Planting Coins: Fifth report

Management Summary Our crypto garden portfolio has now been invested for 120 days and has achieved a return of 26.7%. After the significant price...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

Management Summary

What is the crypto investing series?

This blog post is the eleventh report since the initiation of our crypto portfolio Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up for our newsletter to get the next report straight in your mailbox!

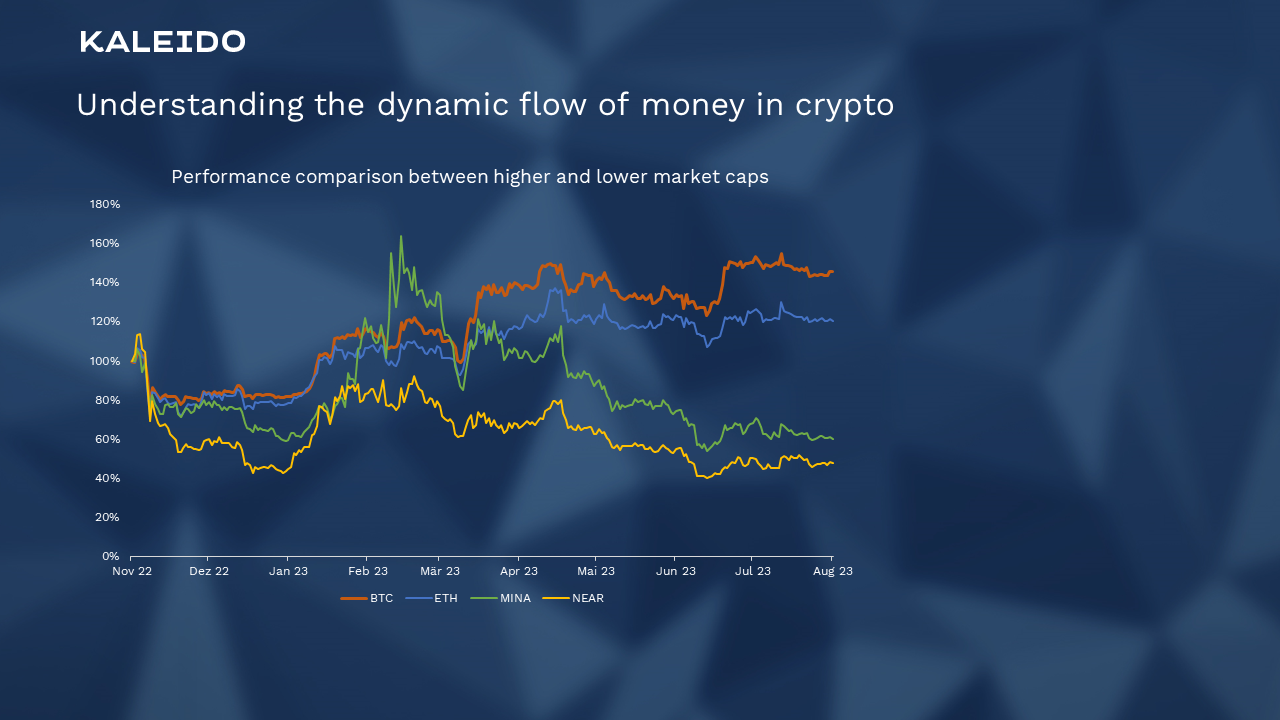

Dynamic money flows in crypto

Our focus topic today is on the money flows that go back and forth between the different coins. Cryptocurrencies are currently establishing themselves, and it is also becoming increasingly clear that their performance is not uniform. Bitcoin, the pioneer among cryptocurrencies, is often the catalyst for significant price increases. As money flows through the cryptocurrency space, different coins experience varying levels of growth and success. In this article, we examine the factors responsible for these fluctuations and show how investors can leverage them for maximum returns.

The Bitcoin Rally

Bitcoin, often referred to as digital gold, remains the poster child of the cryptocurrency industry. Its rally is fueled by positive investor sentiment, global crypto news, and on-chain data indicating supply shortages. Recently, news of a filing for a bitcoin spot ETF from Blackrock led to optimism or even mild euphoria. Retail investors, once again optimistic about Bitcoin, continue to drive the rally.

Why Bitcoin is moving first

Bitcoin's position as the leading cryptocurrency makes it a gateway for new investors to enter the crypto market, with a significant influx coming from fiat currencies. As media attention increases during Bitcoin rallies, new investors become interested in the broader crypto ecosystem. Bitcoin's large market capitalization and rather relatively low volatility compared to other cryptocurrencies make it an attractive asset for traders to store profits. This cycle of new investors entering the market through Bitcoin is helping to set the stage for the next phase of the crypto dance.

The Rise of Ethereum

As the Bitcoin rally gains momentum, investors are beginning to explore other cryptocurrencies, with Ethereum leading the way. Ethereum's appeal lies in its potential to become the infrastructure layer for a decentralized internet. It supports several innovative platforms, including decentralized exchanges (DEXs), stablecoins, credit protocols, and NFTs (non-fungible tokens). These diverse applications have contributed to Ethereum's growth and its position as the second-largest cryptocurrency asset by market capitalization.

Investing in Ethereum and beyond

Investors are increasingly recognizing Ethereum's importance in the crypto space as ultra-sound money, making it a favorable investment choice. Its relatively lower risk compared to lower market cap altcoins is attracting new investors who want to explore the possibilities of decentralized finance (DeFi). As money flows from Bitcoin to Ethereum, investors can position themselves early for potential returns.

Changing dynamics: large-cap altcoins

After Ethereum, money has traditionally flowed into large-cap altcoins that offered investors a range of promising technologies. However, the current cycle shows a different trend. Large-cap altcoins are moving in parallel with Ethereum, indicating a shift in the standard flow of money. This shift is attributed to the emergence of "Ethereum killers" such as Solana, which offer competing technologies and a broader range of investment opportunities.

Make smart investments

Choosing the right investment strategy in this evolving crypto landscape can be challenging. Investors should explore and diversify their portfolios based on the most promising technologies. Large-cap altcoins are now becoming the infrastructural backbone for various tech movements, from NFTs to blockchain-based games. This diversification allows investors to benefit from the growth potential of various projects.

Impact on our portfolio

Understanding the dynamic flow of money in crypto

In order for investors to benefit from the diverse potential in the crypto market in a diversified manner, a thoughtfully positioned portfolio is essential. As we do not believe in timing the market but in time in the market, our equally weighted approach in different coin tiers helps us to navigate around these waves described above. We started the Planting Coins portfolio in the middle of the crypto winter, so it is not surprising that when looking at the performance of individual portfolio components, Bitcoin stands out at the top, followed by Ethereum, but smaller capitalized coins such as Near or Mina are still lagging behind.

Waiting for some Altcoin outperformance

The portfolio was launched on November 2, 2022, at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data of this report is as of August 2, 2023, at 8 am CET.

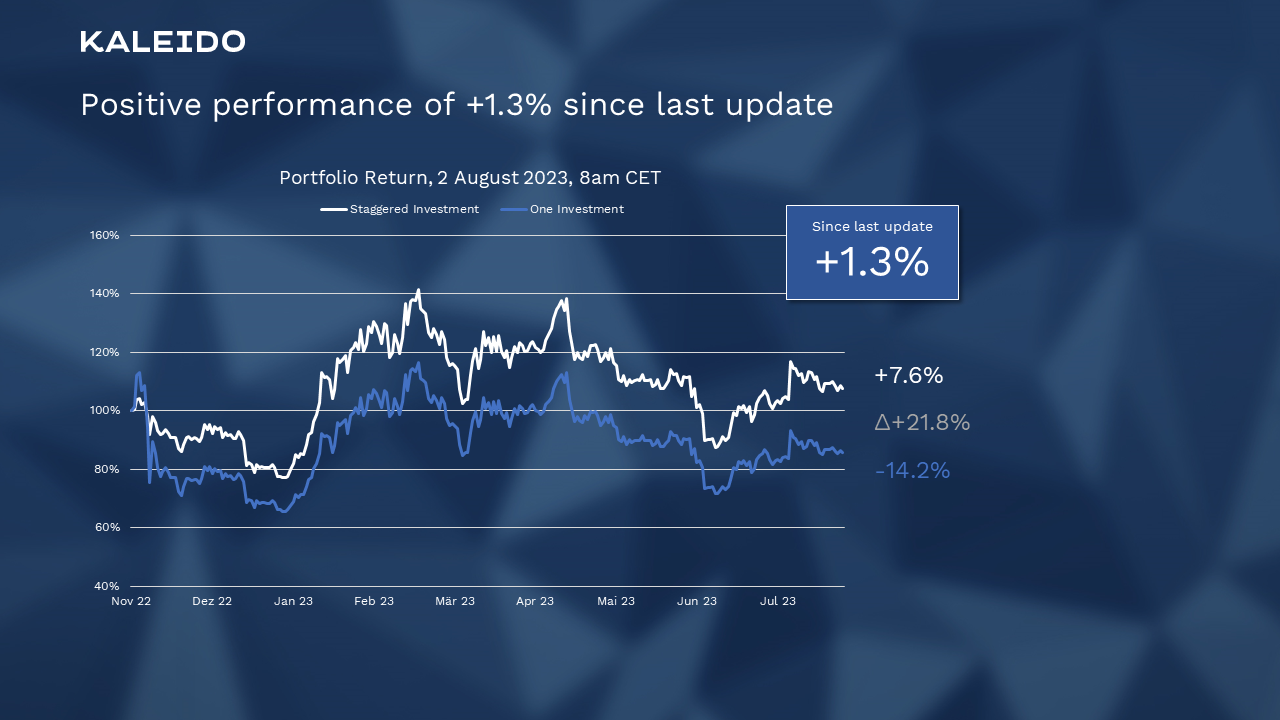

The positive performance of +1.3% since the last update

July was marked by various political moves beside Blackrock's filing for a spot bitcoin ETF. On the one hand, Ripple won in court with its non-classification as a security, resulting in the price jumping from 0.47 to 0.82 immediately following the SEC the decision. While Coinbase CEO Brian Armstrong lobbied US Democrats for a more moderate stance. Further, U.S. presidential candidates such as Ron DeSantis flirted with their endorsement of Bitcoin and distaste for CBDCs. On the exchange side, we saw Bitcoin holdings on central exchanges drop from around 11% of all coins, while more than 1 million wallets now hold more than 1 Bitcoin. The portfolio ends the last 30 days with a positive performance of +1.3%.

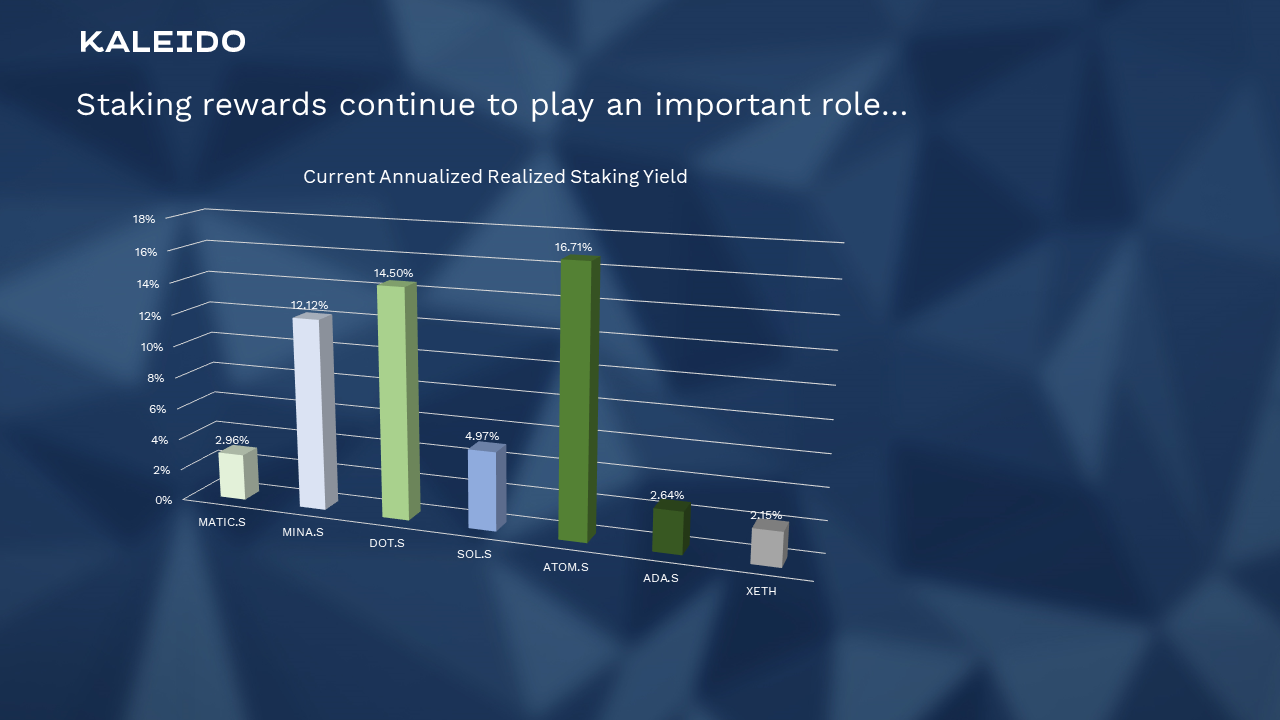

Staking rewards continue to play an important role…

As expected, the ETH Staking Rewards were credited to the portfolio, resulting in a current annualized return of 2.15%. This return will still further increase, as the waiting period until the first rewards will lose weight in relation to the return period.

…contributing 4.0% yield after 273 days

The total Staking Rewards are still held in the respective coins, which brought a return of 4.0% in the first good 9 months.

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here

-1.png)

Management Summary Our crypto garden portfolio has now been invested for 120 days and has achieved a return of 26.7%. After the significant price...

1 min read

Management Summary Today's focus is on the significant price recovery of cryptocurrencies in January and its impact on our crypto garden. In the...