Planting coins: The twelfth report.

Management Summary

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the thirteenth report since the initiation of our crypto portfolio Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up to our newsletter to get the next reporting straight in your mailbox!

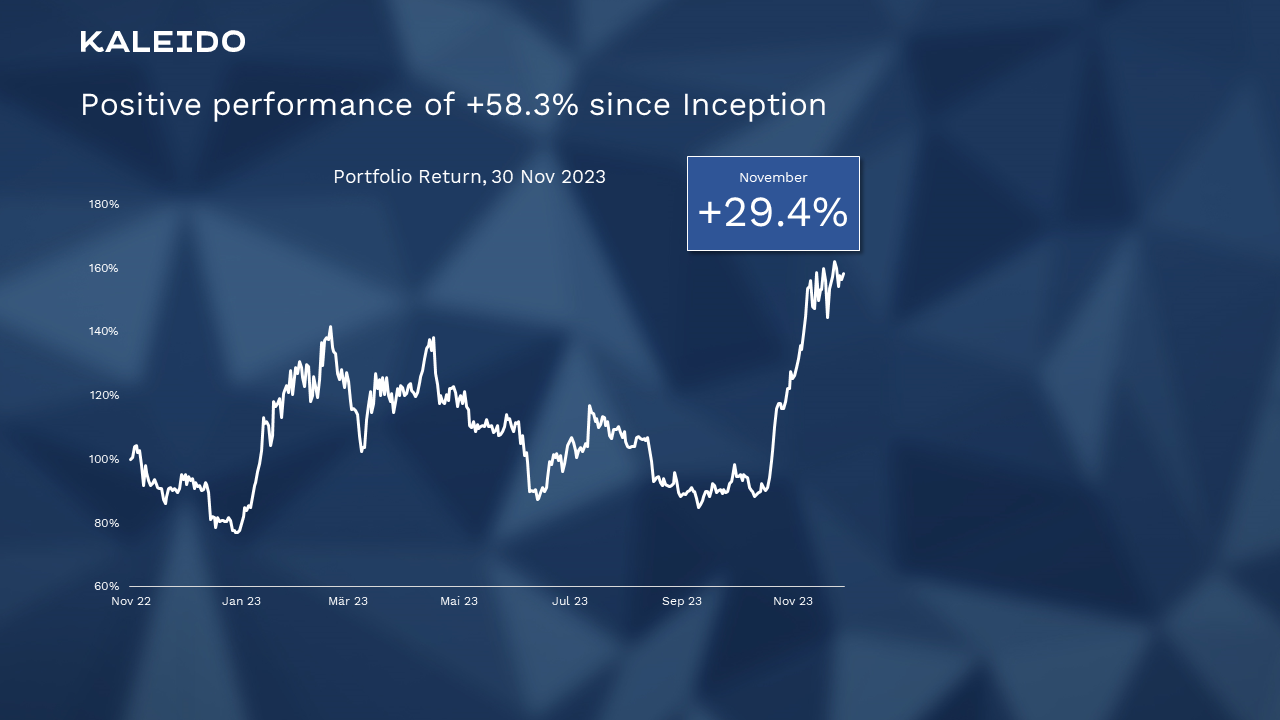

The portfolio was launched on November 2nd, 2022 at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data of this report is as per November 30th, 2023.

Regulation in the crypto market increases - Kraken faces SEC lawsuit - a bold move towards legal clarity

November marked another successful chapter for the KDAC strategy as it rose an impressive 29.4%, solidifying its year-to-date performance to a staggering 105.5%. In the midst of this success, the crypto world witnessed yet another regulatory event as the SEC once again took aim at Kraken, accusing the US exchange of engaging in unregistered securities trading.

Positive performance of +29.4% in October

Rather than bow to the legal storm, Kraken has chosen a less trodden path to set a precedent that not only highlights its professionalism, but also demonstrates unwavering conviction. In the face of adversity, the exchange stands tall and is ready to face the challenges. The outcome of this lawsuit could shape the future of crypto regulation, and Kraken is determined to pave the way to clarity and legitimacy.

The SEC's lawsuit has cast a shadow over the crypto world, but Kraken's response has been nothing short of bold. By deciding to face the allegations head on, the exchange is sending a bold signal of its commitment to transparency and adherence to regulatory standards. This move could be a watershed moment not only for Kraken, but for the cryptocurrency industry, as it sets a precedent for how to handle legal entanglements in a robust and responsible manner.

Binance fined 4.3 billion dollars - KDAC strategy remains unscathed

In a parallel universe, the world's largest crypto exchange Binance faced a huge challenge when it was hit with a colossal fine of 4.3 billion dollars. The impact was quickly felt and the CEO of Binance, known as CZ, pulled the emergency brake and resigned. However, the KDAC strategy, with its deliberate avoidance of coins that carry the counterparty risk of a legal entity, remained intact.

As the Binance issue unfolded, the brilliance of the KDAC strategy came to light. Their careful selection process, which intentionally bypassed coins with potential legal entanglements, protected them from the impact of the relatively heavily capitalized BNB coins. While Binance struggled with the fine, KDAC maintained its stability, allowing investors to watch events unfold from a position of strength.

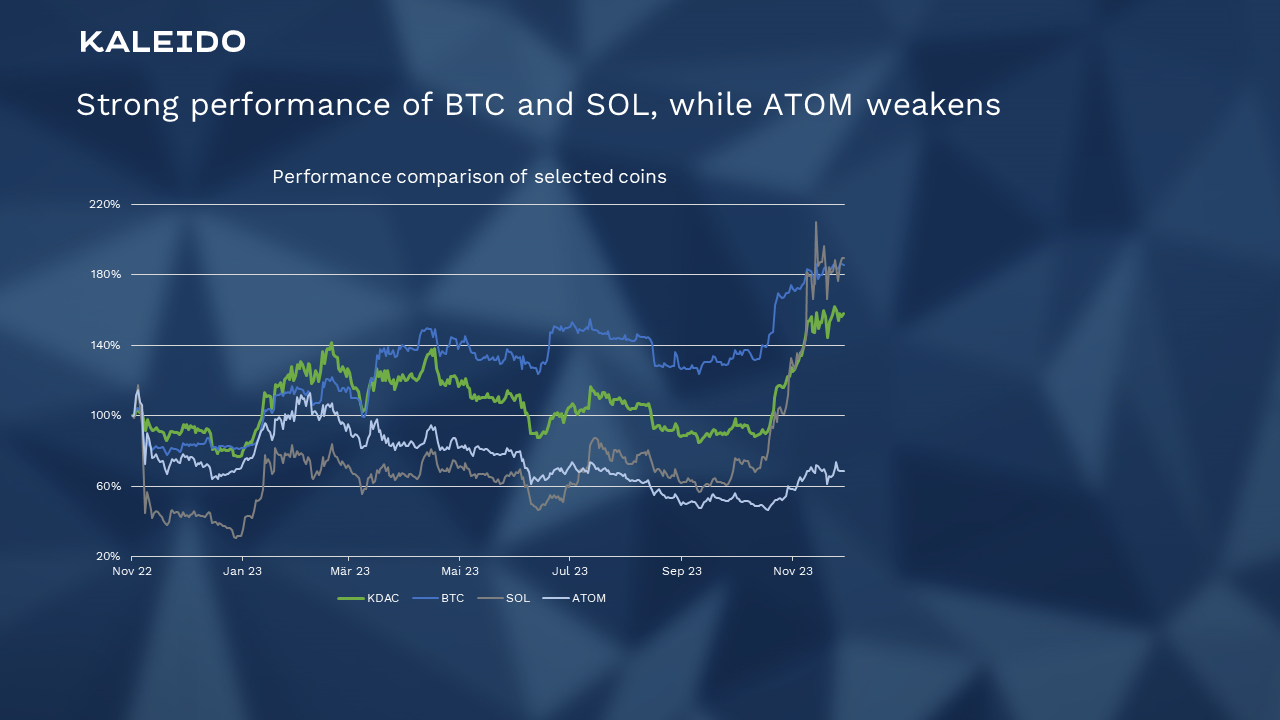

The two positions in Solana and Chainlink were so successful that their position sizes exceeded 17%, leading to a rebalancing.

Strong performance of BTC and SOL, while ATOM weakens

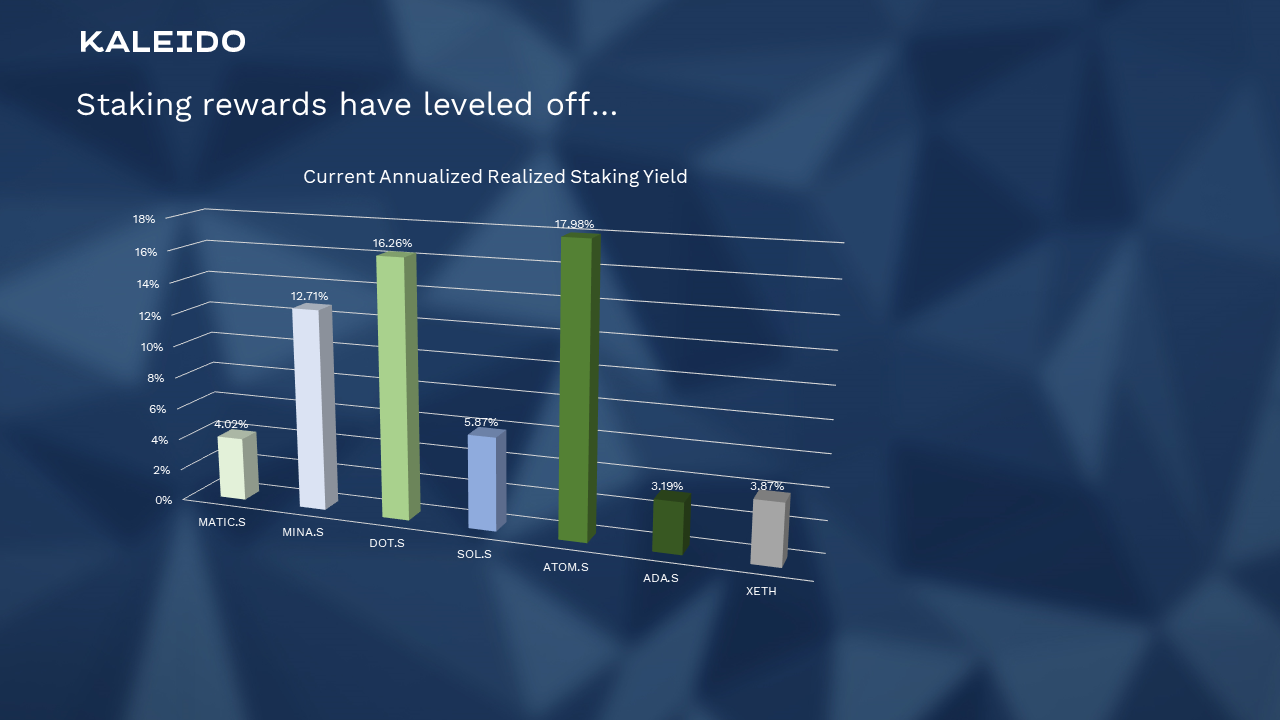

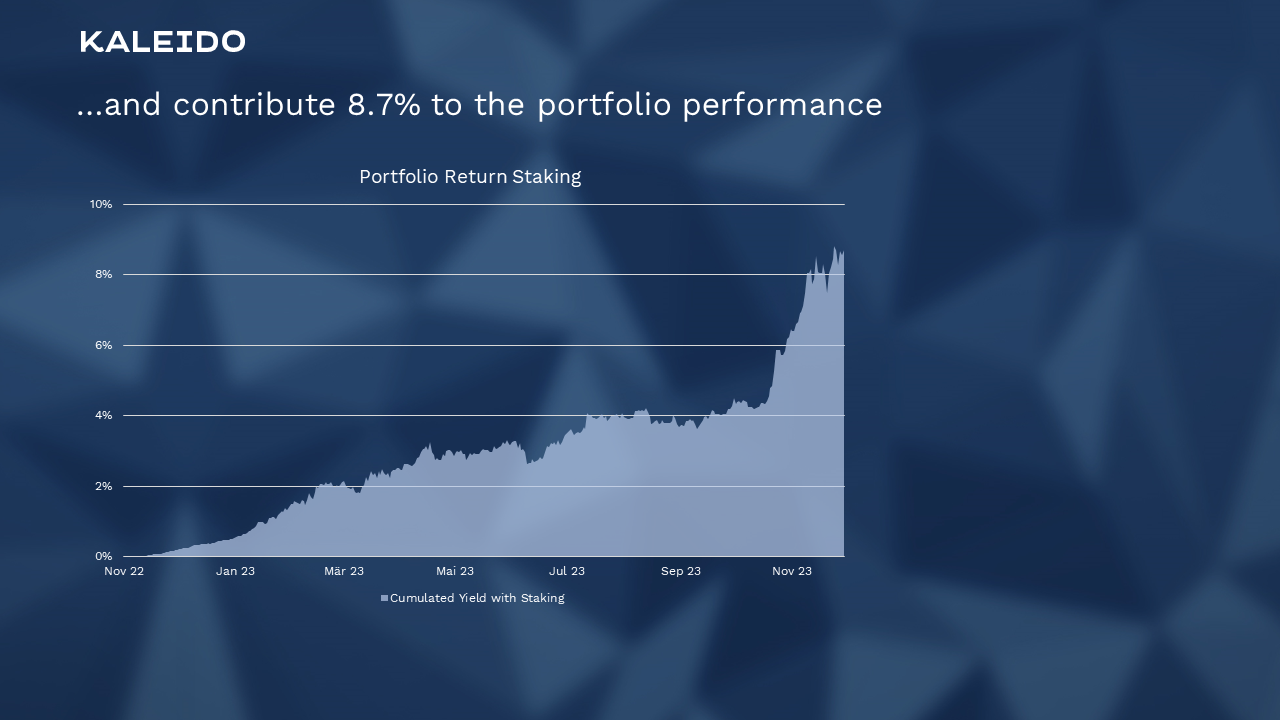

Staking rewards continue to contribute significantly to the overall performance of the portfolio, with staking yields between 3.2% (ADA, Cardano) and 18% (ATOM, Cosmos).

Staking rewards have leveled off…

The total staking rewards are held in the respective coins, which brought a return of 6.1% in the first year.

…and contribute 8.7% to the portfolio performance

Volume consolidation and uptrends

Apart from the legal dramas, November saw further shifts in market dynamics. A consolidation in volume during the month gave way to a subtle but recognizable uptrend towards the end. This indicates a resilience in the market that offers potential opportunities for strategic investors.

Conclusion: Navigating the storm, embracing the future

November was a month of triumphs and trials, with the KDAC strategy successfully navigating legal storms and market volatility in line with expectations. We bid farewell to a month characterized by litigation and market dynamics. The crypto landscape is in flux, but the resilience of strategic approaches like KDAC confirms that the future is bright and holds potential.

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Crypto Portfolio Performance Overview The month of May ended with a negative performance of -7.2% The market was characterized by great...

Management Summary 2023 ended with a positive performance of 197.4% Altcoins outperform Bitcoin for the first time In the first year, staking...