Planting coins: 04/2024

Management Summary Kaleido Digital Asset Core Strategy achieved a strong performance of +21.5% in March Equal-weighted KDAC strategy benefits from...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

1 min read

Markus Abbassi

:

November 22, 2022

Markus Abbassi

:

November 22, 2022

This blog post is the first reporting since the initiation of our crypto portfolio, and the first part of our crypto investing series Planting Coins. Read more about our crypto portfolio framework here. Don't forget to sign up for our newsletter to get the next reporting straight in your mailbox!

The portfolio was launched on November 2, 2022 at 7 p.m. CET, just before the events surrounding the FTX crypto exchange.

Figure 1: Collapse around FTX dominates the headlines

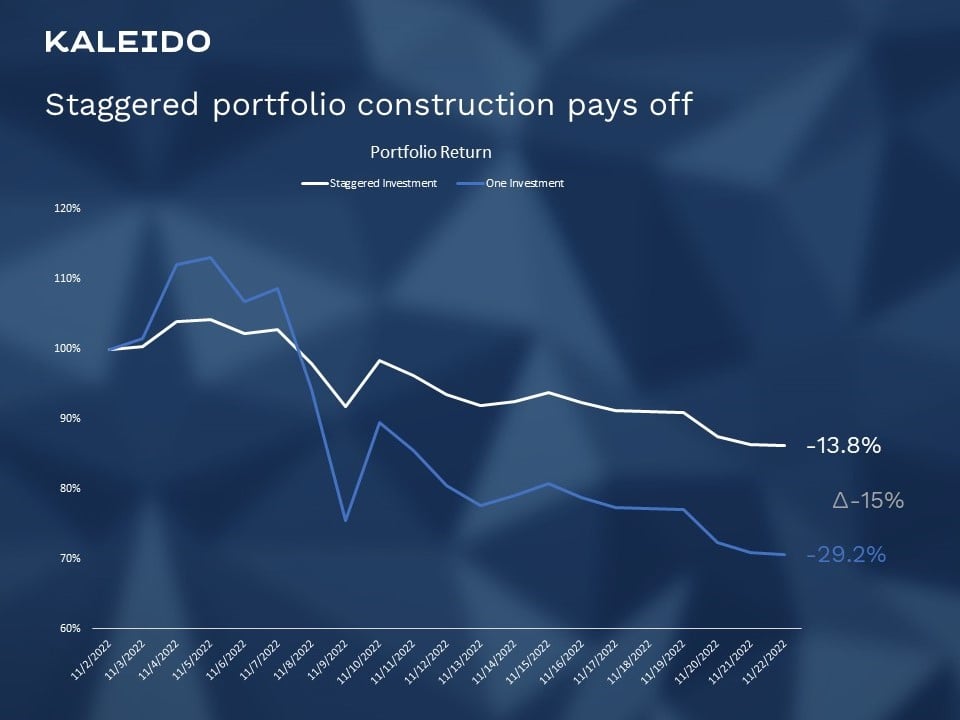

In the first three weeks, three staggered purchases were made in all ten coins, resulting in a negative performance of -13.8 % since the beginning.

We can see that by not investing the whole cash amount at the beginning, we could save another 15% of performance, so Initial rules such as the staggered portfolio construction strategy have already paid off. We also see the benefits of portfolio diversification with the selection and investment in ten different coins.

Figure 2: Staggered portfolio construction pays off resulting in a Portfolio Return of -13.8% over the first three weeks.

As of November 22, 2022, the Portfolio Index stands at 86.2 points, down

13.8 % since inception.

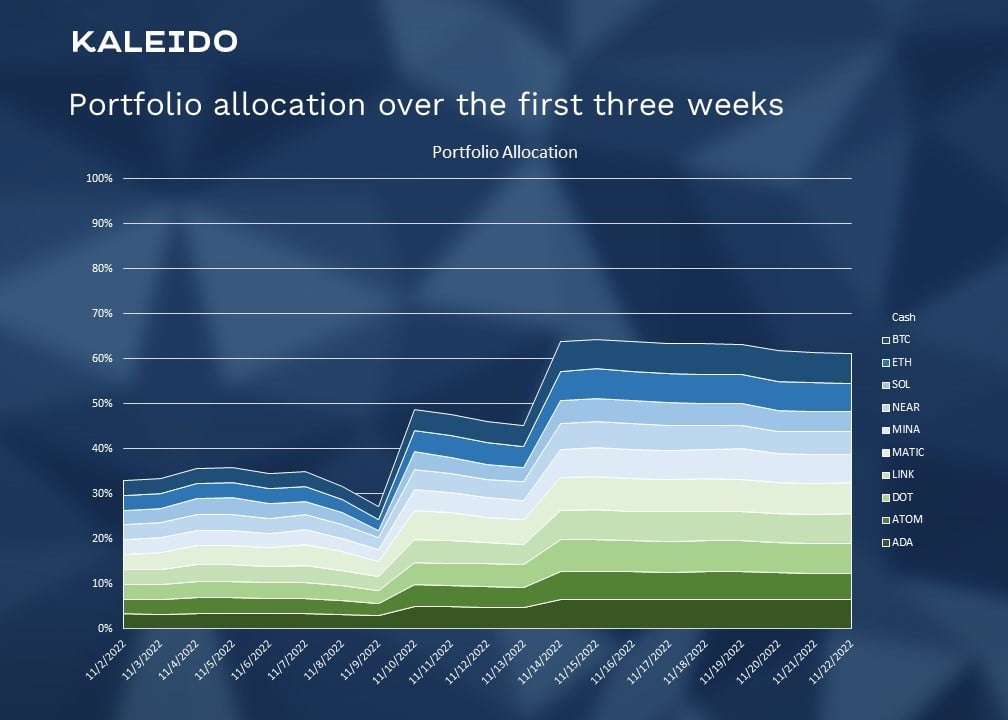

Figure 3: Portfolio allocation over the first three weeks with the first three buy dates on Nov. 2 (9 p.m. CET), Nov. 10 (1 p.m. CET) and Nov. 14, 2022 (12 p.m. CET).

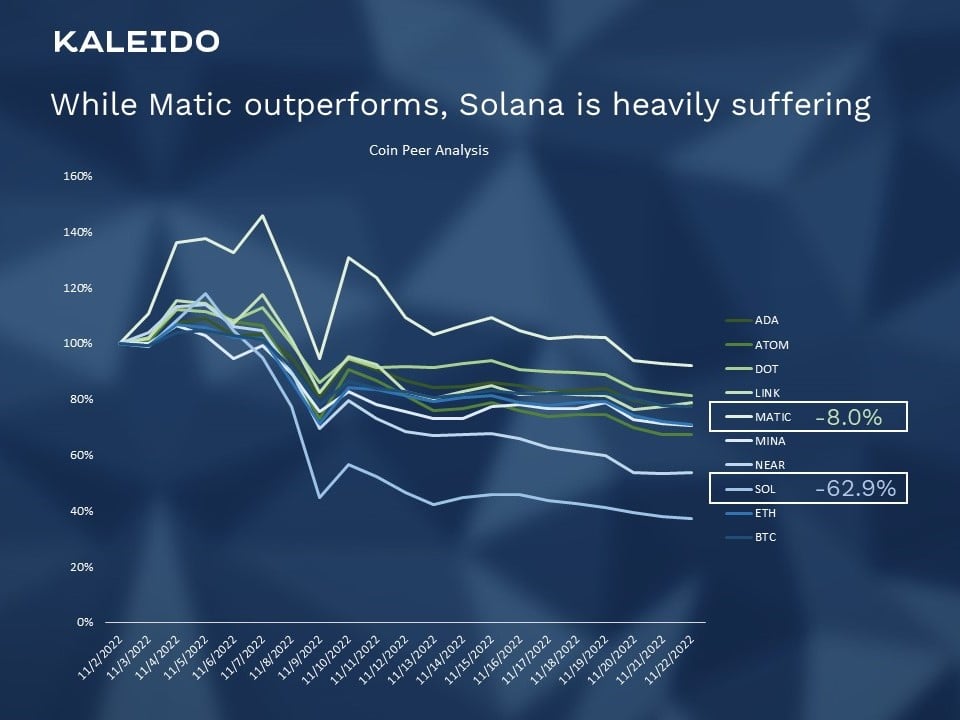

Figure 4: Performance comparison of the 10 portfolio coins with Polygon (MATIC) as the best performer (-8 %) and Solana (SOL) as the worst performer (-62.9 %).

Disclaimer: This piece of information is for marketing and entertainment purposes only and should not be taken as investment recommendation. Remember that all investments involve risk. Please read our full Marketing Disclaimer here.

Management Summary Kaleido Digital Asset Core Strategy achieved a strong performance of +21.5% in March Equal-weighted KDAC strategy benefits from...

Management Summary After a great start into 2023, our Crypto Garden portfolio is currently at 120.4 points. In March, we observe a strong rise in...

Management Summary Today's focus is on staking - the process of holding onto a cryptocurrency to support the operation of a blockchain network and...