The upcoming Ethereum Merge and ways to profit

The Ethereum blockchain is about to undergo arguably the most significant upgrade in the chain's roughly eight-year history. Ethereum is the second...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

Economies thrive on growth, which is achieved sustainably through increases in productivity. Work that was once carried out by hand, was then mechanised and then automated. The following important phase was driven by digitalisation. What began with large, unwieldy calculating machines developed into an innovation suitable for the masses using the advantages of the internet and mobile appliances. Starting off with the simple query of databases through reading rights, it was expanded to include write rights within the framework of Web 2.0. With the ignition of the next innovation stage, we are now slowly glimpsing the contours of Web 3.0 and its new possibilities.

The road to Web 3.0 in banking

Banking has gone through a similar evolution. Starting with the first banks in Tuscany (in the 15th century), the bank was coined as a partner and a place of trust. Savers brought their deposits to the bank, which in turn lent them to merchants as loans. The safekeeping of valuable objects such as gold bars or coins was another pillar of the business model. The internal bookkeeping of who owned how much of what at what time became even more secure and trustworthy thanks to innovations. The counting frame was replaced by the calculating machine. With the developments of Web 2.0 certain services were simplified and partly automated via tools such as e-banking. With Web 3.0, which among other functionalities now allows not only information but also entire assets to be transferred, is the bank now to become completely superfluous, since everyone can keep their own private key?

Such an idea may seem plausible, but whether the future will really look like this is difficult to predict and not (yet) relevant for the current business activities of a bank. Much more valuable are our daily conversations with clients and interested parties, which help us to tailor our product offering to their needs.

When it comes to digital assets, which include cryptocurrencies as well as tokenised assets such as shares, bonds, commodities and alternative investments such as works of art, a fully licensed bank in Switzerland like Kaleido Private Bank has significant advantages as a service provider for certain client groups compared to a form of self-custody.

The client is at the centre

Client groups can be classified in many ways, in this article we use the definition from the Markets in Financial Instruments Directive 2014/65/EU (MiFID II), which applies to all clients domiciled in a country of the European Economic Area (EEA), and henceforth distinguish between retail clients and so-called professional clients.

While the selection of three core arguments discussed below applies to both client groups, their significance and importance may differ significantly in some cases. Accordingly, it is important for the bank to focus clearly on the needs of its clients.

1. Security and trustSwitzerland has an excellent reputation as a banking centre, both historically and today. As of today, 243 licensed institutions bear witness to this. One of the central arguments is the banking licence, which also entails supervision by the Swiss Financial Market Supervisory Authority FINMA and a business audit by a specialised auditor. The strict regulation may be cumbersome, expensive and complicated in many respects, but on the other hand it offers a high degree of security for clients' deposits.

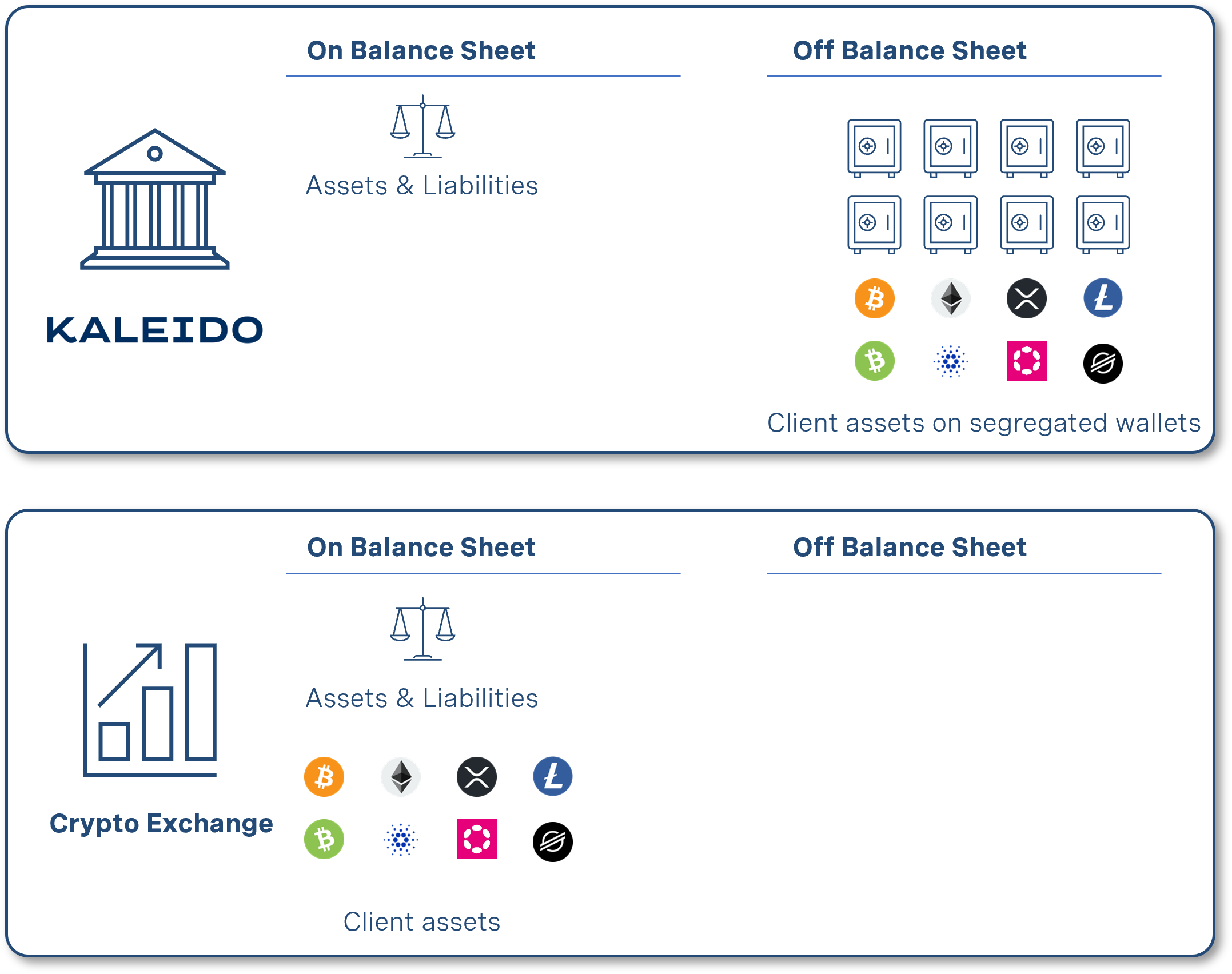

A key aspect here is not least the various legal foundations for distributed ledger technology (DLT) and blockchain, which have come into force in Switzerland in recent months. The overall technology-neutral approach distinguishes itself - in typical Swiss fashion - not with imaginative new legal texts, but with an adaptation of the existing legal and regulatory framework. For the custody of coins and tokens, the Federal Act on Debt Collection and Bankruptcy (SchKG), which clarifies and regulates the segregation of custody assets, is of central importance. This is the case since digital assets are thus not on the bank's own balance sheet but can be held segregated in the name of the client. In the event of bankruptcy of a bank, the assets do not fall into the bankruptcy estate of the institution but can be directly attributed to the client.

Recent adjustments to the terms and conditions by the crypto service provider Coinbase made headlines in the market. Furthermore, the hedge fund Three Arrows Capital (3AC), which used its clients' deposits for leveraged investments, exposed client to asset unwinding risks. Additional revenue opportunities such as lending or liquidity pooling in so-called Decentralised Finance (DeFi) applications can offer very exciting opportunities for investors, but they are still financial products that require extensive knowledge and training. However, these should then also be distinguished separately from a custody offering and made available to the client with an appropriate risk assessment.

With reference to the described customer groups of retail customers and professional customers, the importance of segregated custody of coins and tokens normally correlate with increasing asset size, but also with an increasing weighting in the portfolio.

We also observe further demand for custody services from managers of third-party assets, such as external asset managers or family offices. Here, the governance factor plays a decisive role. Traditionally, this is regulated using a so-called Power of Attorney of the administrator to the accounts and custody accounts of the asset owners, which, however, can lead to relatively complex multi-signature setups when digital assets are held in self-custody. A signature authorisation for two or even three people then require the individual confirmations via a hardware ledger until a blockchain transaction can be executed and, for example, a purchase or sale can take place.

|

2. Simplicity and convenience

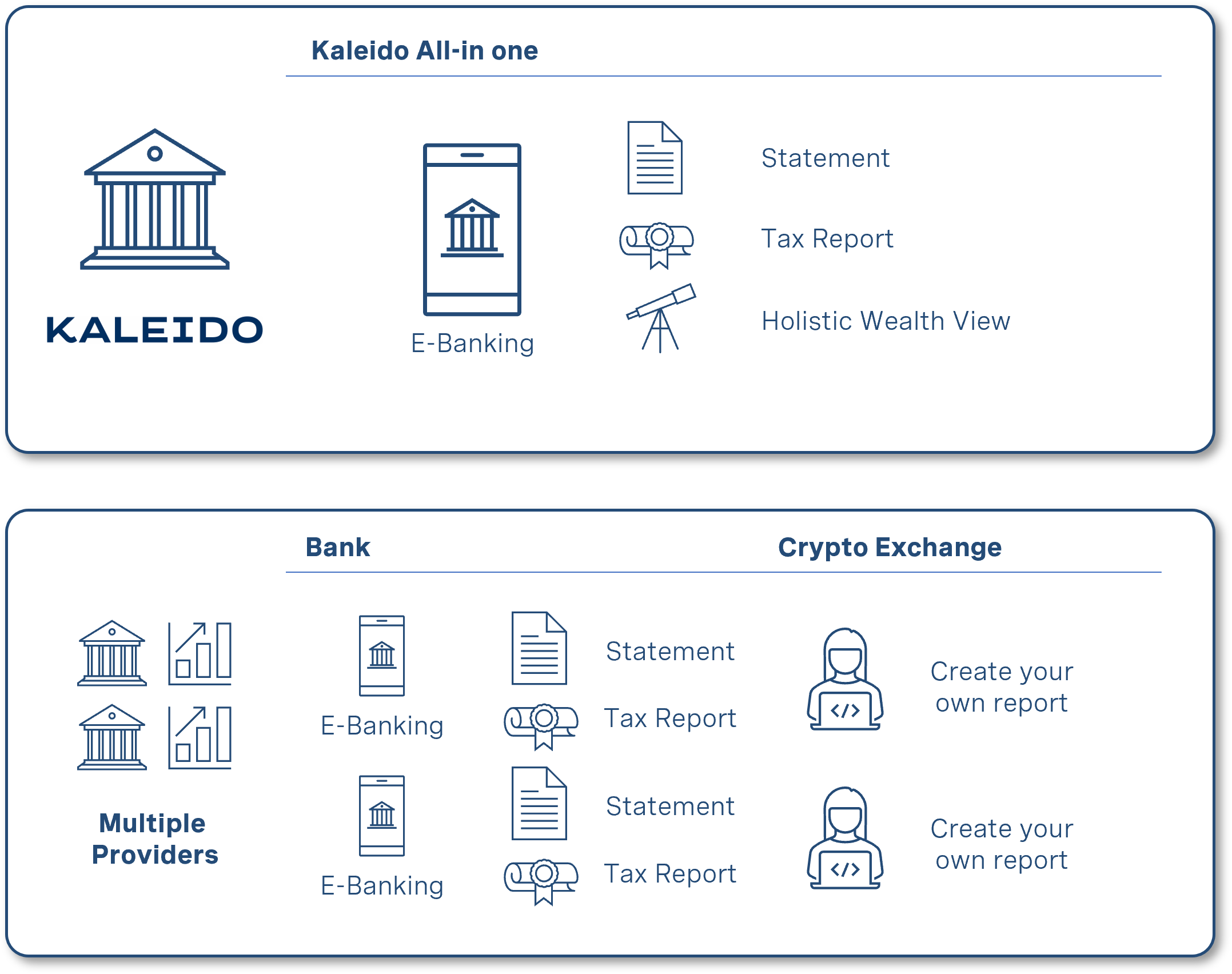

As described above, a bank-client relationship offers clear governance, but also a certain degree of convenience, as transactions can be initiated directly via the existing e-banking account. This may be a strong argument especially for investors who do not deal with the individual aspects of different wallets and blockchains themselves, in detail, but rather consider digital assets as an admixed component of a portfolio and a long-term investment.

The same also applies to the accounting and safekeeping of assets for institutional clients at the beginning of the value chain, but also later on for account and tax statements, which a purely technical wallet does not (yet) offer its users. So far, banks that can book and map digital assets in addition to traditional assets are very few. If digital assets are not to be regarded stepmotherly as a "side investment", but as an independent asset class and portfolio addition, consolidated custody is a critical success factor - both for digital assets themselves and for forward-looking banks.

|

3. Expertise and training

For many clients the third compelling argument for keeping their digital assets at a bank is access to expertise and training. While many players in the financial market are always crying out for stricter crypto regulation, we deliberately focus much more on the topic of education. For example, if one has a basic understanding of how the generation of new coins, or their distribution - the so-called tokenomics of a cryptocurrency - are designed, clients can not only define exclusion criteria for an investment, but also understand, for example, that for some currencies a simple "buy & hold" makes no sense due to the inflationary supply mechanism. Due to the rapid pace of developments in the market, tracking is time-consuming and intensive for clients, which in turn results in a service that creates value for the client.

Accordingly, it is important that a bank builds up this know how internally or cooperate with external experts. Not only do clients need to be trained, but a trained and informed front team and a crypto-savvy risk and compliance department facilitate the daily handling of digital assets. This, in turn, benefits clients. A competent digital asset desk may be an important success factor for a financial institution.

|

The bank as a value-added provider

For a long time, the problem of banks was the focus on cost reduction and the resulting decline in service quality for the customer. In the field of digital assets, banks now have the opportunity to offer their customers additional value-added services. Financial service providers generate this added value in this new technology with three pillars. Firstly, with security and trust through clear rules of the game and close supervision by the supervisory authority; secondly, with simplicity and convenience through a solution integrated into the existing banking product; and thirdly, with easy access to expertise and training so that the customer has the opportunity to understand his products in depth.

The Ethereum blockchain is about to undergo arguably the most significant upgrade in the chain's roughly eight-year history. Ethereum is the second...

On August 9, 2011, the market cap of Apple exceeded Exxon for the first time in history. The development of the two companies and their respective...