The Power of Collaboration

Petiole Asset Management AG and Kaleido Privatbank AG are pleased to announce their collaboration in private markets investing. This long-term...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

In the vast landscape of investing, one key principle has stood the test of time: strategic asset allocation. Far from being only a buzzword, strategic asset allocation has emerged as a powerful technique embraced by seasoned investors and financial experts. When it comes to managing your investment portfolio, strategic asset allocation may hold the power to unlock your full investment potential. But what exactly is strategic asset allocation, and why is it considered a cornerstone of successful investing? In this blog post - you will find out.

What is Strategic Asset allocation?

Strategic asset allocation is a straightforward yet powerful investment approach that involves dividing your investment among different asset classes, such as stocks, bonds, cash, currencies, and alternative investments, deliberately and strategically. The goal is to create a diversified investment mix that aligns with your financial objectives, risk tolerance, and time horizon.

Diversification and Risk Management: Your Shield Against Uncertainty

The concept behind strategic asset allocation is rooted in the understanding that different asset classes perform differently over time. By strategically allocating your investments across various asset classes, you create a safety net that helps reduce risk, maximize potential returns, and shield your portfolio performance.

Each asset class possesses distinct risk and return characteristics. While some investments may experience periods of growth, others may go through downturns. This is because different asset classes have varying levels of sensitivity to the economy, market conditions, and geopolitical events. Equities, for example, have historically delivered higher long-term returns but with greater volatility. On the other hand, bonds offer lower returns but exhibit more stability. Cash and alternative investments can further contribute to diversification, enhancing your ability to manage risk and potentially earn higher returns.

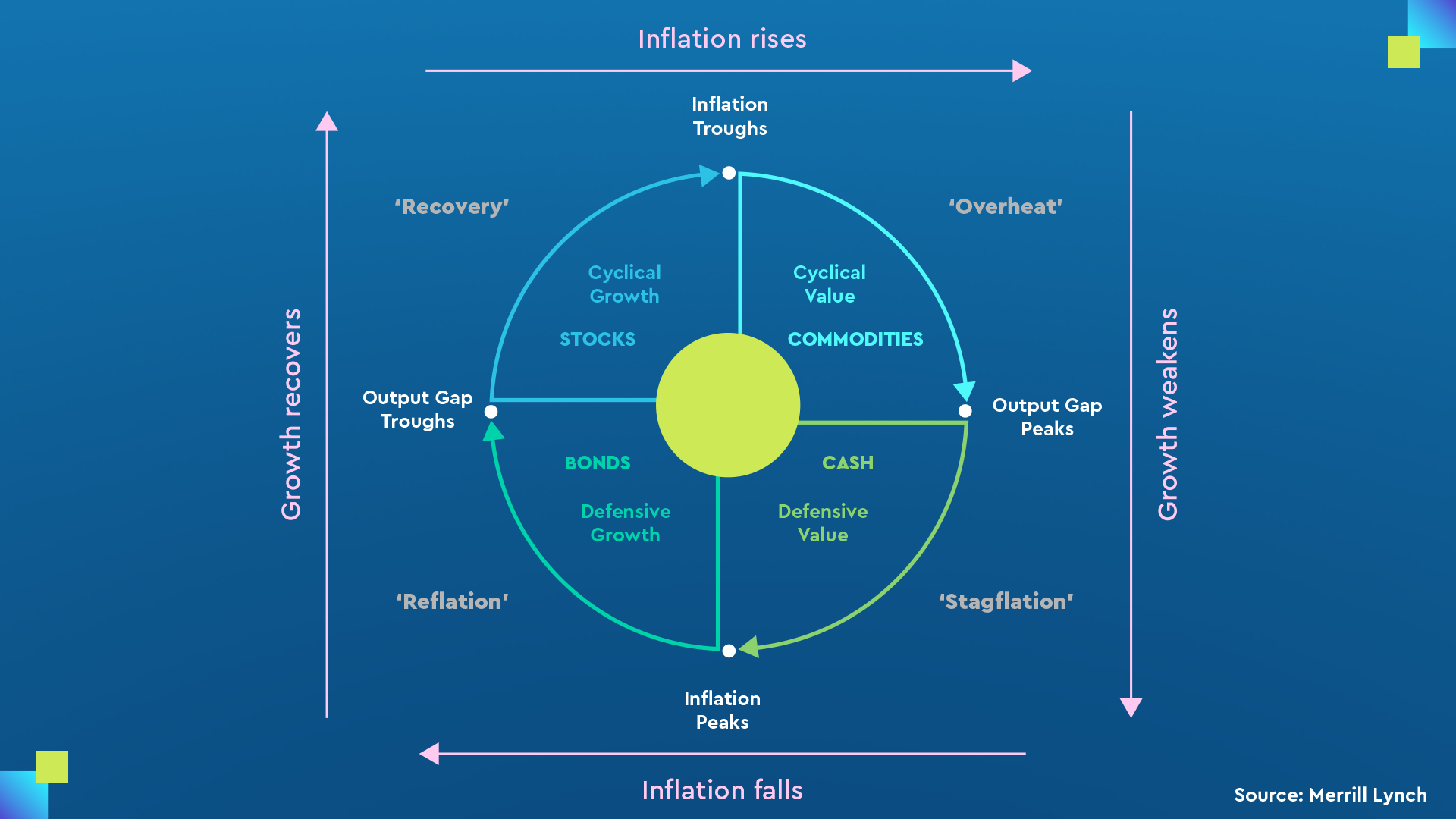

Furthermore, different asset classes also perform differently across economic and market cycles. For example, during periods of economic expansion, equities tend to excel, while bonds may outperform equities during economic downturns or when interest rates decline. To manage risks and benefit from favorable trends, investors should consider economic indicators, valuations, and market conditions when deciding how to allocate their portfolios. By staying aware of these factors, investors can make strategic investment choices that align with the prevailing economic climate, increasing their chances of success.

The right asset allocation for YOU

When deciding on your asset allocation, consider your risk tolerance, time horizon, and financial goals. A well-structured portfolio aligns the allocation with your objectives. A younger investor with a longer time horizon, for instance, may have a higher risk tolerance and allocate a larger portion of their portfolio to equities for long-term capital appreciation. On the other hand, a retiree seeking stable income may opt for a more conservative allocation with a higher share of income-generating assets.

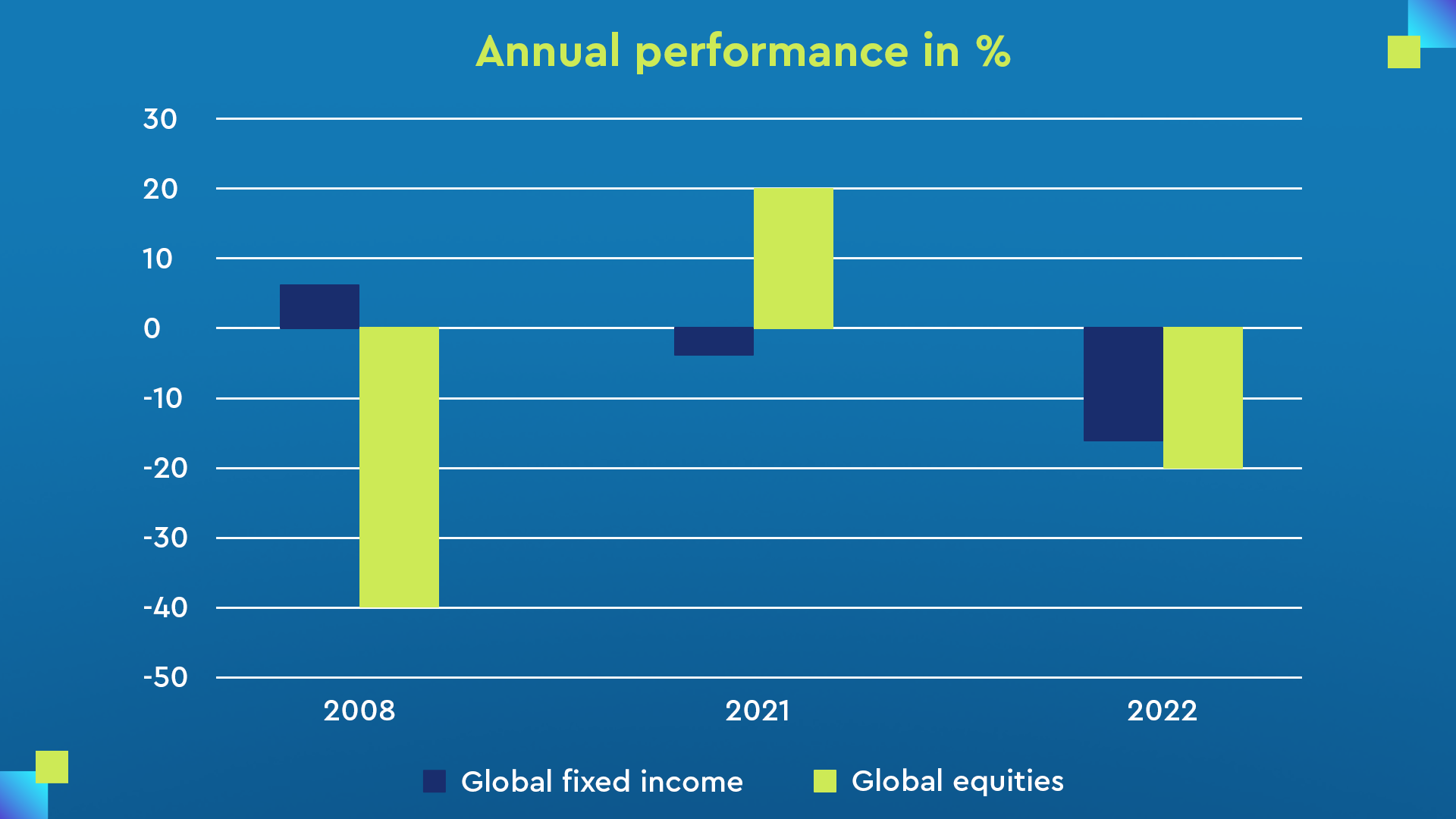

Asset allocation is an ongoing process, not a one-time decision. Market fluctuations can unfortunately disrupt your portfolio's intended balance. For instance, even with their historical negative correlation, a 60/40 portfolio (60% equities, 40% bonds) delivered poor returns last year. This emphasizes the need to regularly review and rebalance your portfolio. By doing so, you can align it with your strategy, seize opportunities, mitigate risks, and stay on track toward your goals.

That is why we at Kaleido believe that diversification across investment strategies, rather than asset classes, makes more sense in the long term.

We prioritize finding top managers and designing portfolios that match desired risk and return preferences. We encourage clients to diversify across both banks and investment strategies. Regular rebalancing keeps the allocation on track. A well-executed asset allocation strategy lays the groundwork for a resilient and successful investment portfolio. Permit yourself more freedom and let us stay on top of this for you!

Recommended next step: Reach out to us to learn more about our investment philosophy.

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation or financial advice. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Petiole Asset Management AG and Kaleido Privatbank AG are pleased to announce their collaboration in private markets investing. This long-term...

2 min read

Management Summary Today's focus is on various portfolio construction strategies: lump-sum investment, market timing, staggered, or Dollar Cost...

Crypto Portfolio Performance Overview The month of May ended with a negative performance of -7.2% The market was characterized by great...