Western World's Energy Strategy: from Jimmy Carter to Robert Habeck

"I call for the greatest peacetime commitment of funds and resources in our nation's history to develop America's own alternative fuel sources." -...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

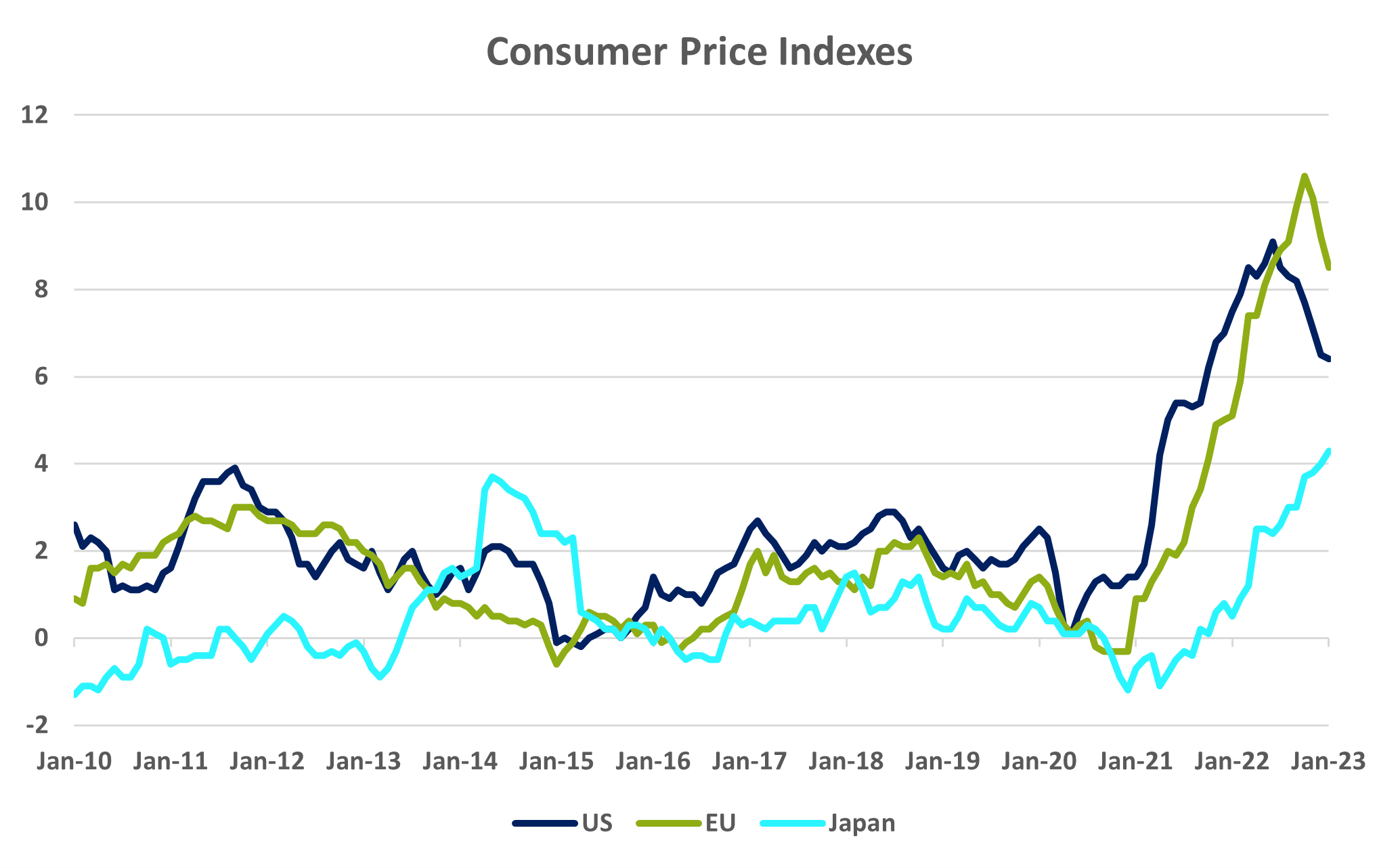

Governor Kuroda will chair his final monetary meeting on March 9 - 10, before his term ends on April. Kazuo Ueda will take over the Governor’s post from him. Kuroda’s tenure at the helm of the Bank of Japan started in March 2013. On the day of his appointment, the Yen fell. This was to be a harbinger of what was to come. That month, 10-Year Japanese Government Bonds (JGBs) had a yield of 0.65%, compared to 0.5% today. Although yields are almost the same then and now, a lot has happened during these 10 years. At the end of January 2016, the BoJ introduced “Quantitative and Qualitative Monetary Easing (QQE) with negative interest rates in order to achieve the price stability target of 2 percent at the earliest possible time”. The short-term policy interest rate was set at -0.1% and the rate never changed since. Also, the BoJ committed to an increase of the monetary base of 80 trillion yen per year and outlined asset purchases (predominantly government bonds and to a lesser degree Japanese equities via ETFs) to contain the 10-Year JGB yield at around zero percent. This was referred to as Yield Curve Control (YCC). The Consumer Price Index in the country was just turning negative again and the BoJ was deeply concerned about deflation.

80 trillion is roughly 15% of Japan’s Gross Domestic Product, so quite a big intervention. Later, the BoJ committed to buy unlimited amounts of Government Bonds and a maximum tolerated yield of 0.25% for the 10-Year bond. Japan waved good-bye to free financial markets that day. The side effects of this brazen policy have been and still are manifold today:

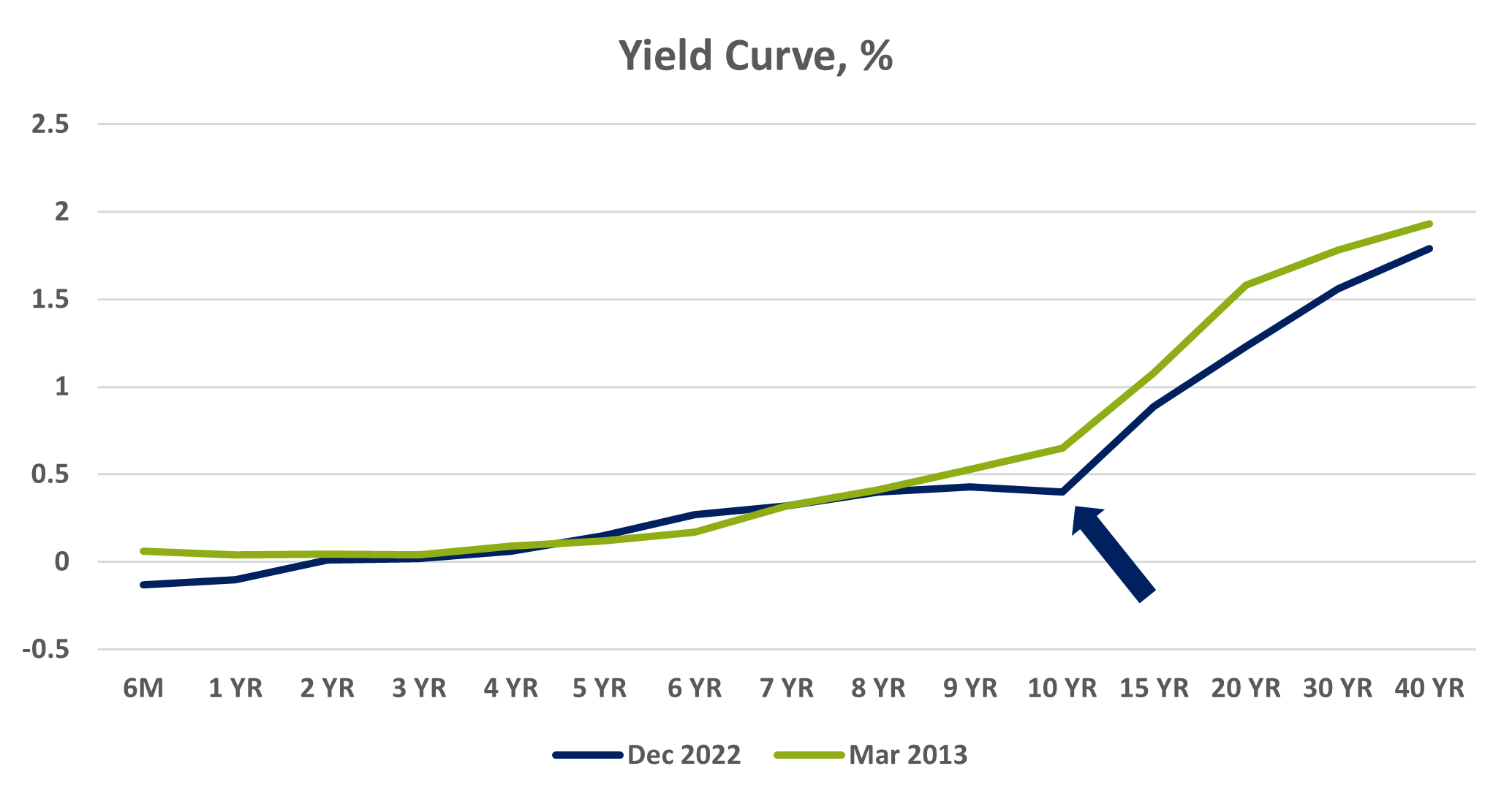

In October 2022, the yield of the 10-Year JGB climbed above 0.25%. The BoJ announced unscheduled bond purchases to rein it back in. On 20 December last year, the Central Bank said it would allow the 10-Year bond yield to rise to around 0.5%, from the previous 0.25%. Governor Kuroda said the move was aimed at ironing out distortions in the shape of the yield curve. As you can see in the chart below, there appears to be only one distortion: the one caused by the BoJ itself. The Yen increased and the Nikkei stock index decreased about 4% immediately that day.

In January 2023, the bond purchases reached a new monthly all-time high at 23.7 trillion yen (about USD 170 billion!). Investors now wonder whether the higher yield cap is a precursor to a normalization of monetary policy. Incoming Governor Ueda indicated that the current monetary stance remains appropriate, although he signaled the potential for tweaks to the Yield Curve Control policy in the future. The part of the Japanese financial market that’s not distorted by the BoJ has made up its mind: 10-Year interest rate swaps trade at around 0.80% currently, significantly above the recently introduced ceiling of 0.50%. Also, 70% of economists surveyed by Bloomberg expect the BoJ to embark on some kind of policy normalization this summer. Annual consumer inflation is running above 4%, the highest since 1991. Remember, the BoJ wanted to get inflation of 2%. Pressure is mounting from wages, too. Large Japanese employers agreed to significantly increase salaries this year. Toyota did not disclose the size of its salary increase, Honda announced 5% more, Suntory 6%, Nintendo 10%, and Uniqlo up to 40% more. Nominal wages grew 4.6% in December last year, the fastest rate since 1997.

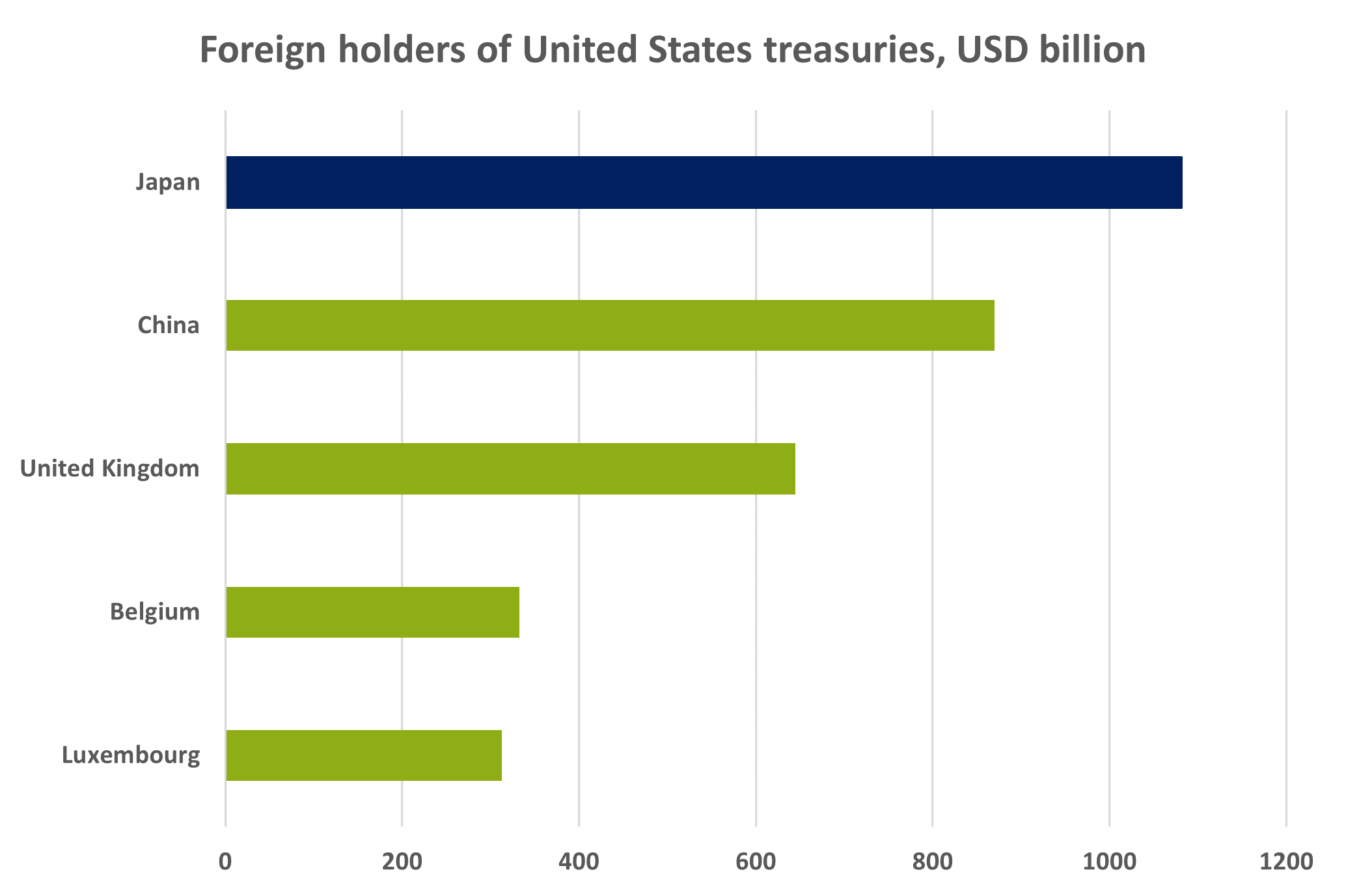

The last interest rate move of the BoJ was the cut to -0.1% from zero in 2016. While every other major central bank (ex-China) started tightening financial conditions by reducing balance sheet assets in combination with interest rate hikes, the BoJ more than offset these balance sheet runoffs. At the same time, Japanese investors have been repatriating assets at a record pace. Also, Japan is the biggest foreign owner of United States public debt.

A policy change of the BoJ could have significant ramifications also for the US Treasury market. Particularly considering the massive borrowing need of the US Treasury, which they project at USD 1.2 trillion for the first six months of 2023.

Perhaps more interesting is how the domestic market would react to a change in wording or a strategic pivot from the incoming governor. 10-Year JGB bonds would certainly have massive downside, so do Japanese equities. We don’t forecast a change in strategy at the meeting this week. But we are certainly prepared to act if markets provide us with an interesting opportunity. If you want to learn how to profit from a potential market dislocation, reach out to us.

"I call for the greatest peacetime commitment of funds and resources in our nation's history to develop America's own alternative fuel sources." -...

The Ethereum blockchain is about to undergo arguably the most significant upgrade in the chain's roughly eight-year history. Ethereum is the second...

Blockchain technology has been the talk of the town for the past few months: Suddenly people were interested in the distributed database as well as a...