Planting Coins: Our crypto portfolio - third report (and staking)

Management Summary Today's focus is on staking - the process of holding onto a cryptocurrency to support the operation of a blockchain network and...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

3 min read

Markus Abbassi

:

December 07, 2022

Markus Abbassi

:

December 07, 2022

This blog post is the second reporting since the initiation of our crypto portfolio, and the third part of our crypto investing series Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up for our newsletter to get the next reporting straight in your mailbox!

There are a wide variety of ways to build a portfolio over time. We will briefly discuss four viable options here:

1) Lump-sum investment: Here, a one-time investment takes place over the entire amount at the beginning of the investment horizon. Various studies, such as the one conducted by Vanguard in 2012 show that over the long term, a lump-sum investment has yielded the best returns for traditional investment securities such as stocks or bonds. This is due to the fact that there are significantly more periods with positive returns than those with negative returns. Accordingly, one forgives return potential by choosing a staggered investment approach. So if you have the money at a certain point in time and at the same time invest in assets that tend to be less volatile, this can pay off accordingly. Another aspect is transaction costs: Especially with high base costs, a lump-sum investment can also pay off.

2) Market timing: The opposite of lump-sum investment is market timing. Here, the question of how to recognize the exact timing is needless, since obviously no one has the famous crystal ball. Accordingly, it is illusory to catch the market at the exact low point of the markets for buying and at the absolute high point for selling. Another important factor here are the very few days with very weak, respectively very strong performance. Accordingly, missing such a day can have a significant impact on performance right away. Here again, other factors such as transaction costs play a central role, because back and forth makes the pockets empty.

3) Staggered Investment Approach: The staggered investment approach is a useful intermediate solution if you want to be exposed to the market in the medium to long term. Especially in volatile markets and with low transaction costs, one can easily eliminate the market timing risk relatively well. Accordingly, we have chosen a time horizon of four weeks for our portfolio construction, with one third of the portfolio invested on day one. Subsequently, one sixth of the investment amount was invested in the upcoming four weeks.

4) Dollar Cost Averaging Approach (DCA): This strategy is mainly suitable for steady investments, for example a savings plan. DCA has additional advantages for very volatile assets, such as cryptocurrencies. By staggering investments with DCA, you reduce the risk of choosing the worst possible time to make a one-time investment when prices are high. If you buy a coin for 100$ per month, you buy two coins in the month in question at a price of 50$ per coin, and even four coins if the price drops by 50% to 25$. If then the Coin rises to 100$, then one buys only one additional coin. Again, it is important to keep an eye on the transaction costs.

The portfolio was launched on November 2, 2022 at 7 p.m. CET, just before the events surrounding the FTX crypto exchange.

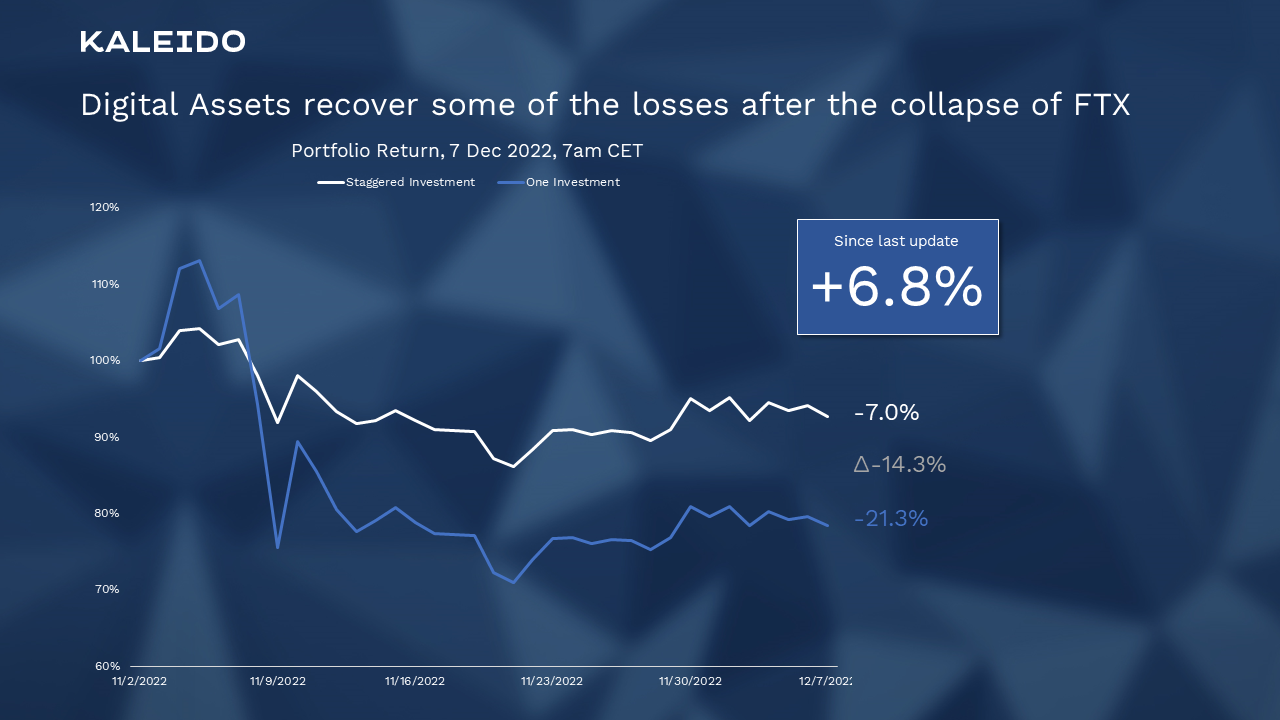

Figure 1: Our portfolio has also recovered from the lows in recent days.

After one month, the portfolio is fully invested. The staggered investment approach results in a negative performance of only -7.0% compared to -21.3%, which would have resulted from a one-time investment at the beginning of November 2022. Our staggered approach thus saved us a 14.3% loss. Strategy beats luck, again.

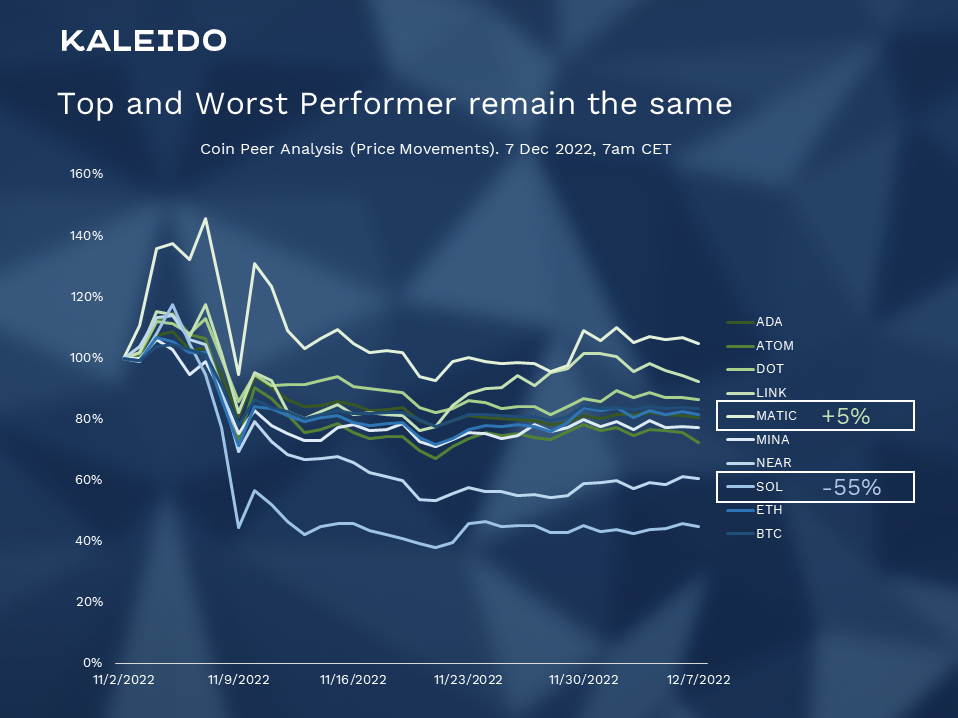

Figure 2: Top (MATIC) and Worst Performer (SOL) remain the same.

From a pure price performance perspective, only Polygon (MATIC) has performed positively since the portfolio was launched. The prices of all other coins are still below those of November 2, 2022.

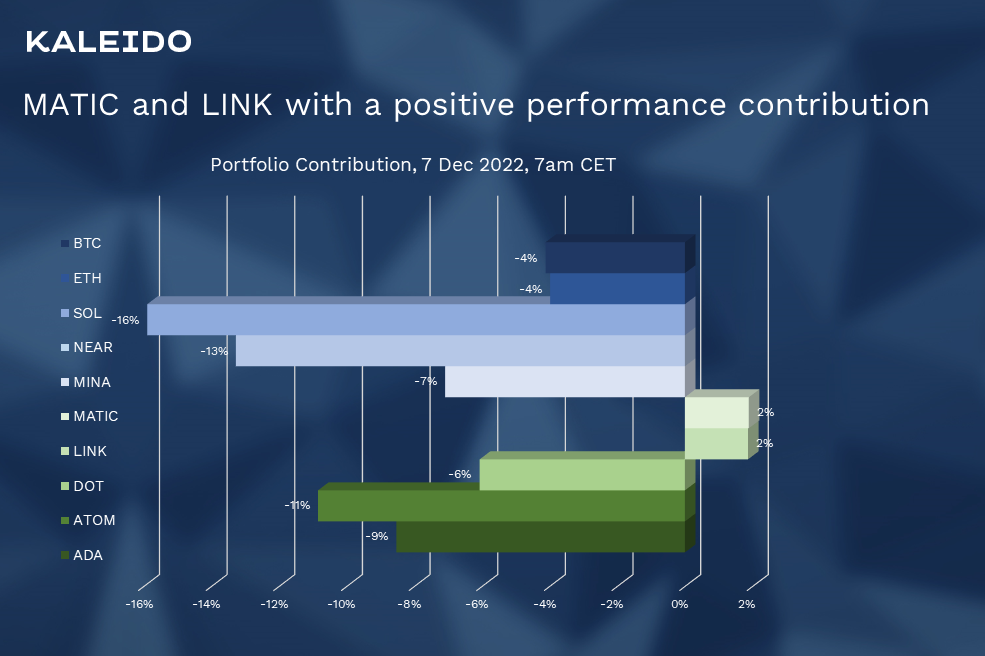

Figure 3: MATIC and LINK with a positive performance contribution.

The staggered investment approach and the associated re-buying of coins at often lower prices ensured that both Polygon (MATIC) and Chainlink (LINK) were able to make a positive return contribution to the portfolio. The negative contributions from Solana (SOL) and Near Protocol (NEAR) were limited at -16% and -13%, although the two coins lost 55% and 39% respectively.

This blog post is written by Markus Abbassi, Head of Digital Assets at Kaleido Privatbank AG. If you have any questions regarding crypto investing, or wish to get in touch with Markus, you can contact him here.

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Management Summary Today's focus is on staking - the process of holding onto a cryptocurrency to support the operation of a blockchain network and...

Management Summary The crypto investing series starts under adverse market conditions. Our investment strategy was able to compensate or dampen...

Management Summary After a great start into 2023, our Crypto Garden portfolio is currently at 120.4 points. In March, we observe a strong rise in...