Kaleido Privatbank relies on InCore Bank's Digital Asset Services

The close cooperation with InCore Bank is being further expanded: Kaleido now also relies on InCore Bank's Digital Asset Services in addition to all...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

3 min read

Patrick Fehr

:

February 07, 2023

Patrick Fehr

:

February 07, 2023

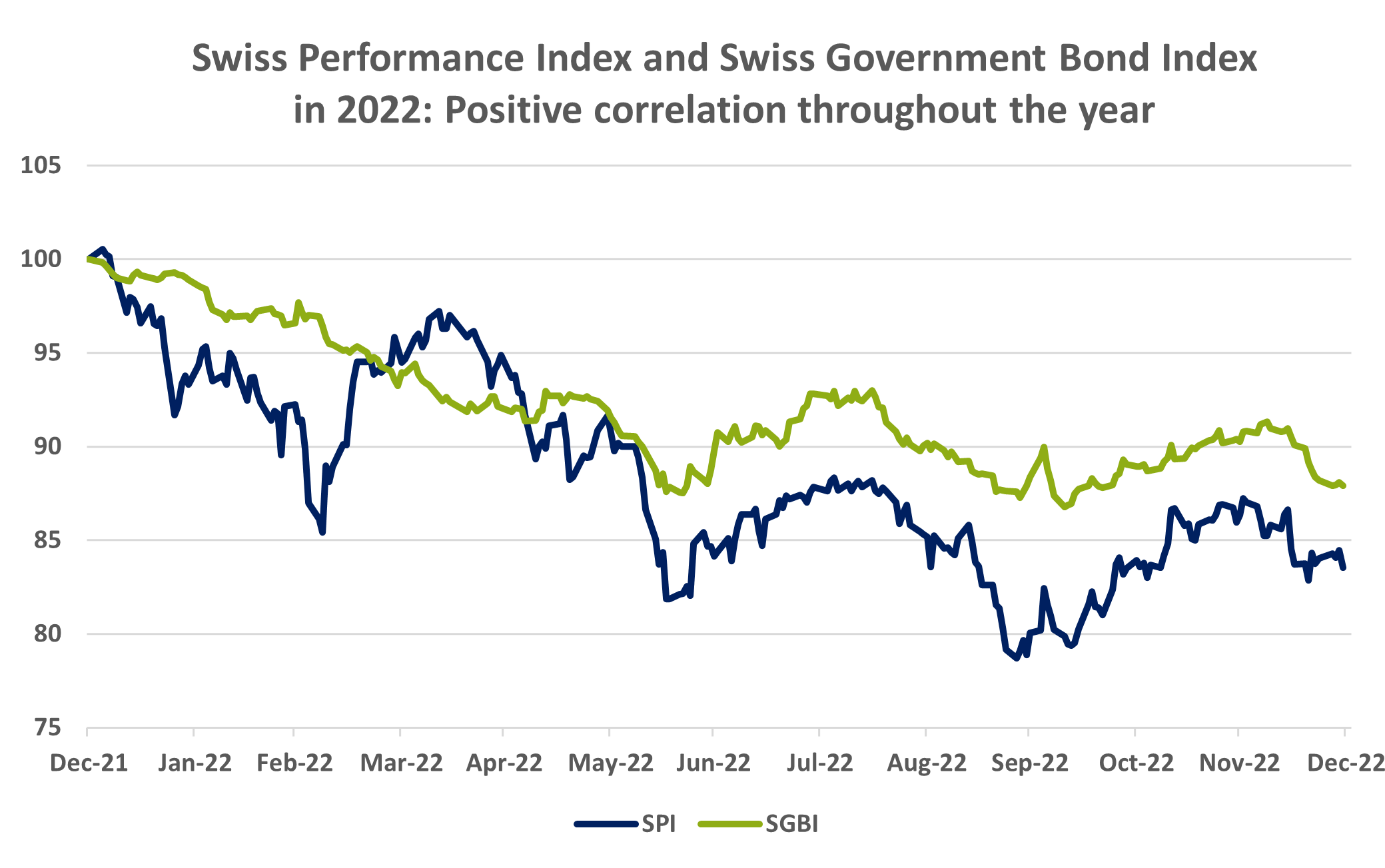

One of the oldest investment strategies is the 60/40 portfolio, a mix of 60 % stocks and 40 % bonds. The point of this balanced portfolio is that bonds mitigate or even offset the loss of the entire portfolio in bad equity years, and vice versa, of course. The basis of this strategy is the expectation that the returns of stocks and bonds are not always in a positive relationship to each other. Over many years, this balanced portfolio has produced good returns. However, this strategy suffered a severe setback last year, as bonds were hit by the worst downturn in decades, amplifying the stock market's losses instead of cushioning them. Thus, "low" risk portfolios may well have lost 10 % or more in value.

2022 was an exceptionally bad year for these portfolios, the worst in several decades. On the other hand, the decade before was exceptionally good. The average risk-adjusted return for a 60/40 portfolio from 2011 to 2021 was three times higher than in the period from 1900 to 2011 (source: Dan Villalon, AQR Capital Management).

During this period, balance sheets of the major central banks and the Swiss National Bank rose sharply. In addition, interest rates were at a very low, in some cases even negative, level. These two factors were important drivers for the above-average risk-adjusted return. The ever-lower interest rates drove bond prices as well as equity valuations sharply higher. The constituents of the S&P 500 stock index are currently valued at 2.4x sales, compared to the twenty-year average of 1.7x. This tailwind is now missing and is even turning into a headwind to some extent.

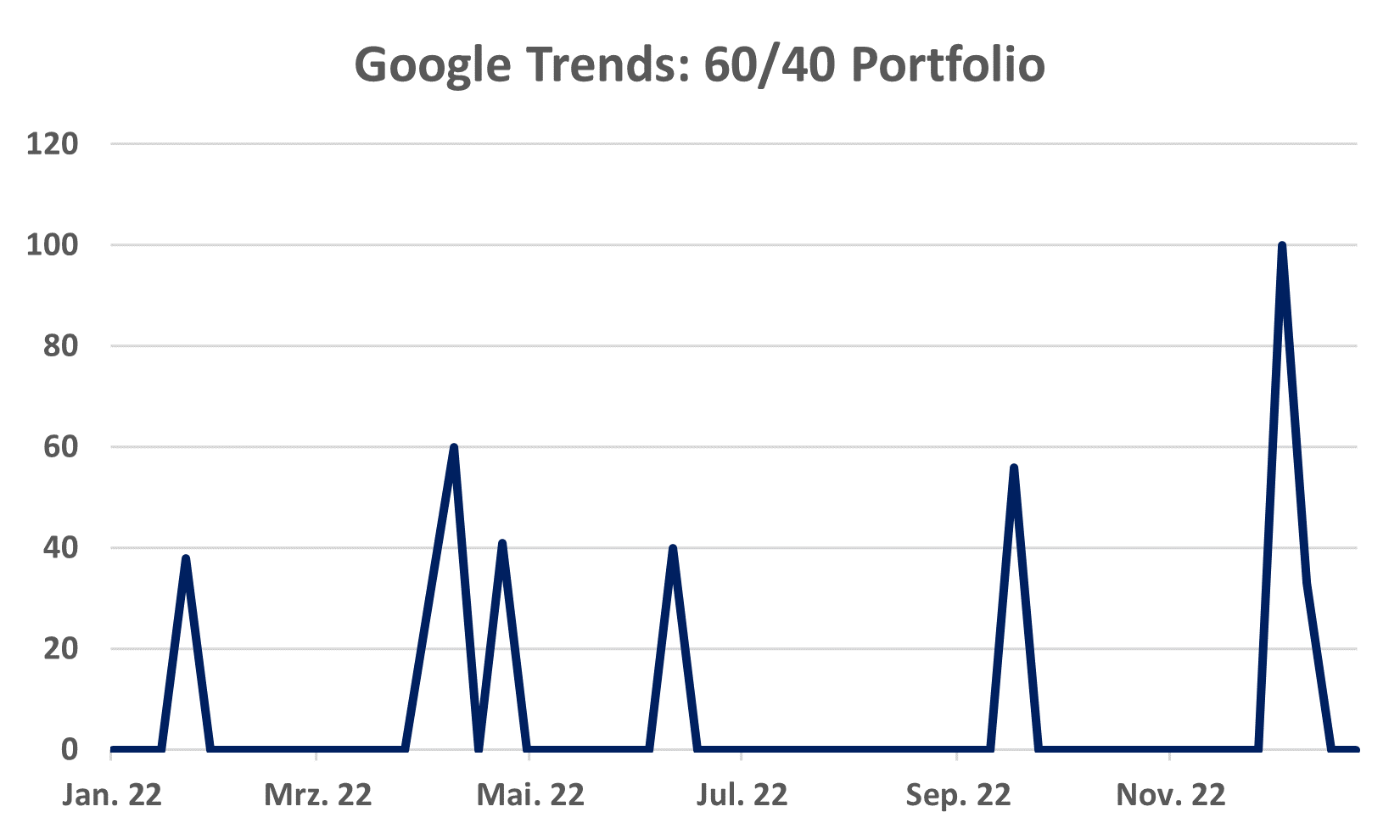

We should therefore assume that the next few years will not be as easy as the period from 2011 to 2021 was. In any case, the 60/40 strategy, which has proven itself over decades, was the talk of the town last year, as we can see in the following chart:

There were more reports and articles on this topic than there had been for a long time. The prospects of the strategy were suddenly questioned. Normally, we see such concerns at the low point of a cycle and the start of the new year has been successful, after all. What do investors expect for the future of this strategy? According to a survey by Bloomberg*, 70 % of professional investors and 60 % of private investors believe that the 60/40 portfolio will generate returns above inflation over the next ten years. Perhaps this optimism is due in part to a lack of alternatives. Kaleido offers the "Protect & Grow" strategy, a portfolio that does well in this environment and generated a positive return last year.

Financial markets trade a variety of instruments that can be used as inflation indicators. Inflation swaps, break-even rates, forwards, to name a few. Most suggest that inflation in the US will settle somewhere around 2 %. That probably wouldn't be a bad scenario for a balanced portfolio. Of course, inflation alone is not the only driver of its return potential.

The U.S. Federal Reserve wanted more than two percent inflation, and its monetary policy (of course, there were other reasons as well) contributed to a peak year-on-year increase in the consumer price index of nine percent. It seems hard for us to imagine that inflation will now be brought so well under control that it just settles around the two percent mark and remains there for an extended period. Maybe there will be a second wave, maybe inflation will even be negative in the second half of the year, we don't know. There are many possible scenarios, some are good for a balanced portfolio, some are not. What we do know is that performance was exceptionally good from 2011 to 2021 and at some point, we should expect long-term normalized returns again. Perhaps that period began last year.

The year 2022 has proven that a 60/40 portfolio often works, but not always. Unfortunately, asset class correlation is not always negative when we would need it most. Kaleido believes that diversification across different investment strategies makes more long-term sense than diversification across asset classes. We focus on finding the best managers for our clients. With them, we put together portfolios which, through discipline and expertise, form the basis for the most attractive results possible in the current environment. Contact us here, we will be happy to offer you an alternative off the beaten track.

Sources: Bloomberg, Google.

*1,056 people participated in the survey. Unfortunately, there was no information on participants' inflation expectations.

Disclaimer: The above information is advertising in accordance with Art. 8 para. 6 FinSA and is for information purposes only. We will provide you with further documentation free of charge at any time. The products, services and information offered may not be available to persons residing in certain countries. Please note the applicable sales restrictions for the corresponding products or services.

The close cooperation with InCore Bank is being further expanded: Kaleido now also relies on InCore Bank's Digital Asset Services in addition to all...

Last year was a year of innovation, growth, and learning. We shifted our focus from radical transformations to small-scale advancements with large...

Managing wealth can swiftly transform into a complex and delicate endeavor, irrespective of whether you're a patriarch, oversee a prosperous...