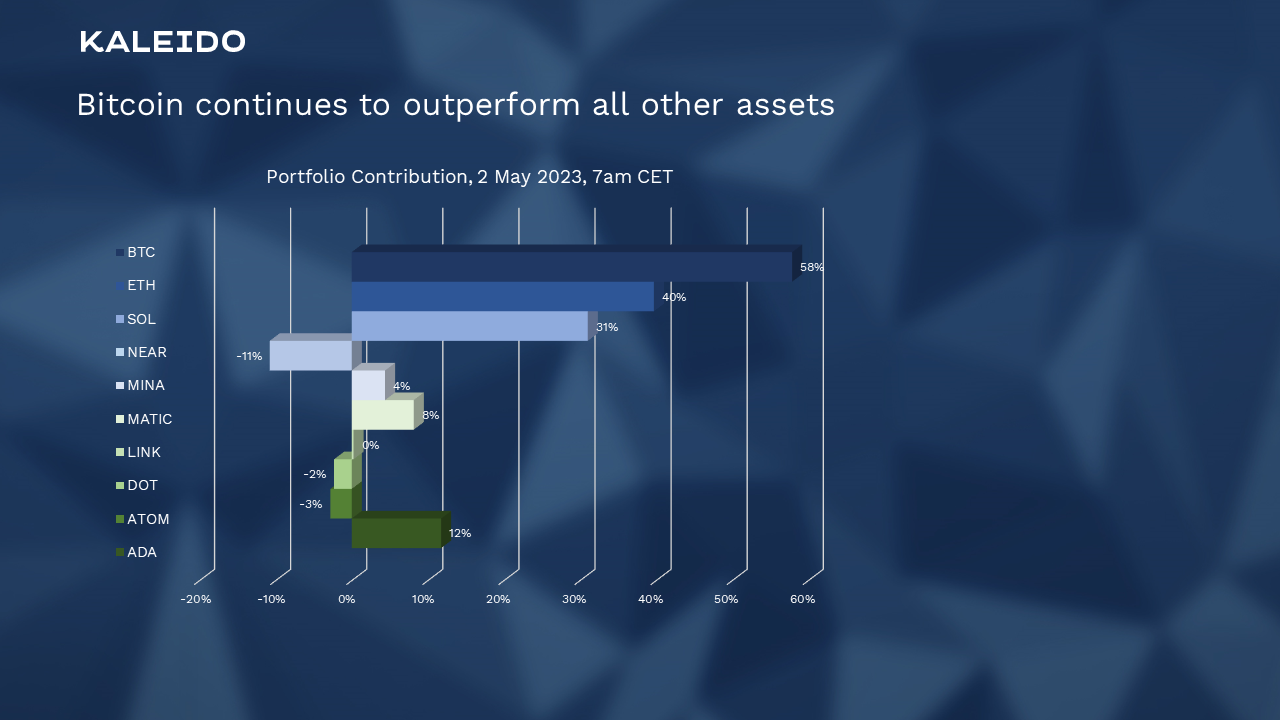

Figure 2: Bitcoin continues to outperform all other assets

As in the previous month, Bitcoin is the best-performing asset. This increased contribution is not due to an overweighting of Bitcoin, but clearly shows the increase of dominance in the market. In addition to the banking crisis narrative, Bitcoin probably also benefited from inflows from the now-defunct stablecoin Binance USD.

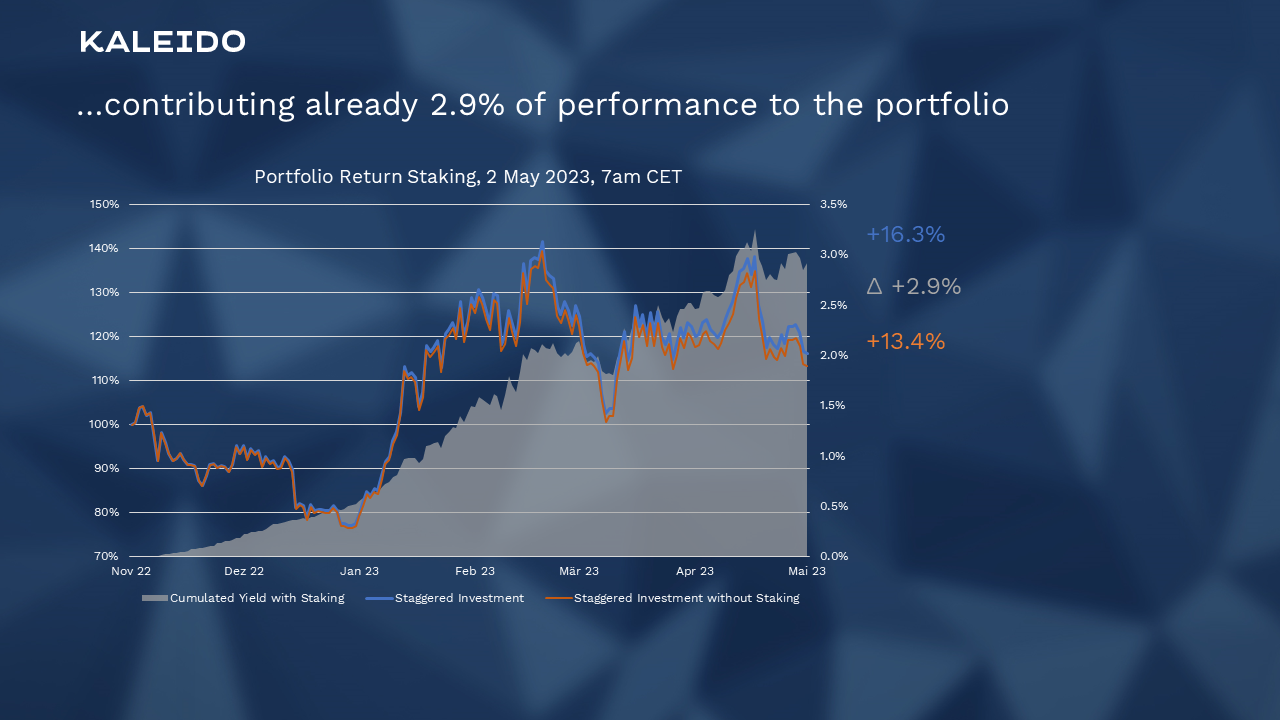

Figure 3: Increasing staking rewards due to illiquid staking…

Staking rewards for the six staked currencies continue to increase slightly due to the adherence to the lock-up period. After the Shanghai upgrade for Ethereum, we are now also considering staking rewards for ETH thanks to the now liquid staking. More on this in the next update.

Figure 4: …contributing already 2.9% of performance to the portfolio

Despite the slight price losses, staking rewards accumulated to just under 3% overall.

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Crypto Portfolio Performance Overview The month of May ended with a negative performance of -7.2% The market was characterized by great...

Management Summary After a great start into 2023, our Crypto Garden portfolio is currently at 120.4 points. In March, we observe a strong rise in...