The upcoming Ethereum Merge and ways to profit

The Ethereum blockchain is about to undergo arguably the most significant upgrade in the chain's roughly eight-year history. Ethereum is the second...

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

4 min read

Patrick Fehr

:

September 27, 2022

Patrick Fehr

:

September 27, 2022

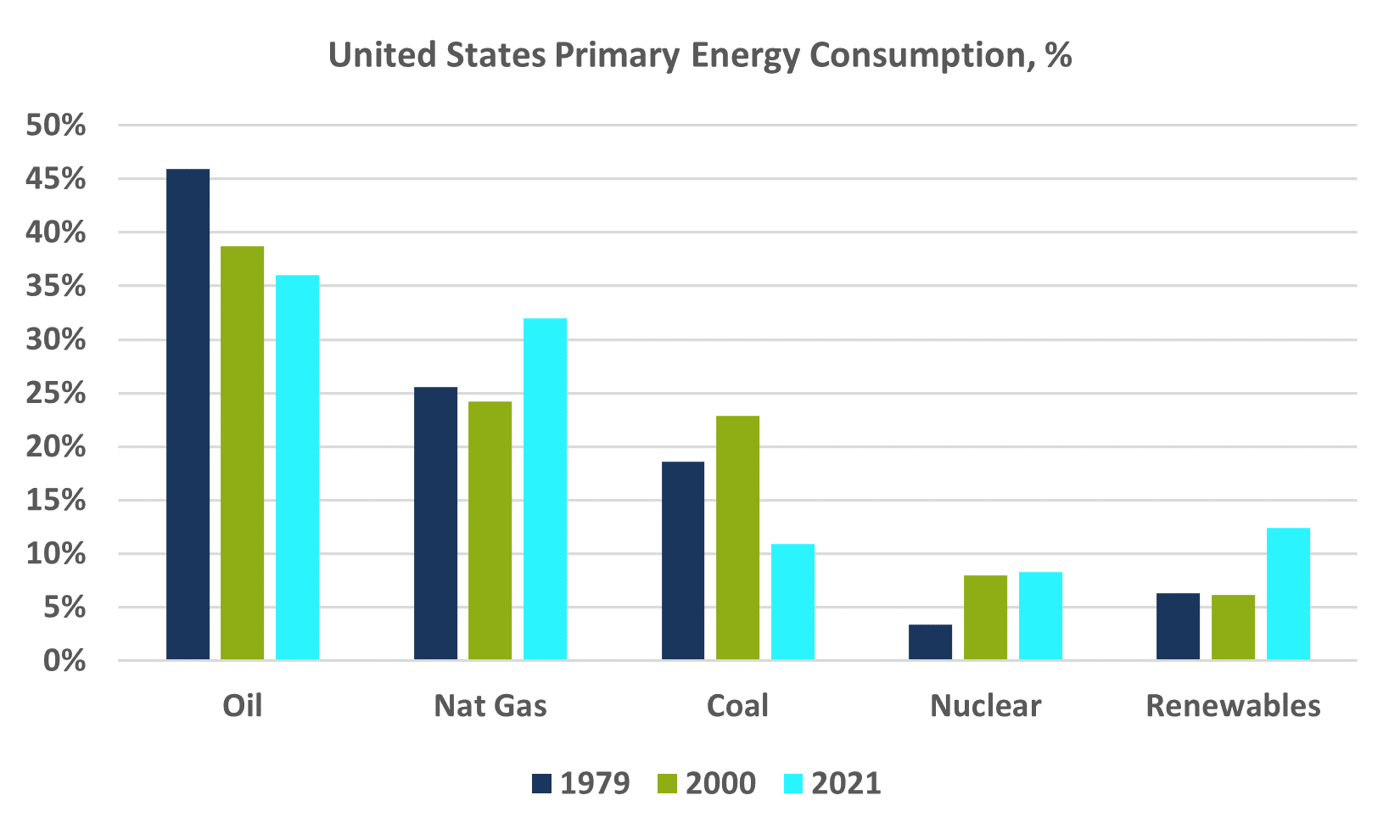

"I call for the greatest peacetime commitment of funds and resources in our nation's history to develop America's own alternative fuel sources." - Jimmy Carter: Crisis of Confidence Speech, July 15, 1979.

He went on to say that he would encourage the production of fuels from sources such as coal, shale oil, unconventional gas, and the sun. He also wanted to submit legislation to Congress to establish the nation's first solar bank to increase energy production from solar power to 20 % of total energy by the year 2000. We must give him credit for his foresight. He was, however, unable to win a second term. Reagan defeated Carter in a landslide in 1980, oil prices declined in the early 1980s, gas station lines dissolved, and alternative energy generation fell into a long sleep.

|

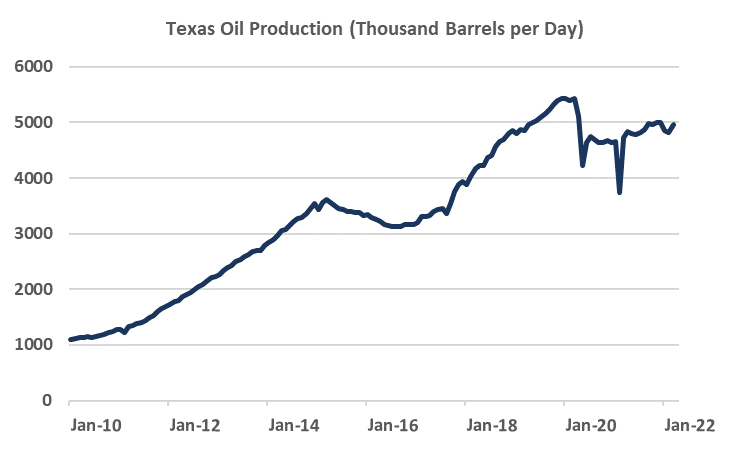

After the global financial crisis, the Federal Reserve printed a lot of money. Some of it went into the U.S. shale oil industry, which began producing a lot of oil in 2009, although at an economic loss for a long time. In fact, unconventional oil production from the U.S. contributed about 90 % of global supply growth over the last 10 years. In other words, without shale oil, the supply side would be at virtually the same level as it was at the beginning of the last decade - at least one of Jimmy Carter's goals was achieved, though not his most important.

Global demand for primary energy grew by 1.3 % per year from 2011 to 2021. If we do not find another growth driver, there is a risk that future energy supply will not meet the demand. Of course, with the corresponding consequences for the price development.

|

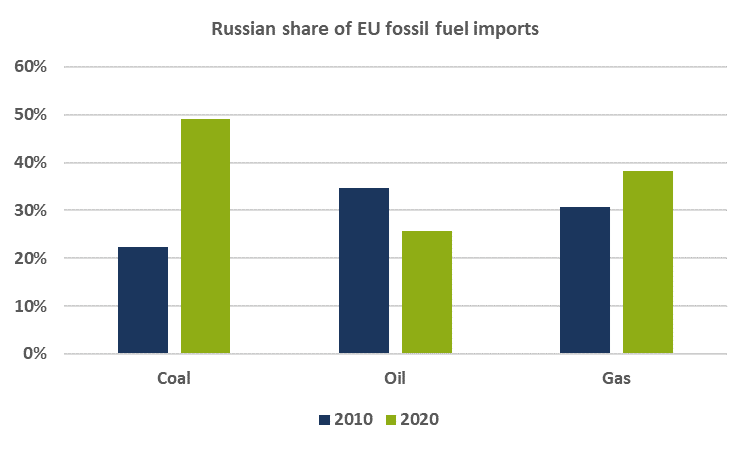

In Europe, the situation developed in a different direction. The import dependency of the EU member states was already 55 % at the beginning of the last decade and has since risen further to over 57 %. The massive reduction of nuclear energy in Germany has certainly not helped to become more independent. Fossil fuels are still the most important source for electricity production in the European Union. According to Eurostat, in 2020 fossil fuels were the basis of 36 % of total electricity production. During this period, imports of coal and gas from Russia have continued to increase, while the share of oil imports has decreased.

|

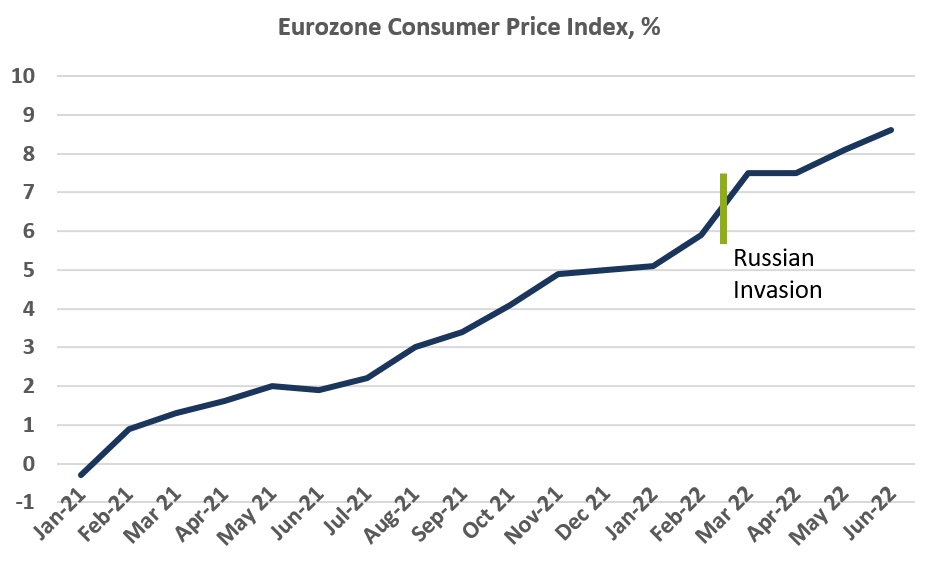

Credit must be given to the European Union for taking the energy transition very seriously. In fact, we in the Western world have not made much effort to reduce our dependence on imported oil and gas since 1979, and it was high time to start doing so. But it is also an unfortunate fact that about three quarters of the world's energy needs are still met by fossil fuels. If we now try to push through the "Energiewende" in a few years, we will have to live with some undesirable side effects, which are becoming very apparent in this moment of time. Inflation was already out of control before the Russian invasion, in the European Union as well as in the United States.

|

When many of the Western governments now blame the war for inflation, they are to a large extent also deflecting attention from their own misdeeds or those of their predecessors. Of course, we, the voters, are also responsible. After all, we prefer to elect government representatives who are happy to distribute money to the population. For example, French President Emmanuel Macron (born in 1977) has never experienced a budget surplus of his country. In Switzerland, we are in a relatively comfortable situation in this respect. According to the Federal Finance Administration, Switzerland has recorded a budget surplus three times in the last five years.

One bright spot in energy policy is the fact that, according to the International Energy Agency, the European Union imported more U.S. liquefied natural gas than Russian pipeline gas for the first time ever in June 2022. The worse part of the news is that the result is owed to reduced Russian export volumes. Investment in liquefied natural gas terminals in Europe will increase sharply and become an alternative to Russian imports over the years. The German Federal Minister of Economics and Climate Protection, Robert Habeck, already commented in mid-June: "In the last few days, the situation on the gas market has worsened. It is still possible to replace the volumes that have been lost, and gas storage facilities are still being filled, albeit at high prices. Security of supply is currently guaranteed. But the situation is serious. We are therefore continuing to strengthen precautions and taking additional measures to reduce gas consumption. This means that gas consumption must continue to fall, but more gas must be put into the storage facilities, otherwise things will really get tight in winter". If consumption, not just for gas, were to fall, subsidies in the form of tax relief are probably not a good idea. But what does that mean now for the development of consumer prices and energy availability?

Is there a risk that European industrial companies will have to reduce or even stop production during this winter due to a lack of gas? You can't predict, but you can prepare.

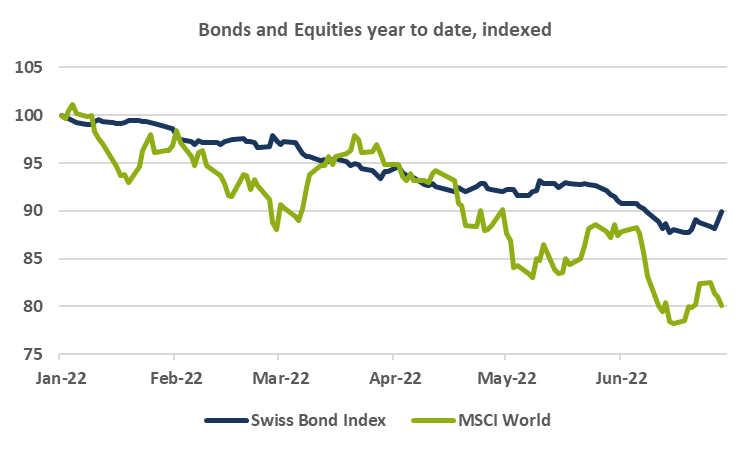

In the first half of the year, we all experienced the consequences that the current situation of interest rate hikes, inflation and supply bottlenecks has had on the financial markets. The most important stock indices have lost around 20 %, the Swiss Bond Index is down about 10 %. For a portfolio consisting of 60 % equities and 40 % bonds, this results in a half-year loss of 16 %.

|

The average risk-adjusted return for a 60/40 portfolio from 2011 to 2021 was three times higher than in the period from 1900 to 2011 (source: Dan Villalon, AQR Capital Management). During this period, balance sheets of the Federal Reserve, the European Central Bank, the Bank of England, the Bank of Japan and also the Swiss National Bank increased sharply. In addition, interest rates were at a very low level, even negative in some countries. These two factors were important drivers for the above-average risk-adjusted return. This tailwind is now missing and is even turning into a headwind to some extent. We should therefore assume that the next few years will not be as easy as the past ten years.

Perhaps the balanced portfolio is indeed not the right one for the next few years. To judge that, we would need to know how the correlation of bonds to equities, interest rates and credit spreads will develop. We don't know that.

In this challenging environment, protecting and growing your wealth requires investment solutions with the best fund managers available, off the beaten path. At Kaleido, we do not manage our own funds, but we focus on finding the best managers for you. We put together portfolios that through discipline and expertise form the basis for the possibly most attractive results in the current environment. Send us an e-mail, we will be happy to offer you an investment alternative off the beaten tracks.

The Ethereum blockchain is about to undergo arguably the most significant upgrade in the chain's roughly eight-year history. Ethereum is the second...

On August 9, 2011, the market cap of Apple exceeded Exxon for the first time in history. The development of the two companies and their respective...

Blockchain technology has been the talk of the town for the past few months: Suddenly people were interested in the distributed database as well as a...