Planting coins: The twelfth report.

Management Summary

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

This blog post is the thirteenth report since the initiation of our crypto portfolio Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up to our newsletter to get the next reporting straight in your mailbox!

The portfolio was launched on November 2nd, 2022 at 7 p.m. CET, just before the events surrounding the FTX crypto exchange. The data of this report is as per October 31st, 2023.

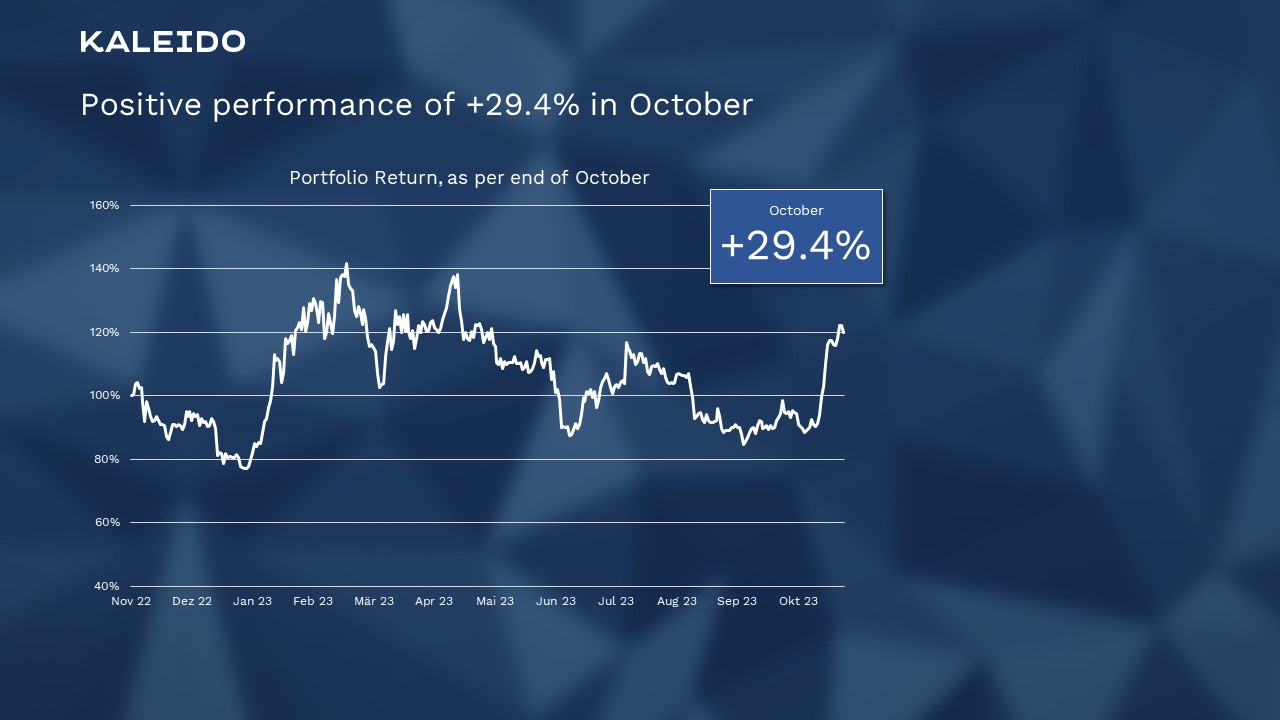

Positive performance of +29.4% in October

In October, the crypto market experienced a major upswing, affectionately referred to by some as "Uptober." Bitcoin's value increased by 26% this month, and Ethereum also saw an increase of nearly 7%. This "Uptober" idea is a belief among crypto fans that October usually brings good times for cryptocurrencies after a tough summer.

There are always quite a few discussions around the various narratives in the crypto space, and the "Uptober" story is just one of them. Interestingly, the facts show that Bitcoin has had a bad October only once since 2015, while in contrast there were six negative months in September. Last month's post (https://blog.kaleidoprivatbank.ch/en/planting-coins-the-twelfth-report) showed that September was different.

The recent surge in October may be mainly due to people being excited about the possible approval of a Bitcoin exchange-traded fund (ETF) in the U.S. by the Securities and Exchange Commission (SEC). This ETF approval is said to be significant for the crypto industry, as it would allow large investors to trade Bitcoin on regular exchanges. At the same time, it is also exciting to wonder how much capital will effectively flow into the asset class in a new way and what the impact on pricing will be, as it is purely a supply and demand driven market. Relevant media outlets report that as much as $155 billion could flow, which could add $1 trillion to the overall crypto market. Additional buoyancy may also come from positive words from the traditional financial world, such as Blackrock's Larry Fink, who in mid-October called buying Bitcoins a flight to quality.

So overall, this is good news for the crypto world, which has been going through some tough times lately, with scandals, failures and huge losses of about $2 trillion in a market that was once worth $3 trillion. But it's not clear if this will help other parts of the crypto world like Web3, NFTs, and the Metaverse, which have also had problems due to changing crypto prices and less interest and money.

While some experts believe Bitcoin will do well, others are more cautious and say the crypto market needs more than just an ETF approval to get back on track after a difficult year. Accordingly, in our view, it makes sense to be purposefully broad-based and follow an equally weighted strategy rather than blindly following market capitalization.

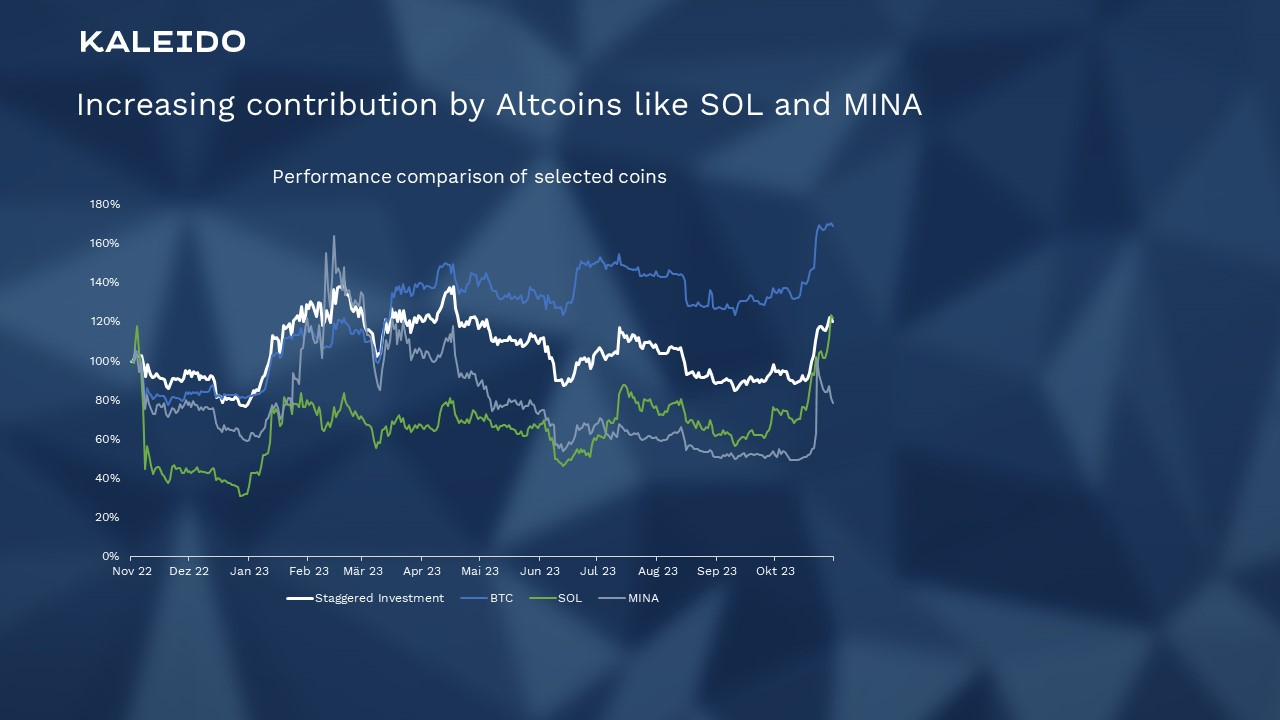

Increasing contribution by Altcoins like SOL and MINA

For the first time, we observe a stabilization in the Bitcoin price as well as first redistributions into Altcoins.

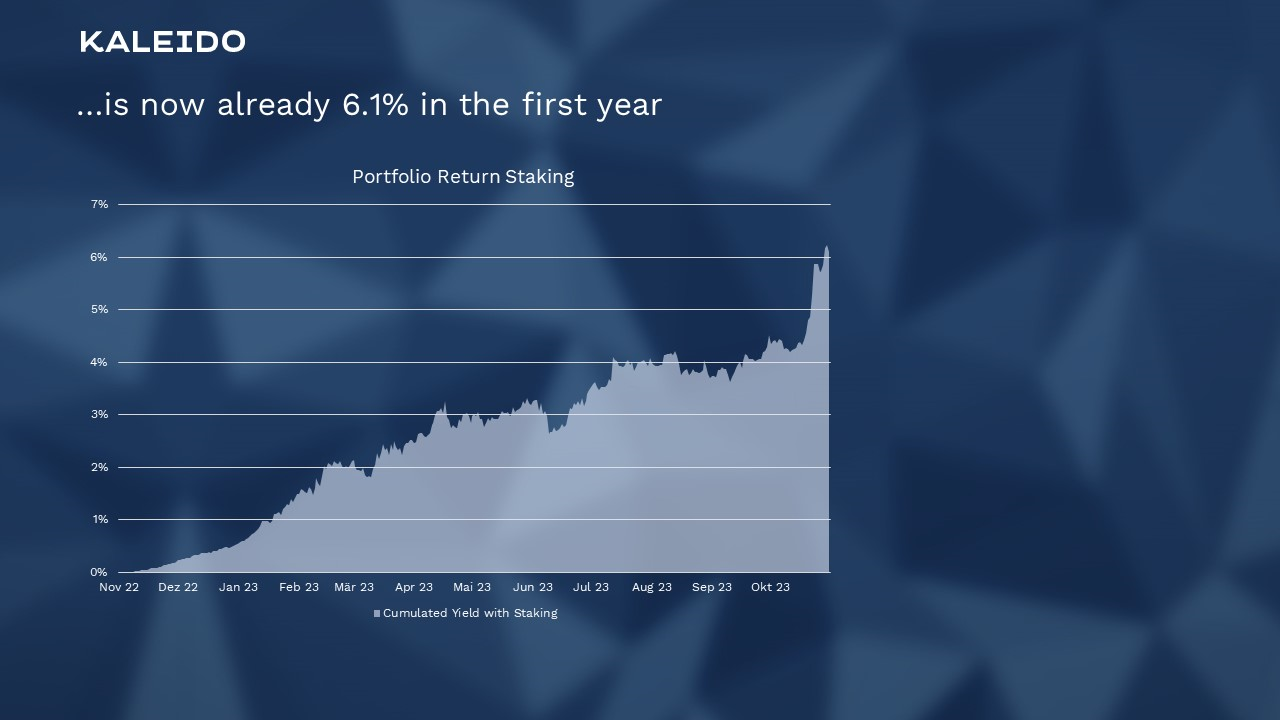

Staking rewards continue to contribute significantly to the overall performance of the portfolio, with staking yields between 3.2% (ADA, Cardano) and 18% (ATOM, Cosmos).

Continuous accumulation of staking rewards…

The total Staking Rewards are held in the respective coins, which brought a return of 6.1% in the first year.

…is now already 6.1% from 364 days

Management Summary October ended with a positive performance of +29.4% Altcoins benefit from initial redistribution of Bitcoin gains made In the...

Crypto Portfolio Performance Overview The month of May ended with a negative performance of -7.2% The market was characterized by great...