Planting Coins: 02/25

Management Summary January was dominated by the launch of the Trump Coin. Bitcoin consolidates slightly above USD 100k, while altcoins performed...

Please click on the green "+" sign to open the full menu.

Get in touch with the most progressive private bank in Switzerland.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

Management Summary

What is the crypto investing series?

This blog post is the twelfth report since the initiation of our crypto portfolio Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up to our newsletter to get the next reporting straight in your mailbox!

Making Digital Assets Accessible and Secure: Introducing Our Latest Crypto Core Strategy Fund

We open our Crypto Garden for you

In the rapidly evolving landscape of digital assets, traditional investors are increasingly seeking opportunities to diversify their portfolios by tapping into the world of cryptocurrencies. However, for those unacquainted with the intricacies of this new asset class, the journey can be daunting. That's where we come in! Our latest product offering aims to make digital assets easily investible for traditional investors. In this article, we'll delve into the three key aspects of what we solved for you: security, regulation, and efficiency.

In the ever-evolving world of cryptocurrencies, safeguarding your digital assets is paramount. Cryptocurrency security often involves the intricate management of private keys, a task that can be both complex and risky. However, we've taken a proactive approach to ensure your peace of mind. We've forged an exclusive partnership with an industry-leading regulated bank, making sure that your investments are protected with the highest level of security measures available in the market.

Cryptocurrency markets are known for their regulatory diversity, where each jurisdiction carries its own set of rules and challenges. Understanding and complying with these regulations can be a daunting task. That's why we've established a Liechtenstein-based Alternative Investment Fund that operates within a well-regulated framework. This fund offers you the unique opportunity to explore digital assets while remaining confident that your investments are under the umbrella of a robust regulatory environment – optimizing issues related to counterparty risks usually present.

In the world of cryptocurrencies, efficiency isn't just about cutting costs; it's about optimizing returns and making the most of your investment. High fees often associated with crypto products can eat into your profits. We believe in fair and transparent pricing, and we go the extra mile by offering staking opportunities across the entire investment universe. By participating in blockchain validation through staking, you have the potential to earn additional revenue, ensuring that your investments work harder for you. Not staking just because a lot of investors struggle with the technical challenges is not an option for us. This combination of transparent pricing and staking offers a pathway to cost-effective and potentially more rewarding crypto investments.

Our Unique Fund Strategy

Our fund's strategy closely mirrors the successful approach that has powered our Crypto Garden Portfolio over the past months. Here's a glimpse into the strategy:

Bank Frick & Co. AG Partnership: Ensuring Security and Staking Opportunities

To make this vision a reality, we've partnered with Bank Frick, a leading institution domiciled in Liechtenstein, renowned for its expertise in custody and staking services. With both Bank Frick & Co. AG and Kaleido Private Bank AG being regulated banks, you can trust in the highest level of financial security and regulatory compliance.

Staking: Enhancing Your Returns

Staking plays a pivotal role in our framework, allowing investors to reap the rewards of blockchain validation without significant dilution from protocol coin inflation. It's an integral piece of our strategy to help you maximize your crypto investment returns.

Conclusion

Our mission is clear: to make digital assets easily investible for traditional investors. With a focus on security, regulation, and efficiency - standard in the 'traditional' asset world - coupled with our unique investment strategy and trusted partnerships, we're here to guide you on your journey into the exciting world of cryptocurrencies.

Are you eager to learn more about our strategy and fund solution? We invite you to reach out to us, where our dedicated team is ready to assist you in taking the next steps toward achieving your investment goals in the world of digital assets. Make the move today and join us in making your crypto investments secure, regulated, and efficient!

History does not always repeat itself: a positive September.

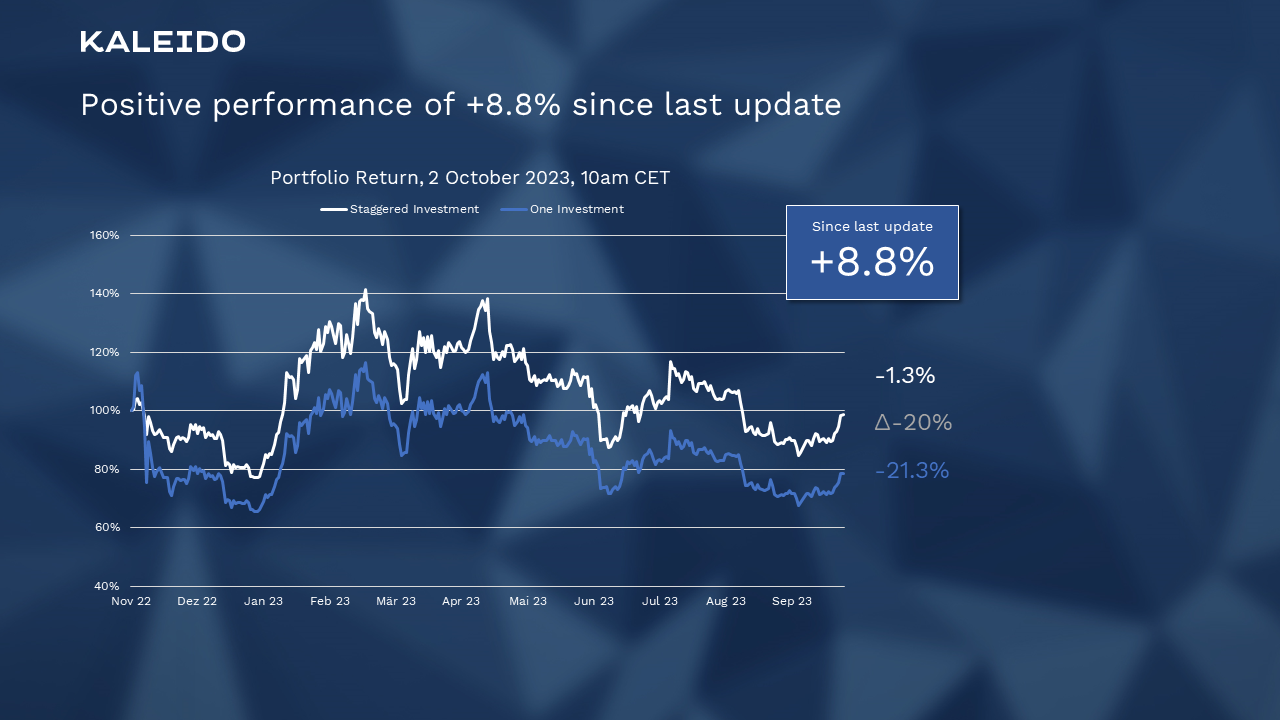

The portfolio was launched on November 2, 2022, at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data of this report is as of October 2nd, 2023 at 10 am CET.

Positive performance of +8.8% since last update

September is historically the month in which Bitcoin has performed the worst. The last month shows that history does not always have to repeat itself exactly. Although there were some significant corrections in the risk asset markets, the crypto markets were relatively stable. Apart from small volatility in the middle of the month, September ended on an overall friendly note. The crypto portfolio gained 5.6% in September, of which 0.5% can be attributed to staking. The fact that this contribution is significantly higher again this month can also be attributed to the pleasing performance of altcoins.

Increasing contribution by Altcoins like LINK and SOL

We can observe that in particular, the gap between ETH and LINK has closed again for the first time this month. In absolute terms, we still observe an outperformance of Ether, but the rebalancing and the resulting re-buying of LINK on June 26 has paid off.

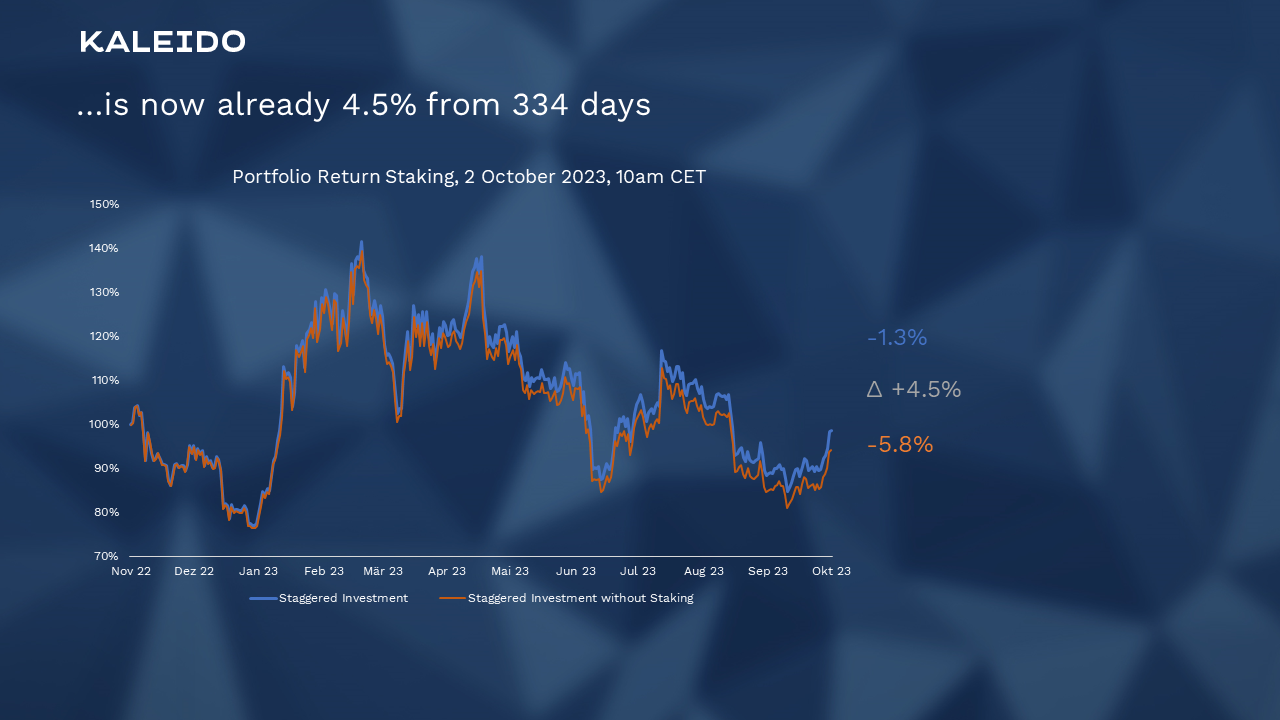

Staking rewards continue to contribute significantly to the overall performance of the portfolio, with Ether also now yielding 3.75% on an annualized calculation.

Continuous accumulation of staking rewards…

The total Staking Rewards are still held in the respective coins, which brought a return of 4.5% in the first 11 months.

…is now already 4.5% from 334 days

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

.png)

Management Summary January was dominated by the launch of the Trump Coin. Bitcoin consolidates slightly above USD 100k, while altcoins performed...

.png)

Management Summary The altcoin rally was briefly interrupted by statements from the Fed in December. The Fear and Greed Index has eased...

.png)

Management Summary November marked the start of the Altcoin Rally with Bitcoin dominance dropping below 56%. The Fear and Greed Index reached...