Terra Luna's Collapse - a bank run in the decentralized world

Blockchain technology has been the talk of the town for the past few months: Suddenly people were interested in the distributed database as well as a...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

The Ethereum blockchain is about to undergo arguably the most significant upgrade in the chain's roughly eight-year history. Ethereum is the second largest blockchain by market capitalization behind Bitcoin and is the preferred platform for programming smart contracts and decentralized applications. Ethereum's success is no accident. Its popularity can be measured, for example, by the number of monthly active contributing developers, which was around 2100 as of the end of July 2022. Compared to the 400 monthly active developers on Bitcoin and 300 on Solana, one also observes Ethereum's significant network effect.

This article briefly and clearly summarizes the key challenges related to the Merge and possible solutions. If you want to go deeper into the details of the topic, please refer to the Ethereum Community Repository, which also serves as the main source for this article.

First of all, with an established blockchain, the question arises as to why an upgrade is necessary at all.

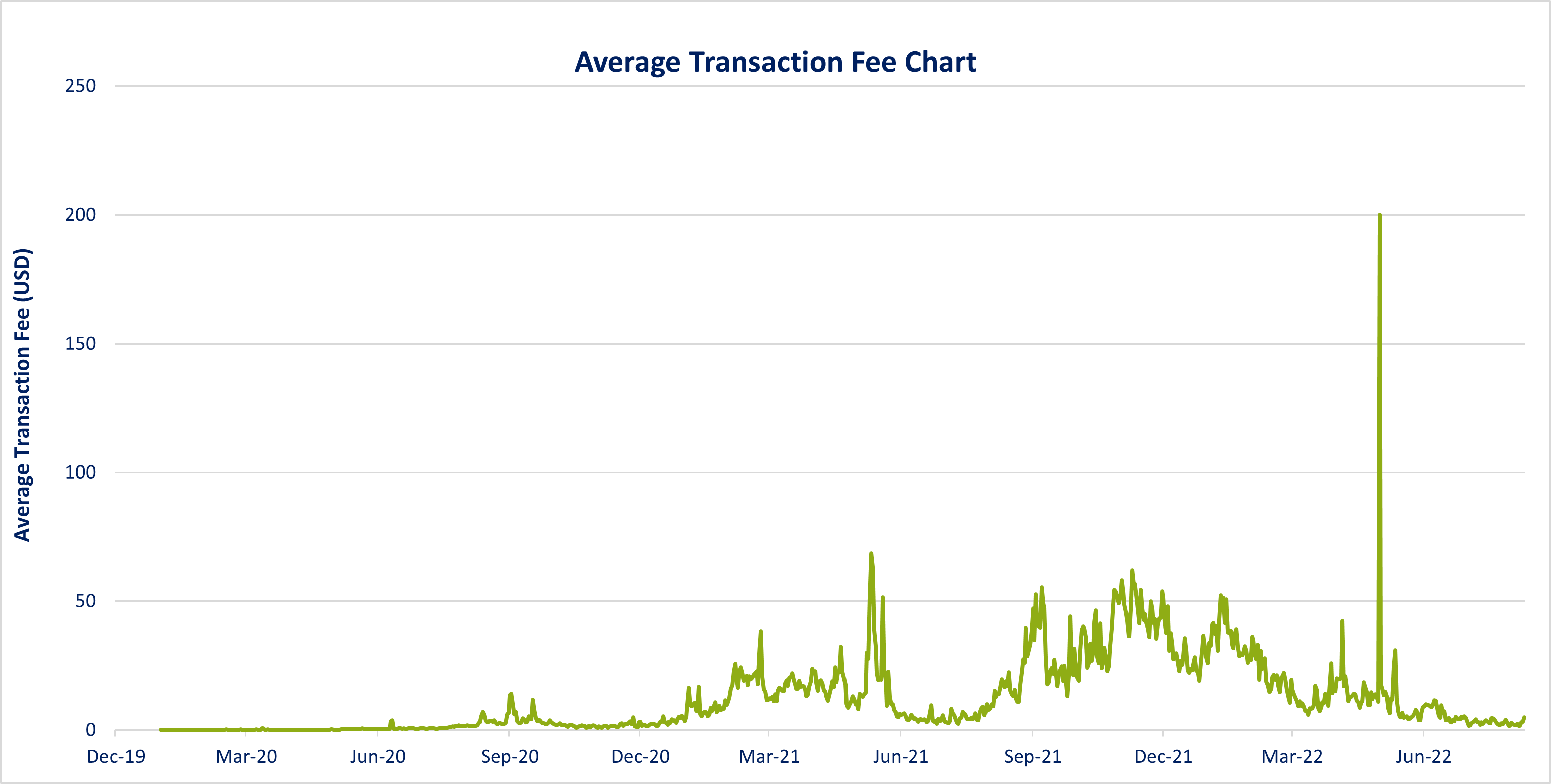

1. Scalability: As the past has shown, the Ethereum blockchain is completely overloaded at peak hours with increased demand, leading to a significant increase in gas prices and a larger number of transactions and smart contract executions. Gas is the fee a user pays to execute a transaction on the blockchain. The most recent example of such an event was the initial sale of what Yuga Labs calls Otherdeeds for Otherside, an NFT collection launched in early May 2022 (Figure 1). This led to a so-called "gas war," with daily paid transaction fees on Ethereum rising to a record USD 231 million in total, a more than 100 percent increase from the previous high of USD 117 million during the May 2021 bull market. As Ethereum's success shows, the blockchain urgently needs to become more scalable, i.e. enable faster and cheaper transaction processing.

|

| Figure 1: Etherscan.io (2022) |

2. Security: Assuming that an even larger number of applications and smart contracts will be executed on a blockchain like Ethereum in the future, the security of the chain is of immense importance for sustainable success. Accordingly, the blockchain is to be made even more secure through the upgrade. With the increasing length of the blockchain as well as size of the network, more data is created, which must be managed. This has a direct impact on the operator of a node, who runs the software for validating the blockchain on his computer. The requirements for the operator increase accordingly, both from a performance and a capacity perspective.

3. Sustainability: In principle, a blockchain is both a common area, which should be open to as many participants as possible, as well as a sophisticated system of incentives, which should induce participants to execute only truthful and truly necessary transactions. As already mentioned, there are various consensus mechanisms for this, whereby the Proof of Work is significantly more energy-intensive than the Proof of Stake, which is becoming more widespread. Ethereum has been based on Proof of Work since its infancy and is now expected to become more sustainable and thus more resource efficient.

Blockchains face a trilemma, whereby only two dimensions could be designed efficiently at a time. For example, if a blockchain is highly scalable and secure, this comes at the expense of decentralization. On the other hand, if the blockchain is highly decentralized and secure, such as Bitcoin, the disadvantage is clearly scalability. Ethereum is now trying to solve this trilemma with the next upgrades. The aim is to address the three challenges of scalability, security and sustainability mentioned above with different approaches. At the same time, decentralization is to be further increased by means of these solutions.

1. Scalability: Probably the most important element regarding increasing efficiency and capacity is called sharding. This involves distributing the network over 64 new chains, which is intended to increase the current capacity above the current limit of 15 to 45 transactions per second. Shard Chains thus provide additional storage layers for data. The upgrade, with the ability to implement, is expected to take place as part of the Merge, with Shard Chains expected to begin operations in 2023. A validator will then only work on its shard chain. This enables operation even on smaller devices, which in turn increases the number of possible clients and thus makes the network even more stable. With regard to the capabilities of a shard chain, the question arises as to what they should be able to do. Is it enough if they simply act as data storage, or should they also be able to execute smart contracts? This question is often discussed with regard to the launch of the various successful so-called Layer 2 Chains and, accordingly, the switch to Proof of Stake was prioritized at Ethereum over the various features around smart contract execution.

2. Security: The greatest danger regarding the misuse of a blockchain is the majority rule, so-called 51% attacks, where someone can make changes with fraudulent intent by controlling a majority of the network. Through the so-called Proof of Stake, validators will in future have to deposit significant amounts in the Ethereum cryptocurrency Ether, of which they will lose shares in the event of attempted attacks (slashing). It is more efficient than Proof of Work in that not only are the rewards lost for the fraudster, but the miner's infrastructure would also have to be destroyed. Additional security is provided by the sharding mentioned above, where the beacon chain randomly assigns different shards to each validator as part of its coordination mission, making collusion virtually impossible. In addition, as the barriers to entry as a validator are lowered by no longer having to invest in high-performance new mining infrastructure every few months, more participants can become validators, which in turn increases the security of the network.

3. Sustainability: Bitcoin, and the Proof of Work consensus in particular, are often criticized for their high energy consumption. The invested energy primarily serves as a safeguard for the blockchain. Staking has already been introduced for Ether through the introduction of the beacon chain. What is currently still running as a Mainnet parallel to the beacon chain will then be completely transferred to proof of stake through the Merge.

The Merge

The new coordination blockchain, the Beacon Chain, went live on December 1, 2020. It runs from the beginning with the Proof of Stake consensus mechanism and has the task of coordinating and linking shards and stakers. Until now, it has been running separately from the Mainnet, i.e. the Proof of Work Ethereum blockchain. In the Merge currently planned for September 19, 2022, the consensus mechanism will be changed to Proof of Stake and the existing Mainnet will be "attached" to the Beacon Chain as a separate shard. For the time being, the Mainnet shard will also enable smart contracts to be executed in the Proof of Stake system and the entire history to be transferred. The next step will be to enable functions such as the unstaking of staked Ether, before shard chains are added as an upgrade. Various test networks such as Ropsten and Goerli have already been successfully merged over the past few months, with Goerli continuing to exist as a proof of stake test network.

How to participate in the future of Ethereum?

There are various possibilities to participate in the future of Ethereum. The strategies described in the following are explicitly not to be understood as investment recommendations or advice, but refer solely to a selection of possible opportunities.

1. Becoming a validator

You decide to become an active validator yourself and operate your own node. This strategy requires an investment of 32 ETH in addition to the necessary technology and technical expertise. This opportunity might be the most profitable.

2. Delegated Staking

Is the more convenient way to profit from the Staking Yields. Ether can be conveniently delegated against payment of a percentage fee in favor of the validator. In addition to technical providers, financial institutions are increasingly offering such services. Staking is partly done via a minimum investment in the amount of 32 ETH or via a pool with smaller amounts. This is an interesting option if you as an investor believe in the success of the Ethereum Blockchain in the long term and are also willing to accept the illiquidity risk until the unstaking feature is established. For more experienced Ether hodlers, there are now also options for so-called liquid staking, whereby the investor receives a futures derivative on future unstaked ETH.

3. Danger and opportunity of a fork

As with every upgrade of a blockchain, there is a risk that the validators cannot agree on the continuation of only one chain and that two chains will henceforth exist as a result of a so-called hard fork. Historically, this has already happened in the early days of the Ethereum Blockchain, when in the aftermath of the "DAO hack" the Ethereum Classic Blockchain with ETC was continued in addition to the mainnet of Ethereum with its currency ETH discussed today. Owners of Spot ETH could benefit from this by owning ETH PoS (Proof of Stake) as well as ETH PoW (Proof of Work) in case of a hard fork in the future.

Blockchain technology has been the talk of the town for the past few months: Suddenly people were interested in the distributed database as well as a...

The Zurich-based private bank is launching its cryptocurrencies and digital assets offering, expanding its existing investment universe to...

"I call for the greatest peacetime commitment of funds and resources in our nation's history to develop America's own alternative fuel sources." -...