PLANTING COINS: THE FOURTEENTH REPORT

Management Summary October ended with a positive performance of +29.4% Altcoins benefit from initial redistribution of Bitcoin gains made In the...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the fourth report in 2024 about the Kaleido Digital Asset Core Strategy. Read more about our crypto portfolio framework here. Don't forget to sign up to our newsletter to get the next reporting straight in your mailbox!

In March, Bitcoin, the crypto market and the KDAC strategy all reached new all-time highs. Another highlight was the first NAV of the KDAC Fund, which was calculated in the second half of the month.

Ending the first quarter with a performance of +41.7%

Adjustments were made to the portfolio as part of two rebalancings, with profits from the NEAR position being used for additional purchases in Chainlink (LINK) and Mina Protocol (MINA) in the first third of the month. In the last quarter of the month, the Solana (SOL) position was then reduced; the cash flow was used for additional purchases in Cardano (ADA), Cosmos (ATOM), Polygon (MATIC), Mina Protocol (MINA) and Ethereum (ETH). As part of the fund setup, MINA Protocol was replaced by Avalanche (AVAX) due to technical limitations.

KDAC is outperforming Bitwise 10 Index and HOLDV

As we approach the Bitcoin halving in mid-April, we expect the KDAC strategy to continue to benefit from its equal weighting over the coming month.

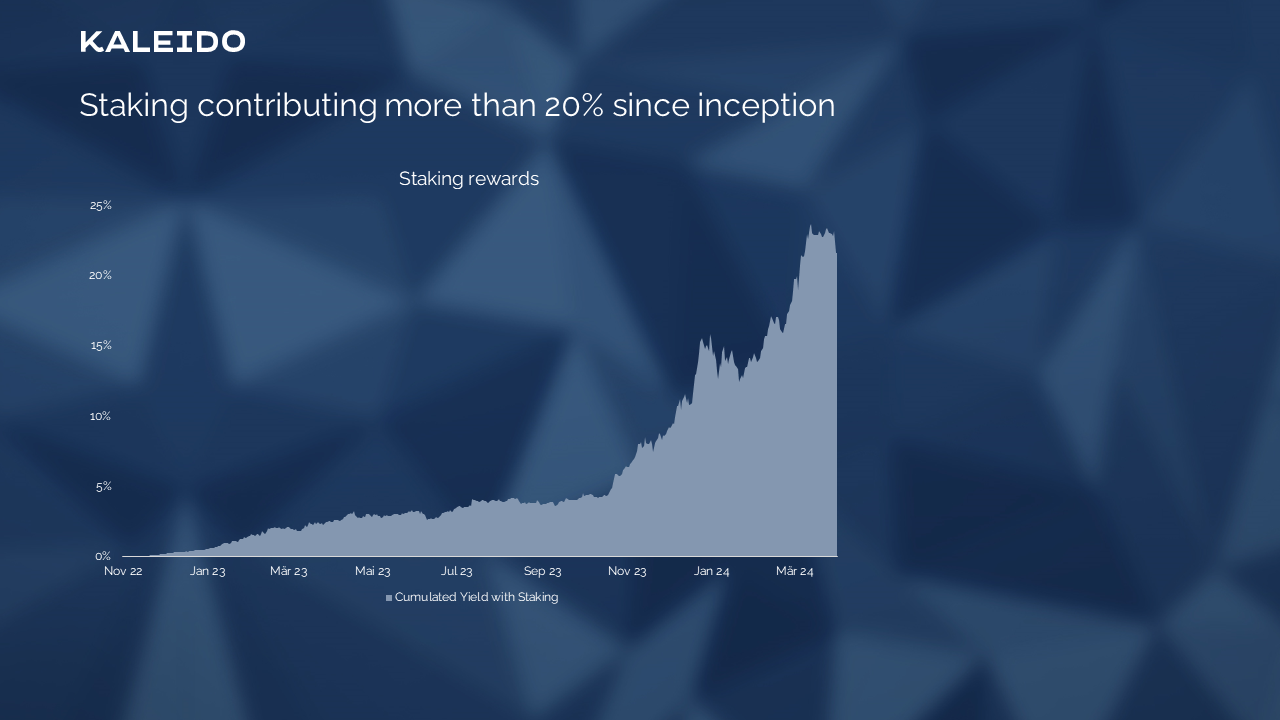

Staking contributing more than 20% since inception

The accumulated staking rewards since the start of the strategy in November 2022 now amount to more than 20% after 17 months, which corresponds to an average monthly return of more than 1.2% measured in USD.

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Management Summary October ended with a positive performance of +29.4% Altcoins benefit from initial redistribution of Bitcoin gains made In the...

Management Summary Kaleido Digital Asset Core Strategy achieved a strong performance of +31.6% in February. The equal-weighted KDAC strategy shows...