What Kaleido Private Banking Stands for

Private Banking is a Trust Business

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

Risk management in private banking is not just a regulatory box to tick, but rather the foundation for the bank's profitability and security, which ultimately secures their clients' deposits.

Think of it as the solid foundation that ensures the continuity of the business, which is the basis for them to support their clients with products and services in the long run.

In this blog post, we'll break down the different types of risks that private banks deal with. We'll also give you a clear overview of some of the key strategies we at Kaleido Private Bank use to tackle these challenges head-on.

The Basics of Risk Management

Risk management is a carefully designed framework that harmoniously integrates regulatory requirements with the most effective strategies from the industry. The core of this system is made up of official rules set by respected authoritative bodies like FINMA and EBA. These bodies play a big role in establishing strong risk management practices in private banks. Additionally, understanding the bank's risk appetite and tolerance, as approved by the Board of Directors, is key. This insight helps identify, measure, assess, report and address risk indicators. However, risk management isn't just about reacting; it's about being proactive, preparing for the known and unknown. An effective and efficient reporting system reduces the chance of management surprises and creates added value for the organization.

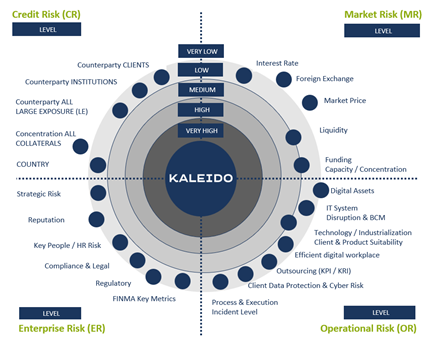

Illustration of Risk & Compliance Report

(Risk level set for illustration only)

Types of Risks in Private Banking

Private banks face various risks, each requiring a tailored approach. Let us go into four of them:

Credit Risk

This type of risk refers to the potential loss arising from borrowers' failure to meet their financial obligations, like for example failing to repay a loan. To mitigate the credit risk, banks employ several tactics like:

Market and Liquidity Risk

Market instability and abrupt external changes can endanger a bank's stability. Such changes might be shifts in interest rates, foreign exchange rates, equity prices, or sudden deposit withdrawals. To manage this risk, banks implement the following measures:

Operational Risk

Inadequate internal processes, faulty systems, human errors, and external events can lead to financial losses or damage the bank's reputation. To make sure the operational risk is as low as possible, the following measures help ensure effective operational management:

Compliance and Regulatory Risk

Not complying with external regulatory as internal management requirements can lead to severe penalties and reputational damage for banks. To manage this risk, banks invest in:

Handling risk is a continuous, ever-changing task that requires understanding different risks and using the proper methods. When banks skillfully manage the credit, market, liquidity, operational, and compliance risks, they strengthen themselves, ensuring depositor funds are safe, and contribute to financial system stability.

A strong risk management plan is vital both for meeting regulations and for thriving in a rapidly shifting financial environment. At Kaleido we always prioritize proactive risk management in which leadership, communication and passion are key drivers, and is enriched with the following ingredients like motivated team with broad knowledge & experience, comprehensive risk reporting based on strong risk culture. All these to ensure the going concern and most important to provide our clients with the stability they deserve.

Private Banking is a Trust Business

Risk management in private banking is not just a regulatory box to tick, but rather the foundation for the bank's profitability and security, which...

.png)

As we begin the new year, we want to take a moment to reflect on the past year and share our achievements and successes with you. Despite turbulence...