Planting coins: 04/2024

Management Summary Kaleido Digital Asset Core Strategy achieved a strong performance of +21.5% in March Equal-weighted KDAC strategy benefits from...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the third report in 2024 about the Kaleido Digital Asset Core Strategy. Read more about our crypto portfolio framework here. Don't forget to sign up to our newsletter to get the next reporting straight in your mailbox!

After the tough crypto winter and the various collapses of FTX, Celsius, and others, the market is currently benefiting from the Bitcoin halving narrative. Even though the halving event is known to all market participants because it is embedded in Bitcoin's code, the narrative seems to be motivating many market participants to invest. The next few weeks around April 19, when the halving is currently expected, will therefore show how the market deals with this narrative in this cycle.

Strong performance of +31.6% in February 2024

For our KDAC strategy in which Bitcoin is one of the selected coins, February was an extremely pleasing month. From the first to the last day of the month, the portfolio increased in value almost every day. The market was indeed mainly dominated by Bitcoin and the significant inflows into the Bitcoin Spot ETFs. The KDAC strategy gained 31.6%, with staking rewards contributing 4.3% measured in USD.

KDAC is outperforming Bitwise 10 Index

In terms of portfolio holdings, MINA exceeded the rebalancing threshold of five percentage points in the middle of the month, which led to a shift into ATOM and MATIC. Despite the increasing dominance of Bitcoin, the strategy was able to keep pace with the market-weighted Bitwise 10.

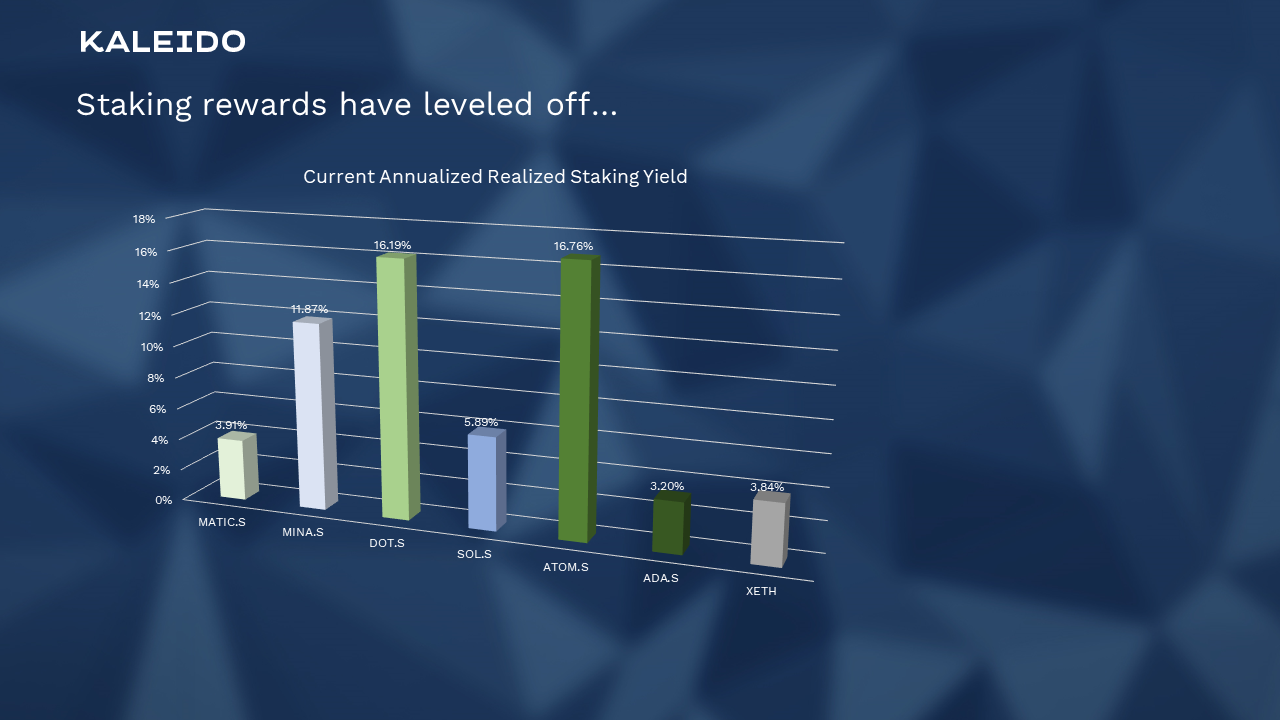

Staking rewards have leveled off…

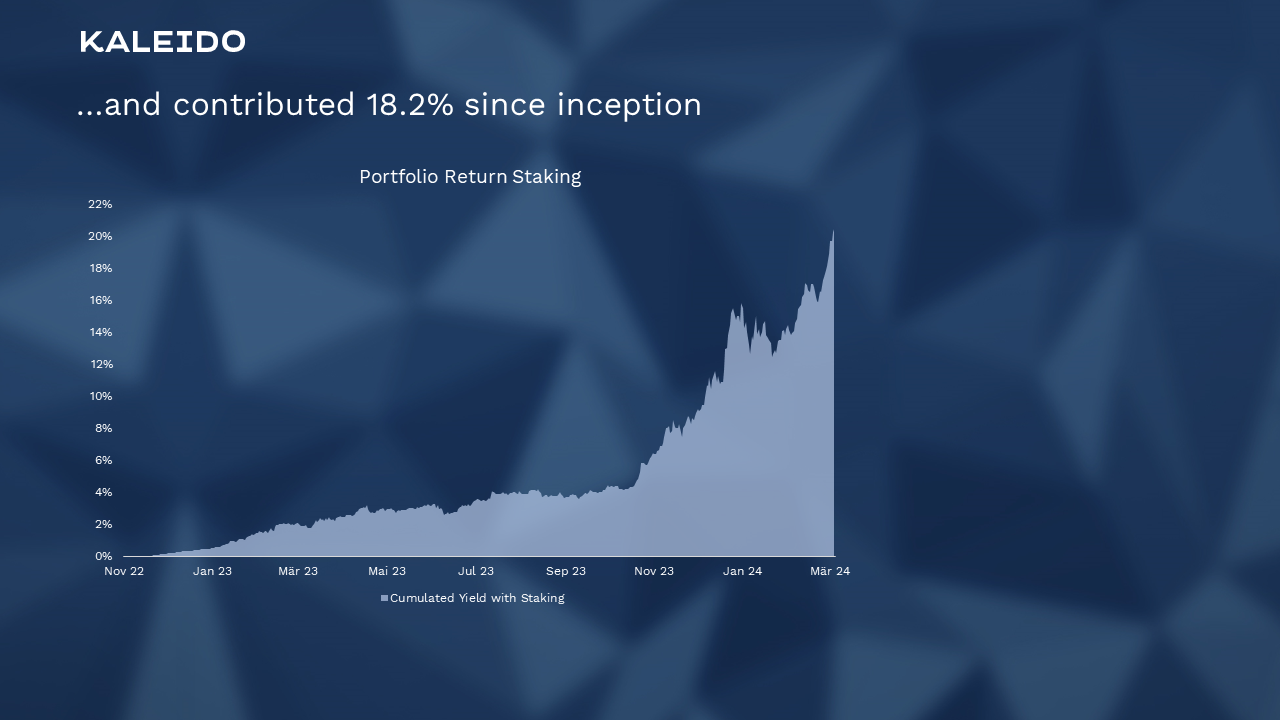

The entire staking rewards are held in the respective coins, which generated a return of 18.2% in USD since inception.

…and contribute 18.2% to the portfolio performance since inception

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Management Summary Kaleido Digital Asset Core Strategy achieved a strong performance of +21.5% in March Equal-weighted KDAC strategy benefits from...

Management Summary The crypto investing series starts under adverse market conditions. Our investment strategy was able to compensate or dampen...

Management Summary KDAC Strategy lost 14.1% in June continuing the sideways consolidation Staking rewards grow steadily, and interest in digital...