Planting Coins: the first report from our crypto portfolio

Management Summary The crypto investing series starts under adverse market conditions. Our investment strategy was able to compensate or dampen...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the seventh report since the initiation of our crypto portfolio Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up for our newsletter to get the next reporting straight in your mailbox!

The portfolio was launched on November 2, 2022 at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data of this report is as per April 4, 2023 at 8am CET.

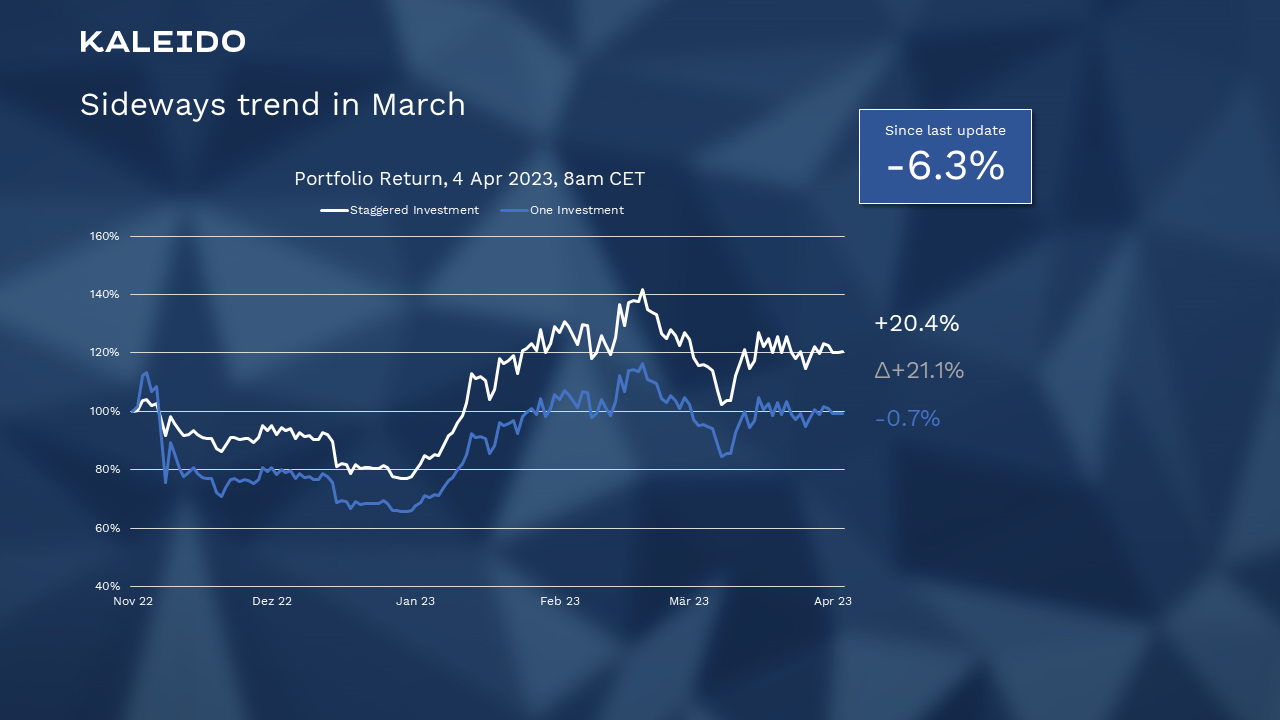

Figure 1: Sideways trend in March

The portfolio performance continued to move sideways in March. This may seem surprising at first glance, as Bitcoin continued to gain momentum and rose to USD 28’000. At the same time, however, the various altcoins clearly underperformed, resulting in a slightly negative return of 6%. This is exemplified by the increase in Bitcoin dominance, i.e. the share of Bitcoin market capitalization in the total market from 43% to 47%.

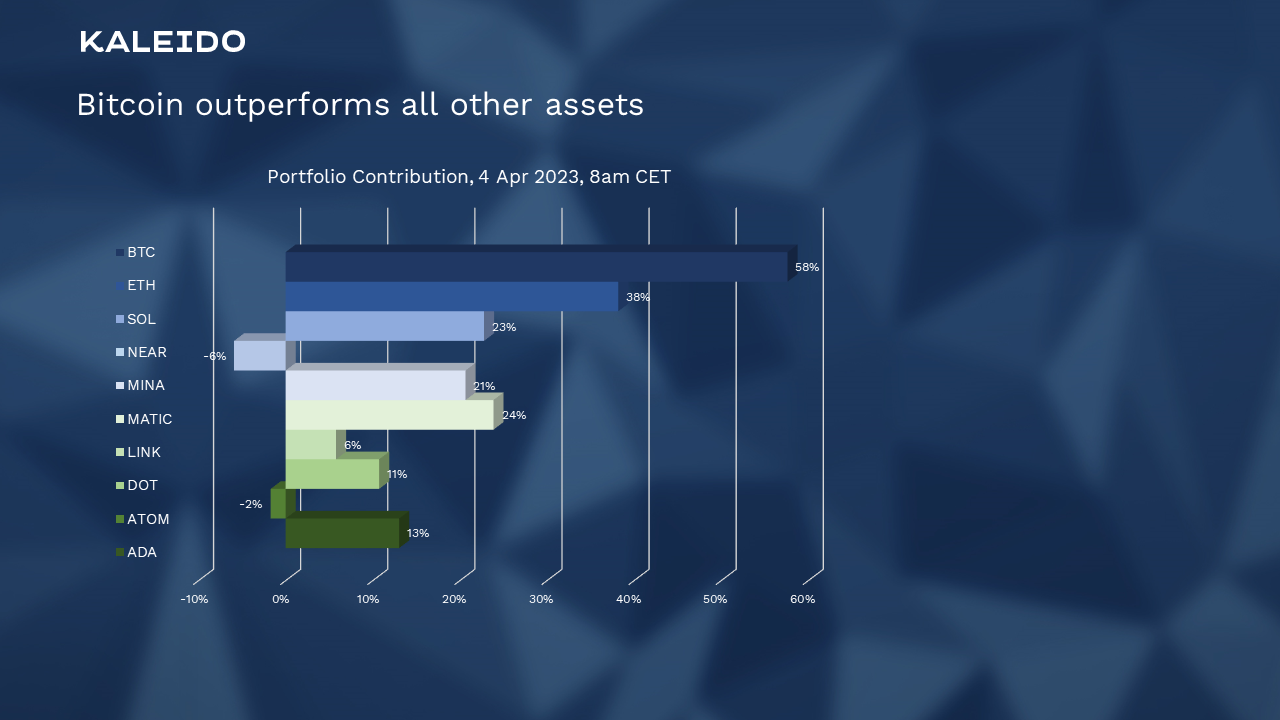

Figure 2: Bitcoin outperforms all other assets

If we compare the contribution of the various coins, Bitcoin has dominated since the portfolio was launched, whereas Near Protocol and Atom Cosmos have lost considerable momentum. Solana, Mina, and Polygon Matic contributed to the performance of the overall portfolio.

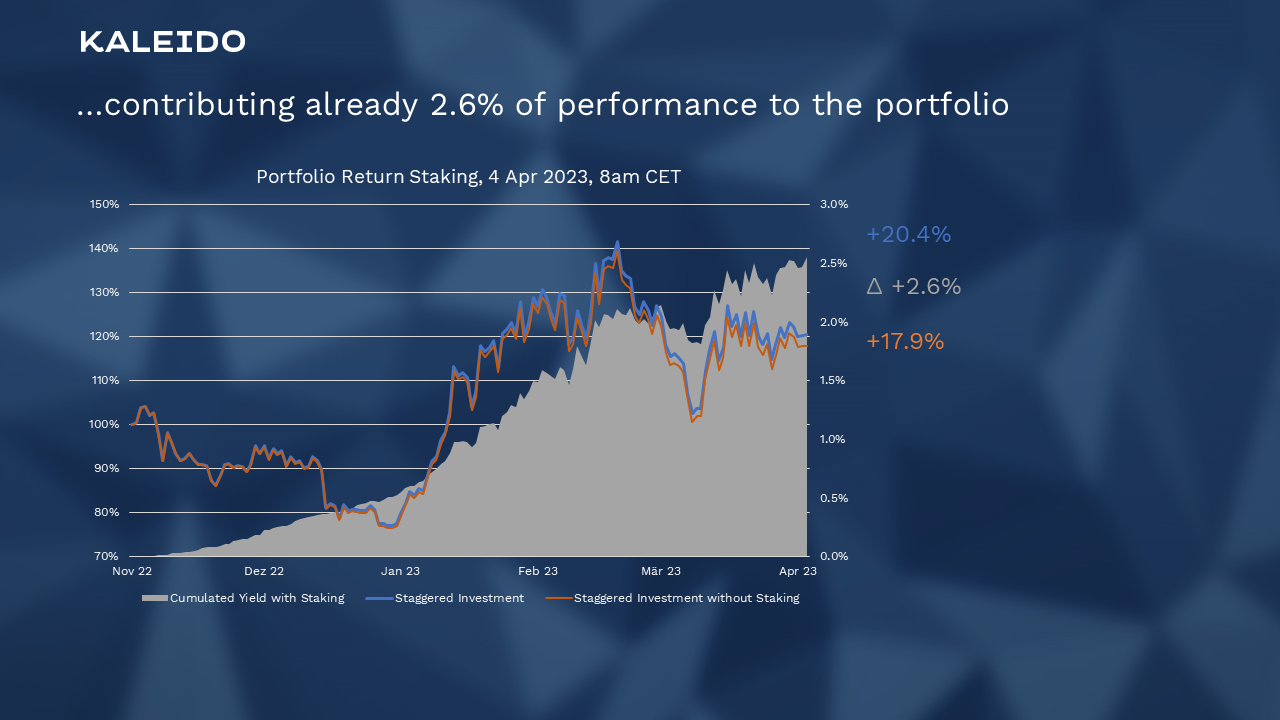

Figure 3: Increasing staking rewards due to illiquid staking…

Kraken now also offers illiquid staking for some coins, which on the one hand increases the rewards, but on the other hand makes any rebalancing more difficult, as the coins cannot be traded immediately. In the context of this project, we have decided to block Polkadot, Solana, Atom Cosmos, and Polygon Matic in exchange for higher rewards.

Figure 4: …contributing already 2.6% of performance to the portfolio

The return achieved through staking now amounts to over 2.6% portfolio performance.

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation or financial advice. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Management Summary The crypto investing series starts under adverse market conditions. Our investment strategy was able to compensate or dampen...

We are in the midst of a crypto winter, and it is not the first since the launch of Bitcoin in 2008. Blockchain technology has been the talk of the...

Management Summary Today's focus is on staking - the process of holding onto a cryptocurrency to support the operation of a blockchain network and...