Planting coins: 05/2024

Management Summary The long-awaited halving brought no price movement Bitcoins as well as altcoins suffer due to politics and inflation ...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the first report in 2024 about the Kaleido Digital Asset Core Strategy. Read more about our crypto portfolio framework here. Don't forget to sign up to our newsletter to get the next reporting straight in your mailbox!

Bitcoin, the most popular cryptocurrency, is facing a major event in 2024 - the halving. But what exactly does it mean? Here's why the Halving is a pivotal moment for Bitcoin and the crypto scene as a whole. The last halving is expected to occur in 2140.

What is the Bitcoin Halving?

The Bitcoin Halving is an algorithmic event that takes place every 210,000 blocks, which is roughly every four years. In this process, the reward for miners who create new bitcoins is halved. Halving is built into Bitcoin's code to limit the total amount of Bitcoins in circulation and create a certain scarcity.

The importance of halving: supply and demand

The halving has a significant impact on the supply of new bitcoins. Halving the reward for miners makes the supply scarcer, while the demand for Bitcoin continues to rise. This imbalance of supply and demand may or may not lead to a price increase. Historically, each halving in the past has led to a significant price increase as investors became more optimistic due to the limited availability of bitcoins. However, other arguments note that the halving cycle in the past also coincided with the liquidity cycle in the markets and the price increase could also be due to this.

Long-term effects on the Bitcoin market

Halving also has a long-term impact on the Bitcoin market. Reducing the reward for miners makes mining more difficult and more expensive. This could lead to less efficient miners dropping out of the market, while those with efficient hardware can continue to operate profitably. This contributes to the security of the network, as only the most efficient miners survive.

Interpretation in the Bitcoin scene

In the Bitcoin community, the Halving is often seen as a festive event that paves the way for a new era of digital currency. It not only symbolizes the technological maturity of Bitcoin, but also underlines the cryptocurrency's resilience and independence from traditional financial systems. The Halving is a milestone that attracts the attention of investors and enthusiasts worldwide.

The future of Bitcoin after the halving

The Bitcoin Halving 2024 promises to change the dynamics of the cryptocurrency market. While it may lead to price increases in the short term, the focus is on the long-term vision of Bitcoin as digital gold and a decentralized payment system. The Halving serves as a reminder that Bitcoin is not only an innovative technology, but also influences and inspires a growing number of people around the world. It remains exciting to see how the crypto market will develop after this epochal event.

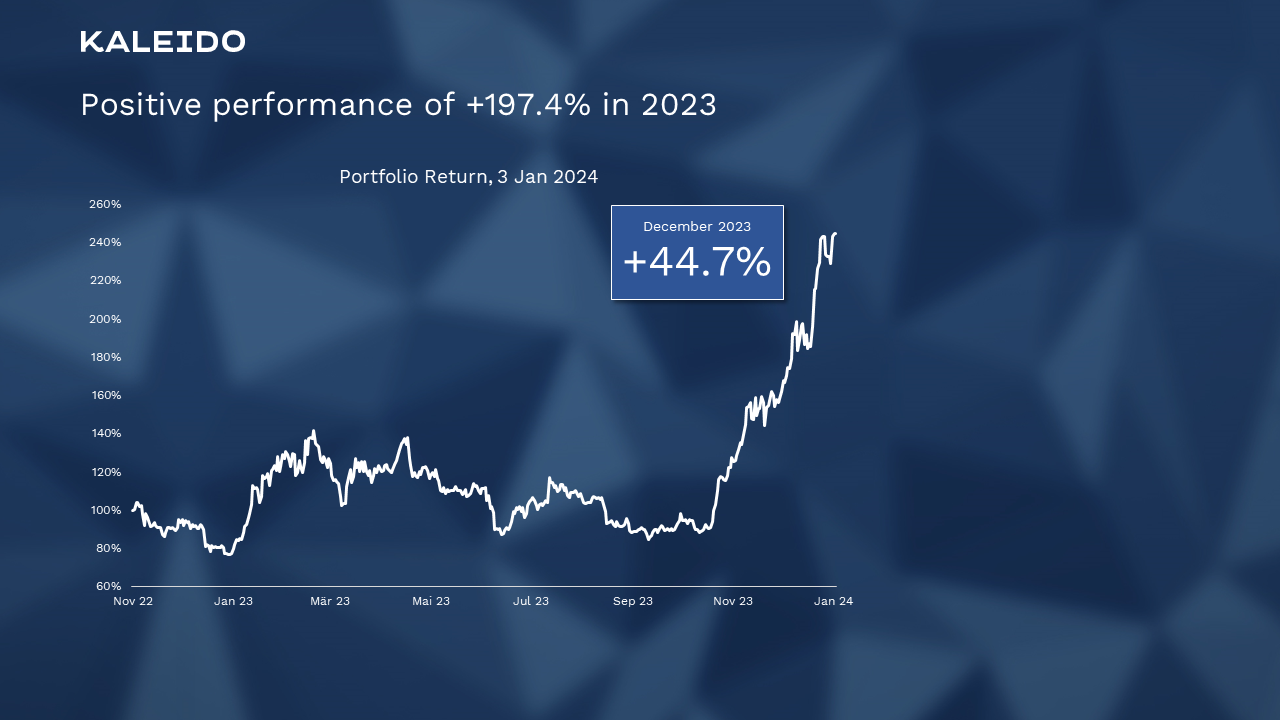

Bitcoin, the dinosaur among coins, is also a component of the Kaleido Digital Asset Core strategy, which generated a return of 197.4% in 2023. The December performance, for its part, amounted to 44.7%, which underlines the remarkable year-end rally.

Positive performance of +44.7% in December

During crypto spring, Bitcoin often stands out as a leading performer as it serves as a safe haven amid rising interest in the crypto market. Capital flows typically start with fiat money, which is first invested in Bitcoin. As an established reserve currency, Bitcoin is seen such as a safe investment in digital assets. Later on, some of these capital flows move to larger capitalized blue-chip coins, which offer stability and a wide range of applications. Finally, in the later phase of the crypto spring, investors look for opportunities in riskier altcoins, which offer the potential for exponential gains despite their volatility. This interplay of capital movements reflects the dynamic nature of the crypto market, with various factors such as market dynamics and regulatory developments playing a role.

These movements are clearly visible in a comparison of selected coins. The KDAC strategy, which consists of one tenth Bitcoin and nine tenths altcoins, outperformed Bitcoin for the first time in December since the strategy was launched. The top performer was Solana, which increased more than ninefold in 2023. Cosmos Atom, on the other hand, was the worst performer last year with a modest 13%.

KDAC strategy overtakes Bitcoin in its performance

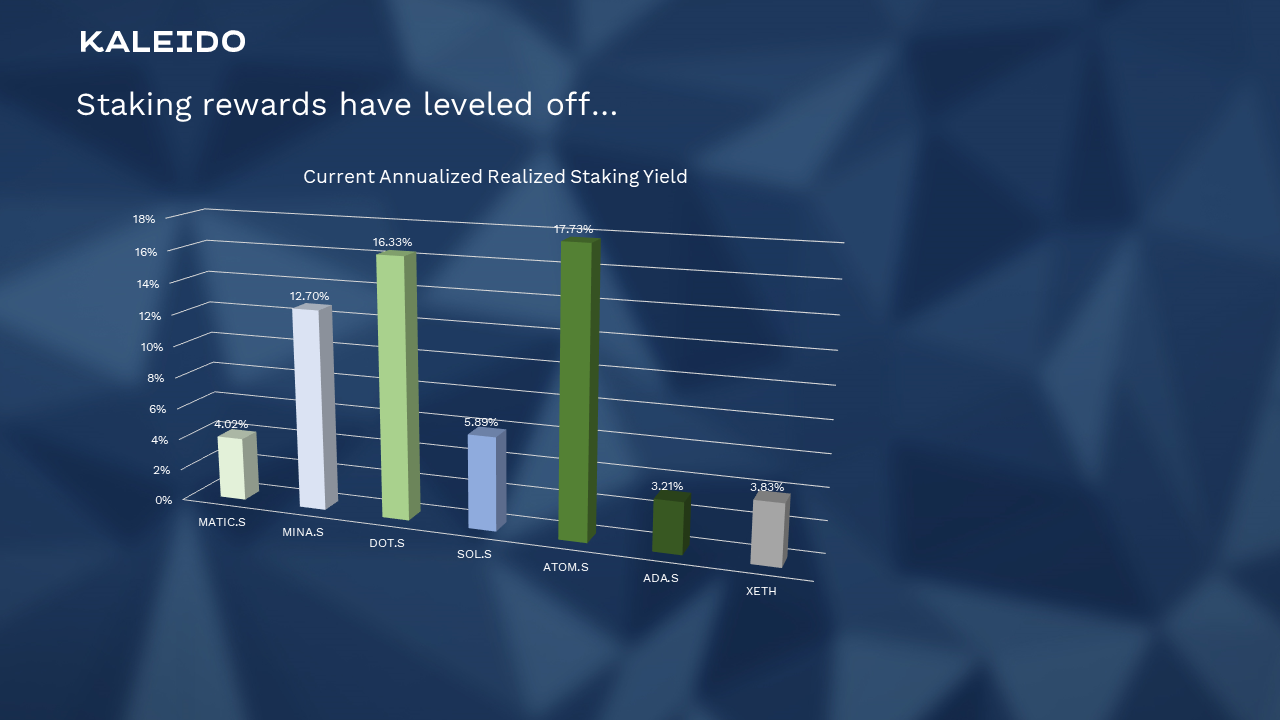

Staking rewards continue to contribute significantly to the overall performance of the portfolio, with staking yields between 3.2% (ADA, Cardano) and 17.7% (ATOM, Cosmos).

Staking rewards have leveled off…

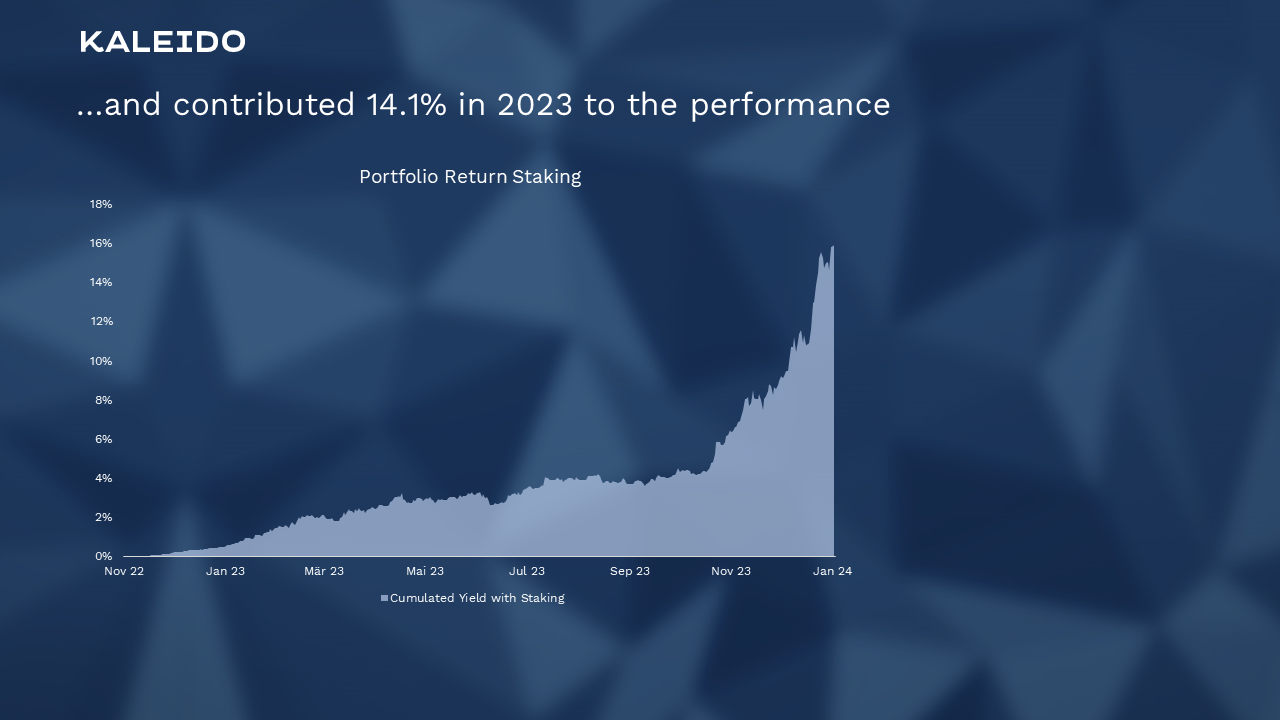

The entire staking rewards are held in the respective coins, which generated a return of 14.1% in USD in the first year, or 5.9% in December alone.

…and contribute 14.1% to the portfolio performance

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as an investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Management Summary The long-awaited halving brought no price movement Bitcoins as well as altcoins suffer due to politics and inflation ...

Management Summary Kaleido Digital Asset Core Strategy achieved a strong performance of +31.6% in February. The equal-weighted KDAC strategy shows...

1 min read

Management Summary Kaleido Digital Asset Core Strategy started with a consolidation with a return of -11.3% in January Equal-weighted KDAC strategy...